The stock market can be a thrilling and unpredictable place, filled with opportunities for both immense gains and crippling losses. As a seasoned investor, I’ve always sought ways to mitigate risk while still maximizing potential returns. That’s where option spread trading entered my life. While I won’t claim to be a Wall Street wizard, I’ve learned that option spreads, when used strategically, can be a powerful tool to add to any investor’s arsenal.

Image: www.stockinvestor.com

Remember, investing carries inherent risks, and option spreads are no exception. It’s crucial to understand the nuances, complexities, and inherent risks associated with this strategy before diving in. But when approached with discipline and knowledge, option spreads can be a valuable tool for navigating the market’s roller coaster, helping you generate profits while safeguarding your portfolio.

Understanding Option Spread Trading

What are Option Spreads?

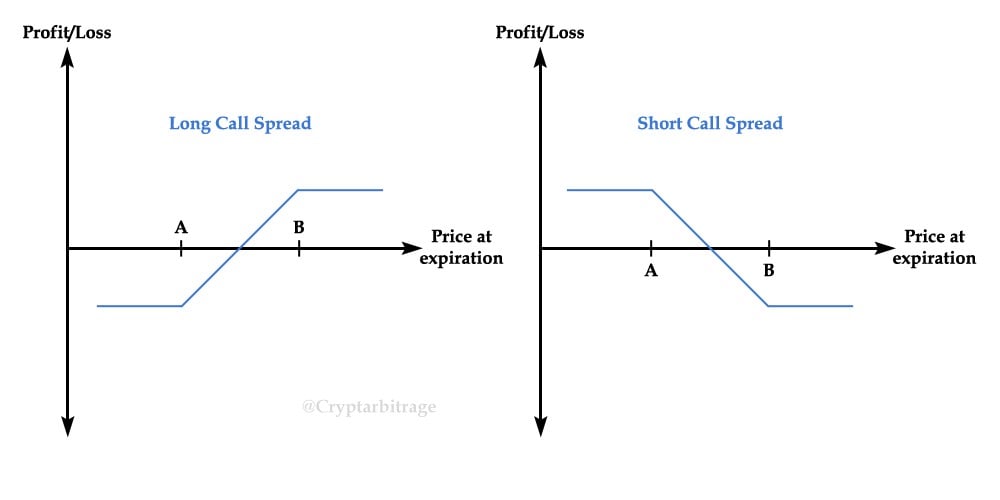

Option spreads are a type of options trading strategy that involves simultaneously buying and selling two options contracts of the same underlying asset but with different strike prices or expirations. The key to option spreads is that they create a defined risk profile, allowing you to control the potential losses while still allowing for potential profits. Think of it as a way to limit damage in the event of an adverse market move.

Types of Option Spreads

There are several types of option spreads, each offering unique risk and reward profiles. Here are a few common examples:

- Bull Call Spread: You buy a call option with a lower strike price and sell a call option with a higher strike price. This strategy profits when the underlying asset price rises, but your potential gains are limited to the difference between the strike prices. (Bull put spreads are similar, but with options that profit when the stock drops)

- Bear Put Spread: You buy a put option with a higher strike price and sell a put option with a lower strike price. This strategy profits when the underlying asset price falls, but again, your potential gains are limited to the difference between the strike prices.

- Bull Put Spread: You buy a put option with a higher strike price and sell a put option with a lower strike price. This strategy profits when the underlying asset price falls.

- Collar: You buy a put option and sell a call option on the same underlying asset. This strategy limits potential losses while capping potential gains.

- Calendar Spread: You buy an option contract with a longer expiration and sell an option contract with a shorter expiration. This strategy profits from time decay (the decrease in an option’s value as the expiration date approaches) of the shorter-term option.

Image: insights.deribit.com

Why Use Option Spreads?

Option spread trading offers several advantages:

- Defined Risk: Knowing the maximum potential loss is a huge benefit, especially for risk-averse investors.

- Lower Premium Costs: Because you are both buying and selling options, the premium costs can be lower compared to buying a single option contract (although potential returns are also reduced).

- Versatility: Option spreads can be used to profit from both rising and falling markets, providing greater flexibility.

Navigating the World of Option Spreads

The beauty of option spread trading lies in its complexity. It’s not just about randomly picking options; it’s about understanding the intrinsic nuances of your chosen spread, the nuances of the underlying asset, and the bigger market forces at play. Here’s where a solid understanding of options, their pricing, and factors impacting option premiums is critical to making informed decisions:

Choosing the Right Spread

The specific option spread you select will depend on your unique investment goals, risk tolerance, and market outlook. Perhaps you believe a stock is going to rise but want to limit potential losses – a bull call spread could work. Maybe you want to profit from a sharp decline but want a controlled approach – a bear put spread might be more suitable. Do your research and understand the underlying asset, implied volatility, and market sentiment before making a move.

Understanding the Greeks

Greek letters (like Delta, Gamma, Theta, Vega) are crucial pieces in the option spread puzzle. They describe how the option’s price changes relative to factors like the underlying asset price, time to expiration, and volatility. You need to understand these factors, because they fundamentally impact your profit potential and your risks.

Leveraging Volatility

Option spreads thrive on volatility, meaning they can be more profitable in turbulent markets, where prices are swinging wildly (although that also means greater risk!). A key nuance is that option prices are not directly proportional to underlying asset prices. This dynamic can be advantageous in the right situations, but requires deep understanding.

Expert Advice and Tips for Option Spread Trading

Based on my years of experience, here’s some advice that has helped me stay ahead of the curve:

Start Small and Be Patient

Don’t jump into complex spreads with a massive investment. Test the waters with smaller trades to hone your strategy and gauge your comfort level. The market swings, and sometimes you’ll lose. It’s vital to be patient, accept losses as part of the process, and keep refining your approach.

Research is Paramount

Don’t blindly follow tips or market predictions. Research the underlying asset, understand its fundamentals and the market forces at play. The more you understand the asset and its underlying dynamics, the better your odds of making informed decisions.

Stay Up-to-Date

The option market is dynamic. Market conditions change constantly. It’s vital to stay on top of news, economic reports, and any event that could impact your chosen asset or specific spreads you’re trading.

Don’t Over-Trade

Patience is a virtue in this arena. Avoid chasing every minor market blip or “hot” tip. Choose your spreads carefully and be disciplined about sticking to your strategy.

Utilize Options Trading Platforms

There are fantastic platforms available (like Thinkorswim, Robinhood, et al.) that provide comprehensive tools to track your trades, research options contracts, and visualize your strategies. It’s worth investing time in learning how these platforms can benefit you.

FAQs About Option Spread Trading

Q: What is the main difference between option spreads and buying single options?

A: Option spreads involve both buying and selling options, creating a defined risk profile and often lower premium costs while limiting potential profit potential. Buying single options carries higher potential for both gains and losses.

Q: Are option spreads suitable for beginner investors?

A: While spread trading can be beneficial, it’s generally considered more advanced than buying single options. It requires a deep understanding of options, market dynamics, and risk management. Experienced investors often recommend starting with a basic understanding of options before venturing into spreads.

Q: What are the greatest risks involved in option spread trading?

A: While option spreads offer defined risk, it’s important to remember that the market’s volatility can still dramatically impact your position. Risks include:

- Time Decay: Options lose value as they approach expiration, so time is against you.

- Unforeseen Market Events: Economic news or unexpected events can cause sharp price movements that hurt your spread.

Q: How do I manage my risk in option spread trading?

A: Some key tips include:

- Start small: Enter trades with smaller amounts until you develop confidence and expertise.

- Define your exit plan: Determine what price action will cause you to close the position.

- Use stop-loss orders: Prevent catastrophic losses if your trades go against you.

Option Spread Trading

Conclusion

Option spread trading can be a valuable tool for savvy investors looking to manage risk while potentially generating profits. By thoroughly understanding different spread types, the intricacies of option pricing, and the importance of market research, you can confidently employ this strategy in your trading arsenal. Are you ready to take your investing game to the next level with option spreads?