Introduction

Options trading has emerged as a potent investment strategy, empowering traders to navigate market complexities and potentially generate significant returns. However, the journey into options trading necessitates the selection of a reliable and capable broker. With a plethora of options trading brokerages available, choosing the one that aligns seamlessly with your investment objectives can be a daunting task. This comprehensive guide aims to equip you with the knowledge and insights necessary to evaluate and compare options trading brokers, ultimately empowering you to make an informed decision that aligns with your financial aspirations.

Image: www.interactivebrokers.com

Understanding the nuances of options trading brokers is of paramount importance. An options trading broker acts as an intermediary between the trader and the options exchange, facilitating the execution of options trades. Choosing the right broker for your trading needs is crucial due to the implications it has on your trading experience, from execution efficiency to platform functionality and pricing structures. By delving into the key aspects to consider when comparing options trading brokers, such as their trading platforms, fees and commissions, account features, and customer service, you can make an informed decision that sets you on a path toward potential success.

Trading Platforms: The Cornerstone of Your Trading Experience

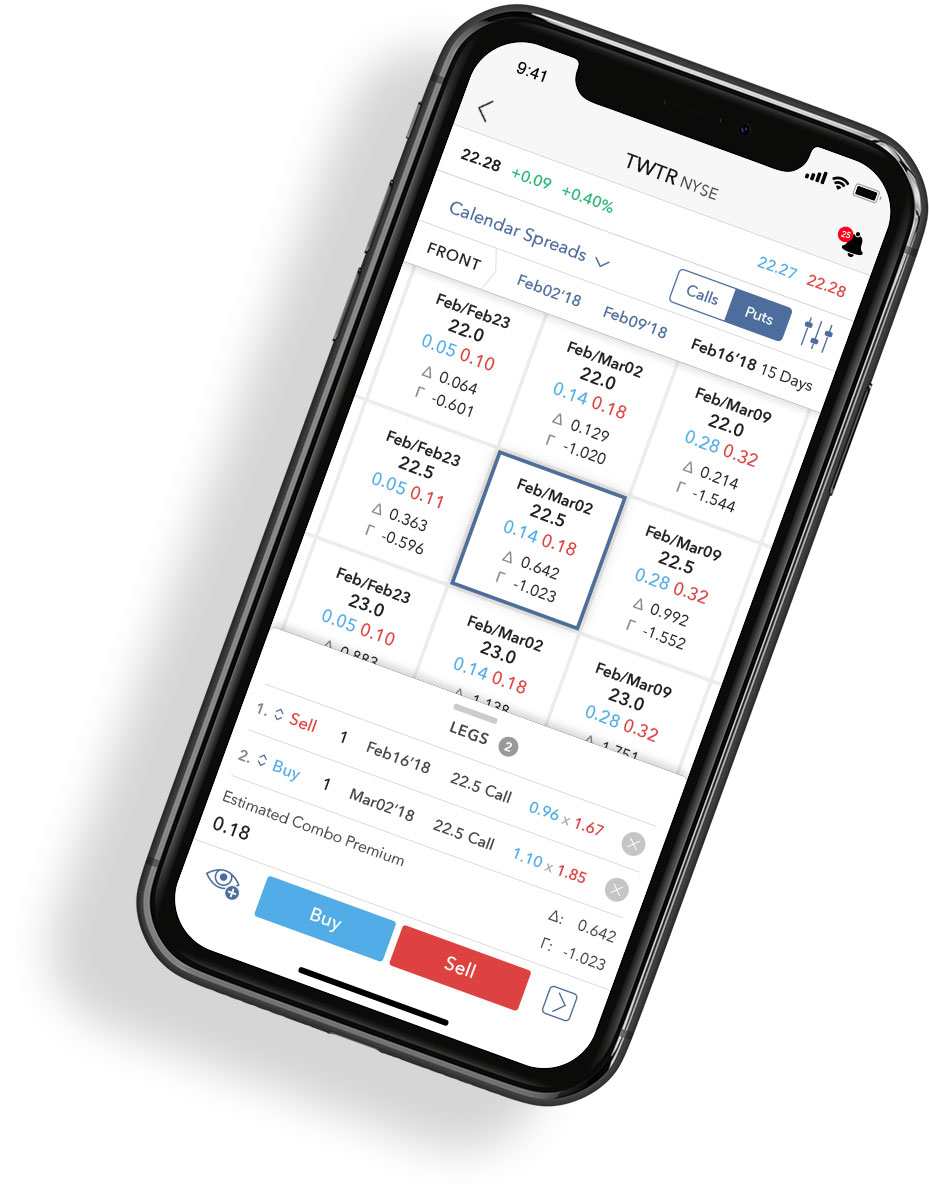

The trading platform provided by an options trading broker is your gateway to the market, serving as the interface through which you execute trades, monitor market data, and perform analysis. The functionality and user-friendliness of the platform can significantly impact the efficiency and profitability of your trading endeavors. Consider the following when evaluating a broker’s trading platform:

- Ease of use: The platform should have an intuitive interface, making it easy for you to navigate and execute trades swiftly, even in fast-paced market conditions.

- Functionality: The platform should offer comprehensive features catering to your trading needs, such as real-time market data, charting tools, and risk management capabilities.

- Compatibility: Ensure that the platform is compatible with your preferred devices, whether desktop, laptop, or mobile, to maintain trading flexibility and accessibility.

Fees and Commissions: Understanding the Cost of Trading

Fees and commissions directly impact your profitability. It’s essential to fully comprehend the pricing structure of potential options trading brokers to avoid unpleasant surprises and ensure that your returns are maximized. Consider the following key aspects:

- Transaction fees: These fees are charged per trade, so it’s crucial to seek brokers offering competitive rates, especially if you plan to trade frequently.

- Account fees: Some brokers charge monthly or annual account fees, which can add up over time. Be aware of these fees and factor them into your decision.

- Margin interest rates: If you plan on trading on margin, the interest rates charged by the broker will impact your trading costs.

Account Features: Tailoring the Brokerage to Your Trading Style

Beyond trading platforms and fees, several account features can significantly enhance your trading experience. Explore the following aspects when comparing brokers:

- Account types: Brokers offer a range of account types, such as individual, joint, and institutional accounts, each with its specific features and requirements. Choose the account type that aligns with your trading needs and legal status.

- Margin trading capabilities: Margin trading allows you to borrow funds from the broker to amplify your trading power. However, this feature comes with inherent risks, so evaluate your risk tolerance before considering margin trading.

- Account security measures: The security of your funds and personal information should be paramount. Look for brokers with robust security measures, such as two-factor authentication and encryption.

Image: www.pinterest.de

Customer Service: A Lifeline for Traders

Exceptional customer service is invaluable, particularly when navigating market challenges or technical difficulties. Consider the following when assessing broker customer service:

- Availability and responsiveness: Ensure that the broker offers multiple channels for customer support, such as phone, email, and live chat, and that they are available during extended hours.

- Knowledge and expertise: The support team should possess in-depth knowledge of options trading and the platform to provide prompt and accurate assistance.

- Proactive communication: A broker that proactively communicates platform updates, market events, and educational resources can enhance your trading experience.

Options Trading Broker Comparison

Conclusion

Selecting the right options trading broker is a pivotal decision that can significantly impact your trading success. By meticulously evaluating trading platforms, fees and commissions, account features, and customer service, you can make an informed choice that aligns seamlessly with your investment objectives. Remember to conduct thorough research, consult with industry experts if necessary, and prioritize brokers that are reputable, reliable, and committed to providing an exceptional trading experience.

As you embark on this journey, bear in mind that your trading strategy should remain your guiding light. The best options trading broker for you is the one that empowers you to execute your trades effectively, minimizes trading costs, caters to your account needs, and provides unwavering support. By making a well-informed decision, you can set the stage for a successful and rewarding options trading experience.