Introduction:

Image: www.trality.com

In the ever-evolving world of finance, the advent of algorithmic trading has brought about a paradigm shift in the way traders make decisions. Algorithmic trading tools have emerged as indispensable instruments for options traders, providing unprecedented speed, efficiency, and accuracy in navigating the complex options market.

Options, derivatives that derive their value from underlying assets, offer investors a versatile range of trading strategies. However, the intricate nature of options pricing and the need for real-time market data can create challenges for manual trading. This is where options algorithmic trading tools come into play.

Delving into Options Algorithmic Trading

Options algorithmic trading tools utilize sophisticated algorithms to automate the process of identifying, selecting, and executing options trades. These tools leverage market data, historical pricing patterns, and advanced statistical models to make informed trading decisions.

Key Concepts:

-

Automated Order Execution: Algorithmic trading tools execute orders automatically, eliminating the need for manual intervention. This not only enhances trade speed and precision but also reduces the risk of human error.

-

Real-Time Market Data: These tools are integrated with real-time market data feeds, providing traders with up-to-the-second information on option prices, Greeks, and market conditions.

-

Backtesting and Optimization: Algos can be backtested using historical data to optimize trading strategies and identify parameters that maximize profit potential and minimize risk.

Types of Options Algorithmic Trading Tools:

-

Delta Neutral Strategies: These algos aim to maintain a delta-neutral position, minimizing volatility risk by balancing long and short option positions.

-

Volatility Arbitrage Strategies: These tools exploit price inefficiencies between different volatility surfaces, aiming for profit by executing simultaneous trades on various options contracts.

-

Statistical Arbitrage Strategies: Algos identify statistical dependencies between different options markets, executing trades to profit from mean reversion and price anomalies.

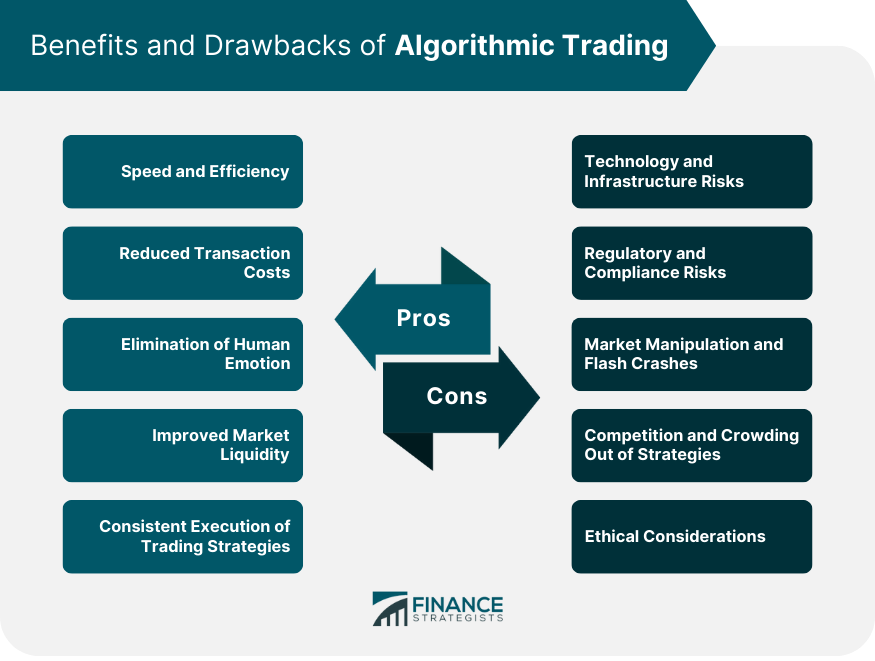

Benefits and Considerations

Options algorithmic trading tools offer numerous benefits, including:

-

Increased Precision and Speed: Algorithms can quickly and accurately execute trades, ensuring optimal entry and exit points.

-

Reduced Emotional Trading: By automating trading decisions, algorithms remove the impact of human emotion, resulting in more objective trading strategies.

-

Enhanced Risk Management: Algos continuously monitor market conditions and adjust positions based on pre-defined risk parameters.

However, it’s important to consider potential limitations:

-

Algorithm Dependency: Algorithmic trading relies heavily on the effectiveness of the underlying algorithm. Poorly designed algos can lead to losses.

-

Market Impact: Algorithmic trading can contribute to market volatility if large volumes of trades are executed simultaneously.

-

Cost: Developing and maintaining algorithmic trading tools can be expensive, especially for individual traders.

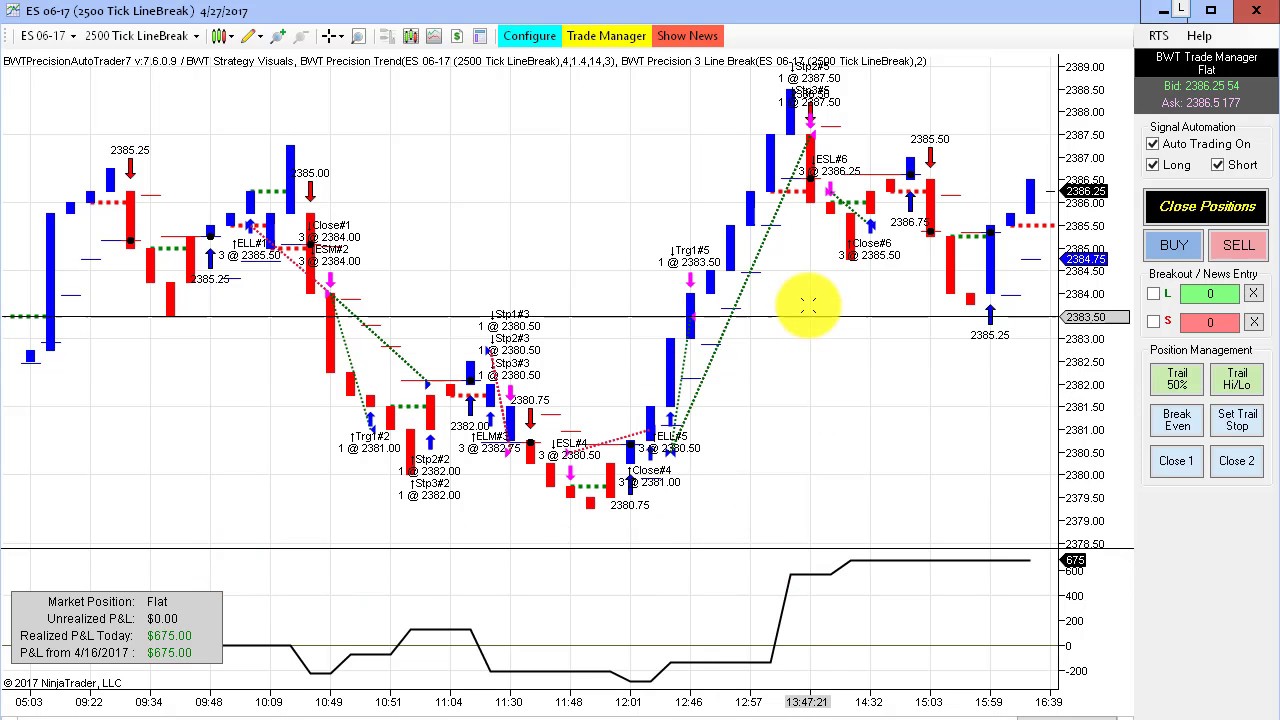

Image: www.financestrategists.com

Options Algorithmic Trading Tools

Image: dewiamira.blogspot.com

Conclusion

Options algorithmic trading tools have revolutionized the way traders approach the options market, providing a level of speed, efficiency, and accuracy that was previously unattainable. By leveraging the power of technology and data, these tools empower traders to navigate market complexities and capture profit opportunities more effectively.

While algorithmic trading offers significant advantages, it’s crucial to approach it with caution and proper knowledge. Traders must carefully consider the limitations and ensure that their algos are designed and tested thoroughly. By embracing these tools responsibly, investors can unlock the full potential of the options market and achieve their financial goals with greater confidence.