Introduction

When the sun sets and the stock market closes, seasoned investors turn their attention to after-hours options trading. This exciting arena offers unique opportunities and challenges, allowing traders to extend their trading hours beyond the traditional market window. ETrade, a leading online brokerage, stands out as a prominent platform for after-hours options trading, providing its clients with access to a vast array of options contracts beyond the regular trading session. This comprehensive guide will delve into the intricacies of ETrade after-hours options trading, empowering traders with the knowledge and strategies to navigate this dynamic trading environment.

Image: www.warriortrading.com

Understanding After-Hours Options Trading

After-hours options trading takes place outside the regular stock market trading hours, typically extending from 4:00 pm to 8:00 pm ET. During this extended session, traders can execute options trades on select stocks, indices, and ETFs. These trades are facilitated by electronic communication networks (ECNs) or market makers, ensuring liquidity and facilitating price discovery after the primary market closes.

The key advantage of after-hours options trading lies in its extended trading hours, enabling traders to react to breaking news, earnings reports, and other market-moving events that occur after the regular trading session. This flexibility allows investors to adjust their positions, hedge against risk, and capitalize on market volatility during a period that would otherwise be inaccessible.

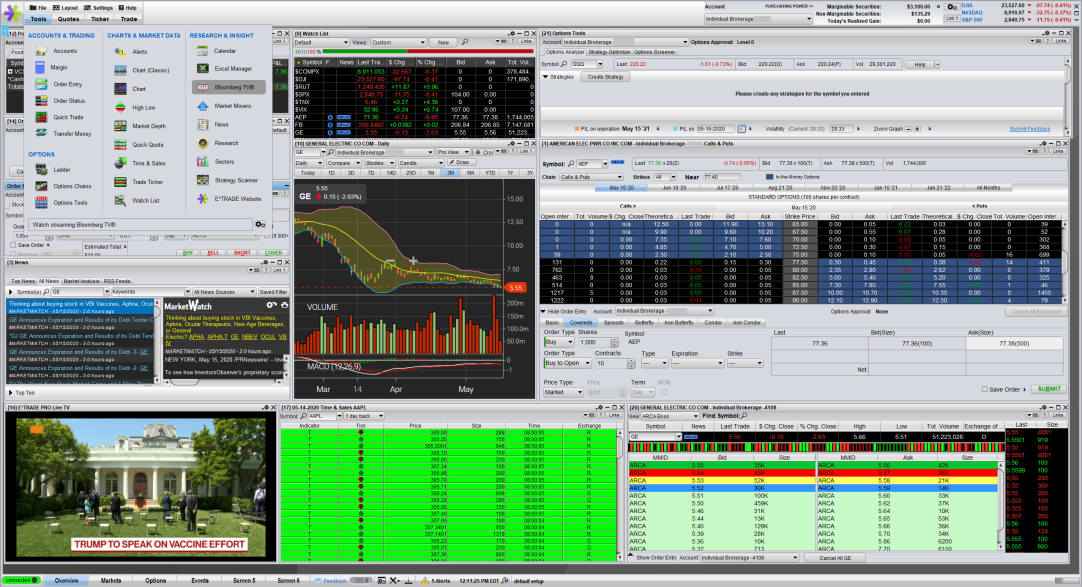

E*Trade’s After-Hours Options Trading Platform

E*Trade’s after-hours options trading platform is designed to meet the diverse needs of both novice and experienced traders. The platform offers a suite of trading tools, including:

- Real-Time Market Data: Stay informed with up-to-date streaming quotes, bid-ask spreads, and market depth during after-hours trading.

- Advanced Charting Capabilities: Utilize technical analysis tools to identify trading opportunities, pinpoint support and resistance levels, and devise effective trading strategies.

- Order Execution Flexibility: Choose from a variety of order types, including market orders, limit orders, and stop orders, ensuring precise execution of your trading decisions.

- Mobile Trading: Access E*Trade’s after-hours options trading platform anytime, anywhere with their mobile app, providing the convenience to trade from your smartphone.

Benefits of After-Hours Options Trading with E*Trade

Leveraging E*Trade’s after-hours options trading platform provides several notable benefits, including:

- Extended Trading Hours: Extend your trading day beyond the traditional market window, allowing you to capitalize on market events that occur after the primary market closes.

- Improved Risk Management: After-hours trading offers an opportunity to hedge risk by adjusting positions or executing protective strategies based on evolving market conditions.

- Enhanced Liquidity: E*Trade’s strong relationships with market makers and ECNs ensure ample liquidity, facilitating smooth order execution during after-hours trading sessions.

- Competitive Trading Costs: E*Trade’s competitive pricing structure helps minimize trading expenses, allowing you to maximize your investment returns.

Image: s3.amazonaws.com

Risks Involved in After-Hours Options Trading

While after-hours options trading offers numerous benefits, it also comes with inherent risks, including:

- Reduced Trading Volume: After-hours trading volumes tend to be lower compared to regular trading hours, potentially affecting liquidity and price discovery.

- Increased Volatility: Market movements can be more pronounced during after-hours trading due to reduced liquidity and the heightened influence of large orders.

- Execution Delays: Order execution may experience delays due to lower liquidity and the involvement of multiple market participants.

Strategies for Successful After-Hours Options Trading

Mastering after-hours options trading requires a blend of knowledge, strategy, and risk management. Here are some effective strategies to consider:

- Research and Due Diligence: Stay informed about the underlying securities, market conditions, and potential catalysts that may impact after-hours price movements.

- Use Technical Analysis: Identify trading opportunities and manage risk by utilizing technical indicators and chart patterns to analyze after-hours price action.

- Manage Your Risk: Employ risk management strategies such as stop orders and position sizing to protect your capital from excessive losses during volatile after-hours trading conditions.

- Scalping: Capitalize on short-term market fluctuations by executing a series of small-profit trades within a single after-hours trading session.

- Hedging: Use after-hours trading to hedge existing positions or create protective strategies against potential adverse market developments.

Etrade After Hours Options Trading

Image: fibooptionsforex.blogspot.com

Conclusion

ETrade’s after-hours options trading platform empowers traders with a unique opportunity to extend their trading day and capitalize on market events that unfold beyond the regular trading session. By understanding the benefits, risks, and strategies involved, traders can navigate this dynamic trading environment effectively. Whether it’s managing risk, hedging positions, or seeking enhanced liquidity, ETrade’s after-hours options trading platform provides a powerful tool for both novice and experienced traders.