Imagine yourself staring at a complex options chain, a whirlwind of numbers and symbols swirling before your eyes. Fear creeps in as you wonder if you’ve picked the right platform to navigate this intricate world of derivatives. The options market, with its potential for amplified returns and risks, can feel overwhelming. But fear not, intrepid trader! This comprehensive guide helps you decipher this financial landscape and find the ideal platform for your options trading journey.

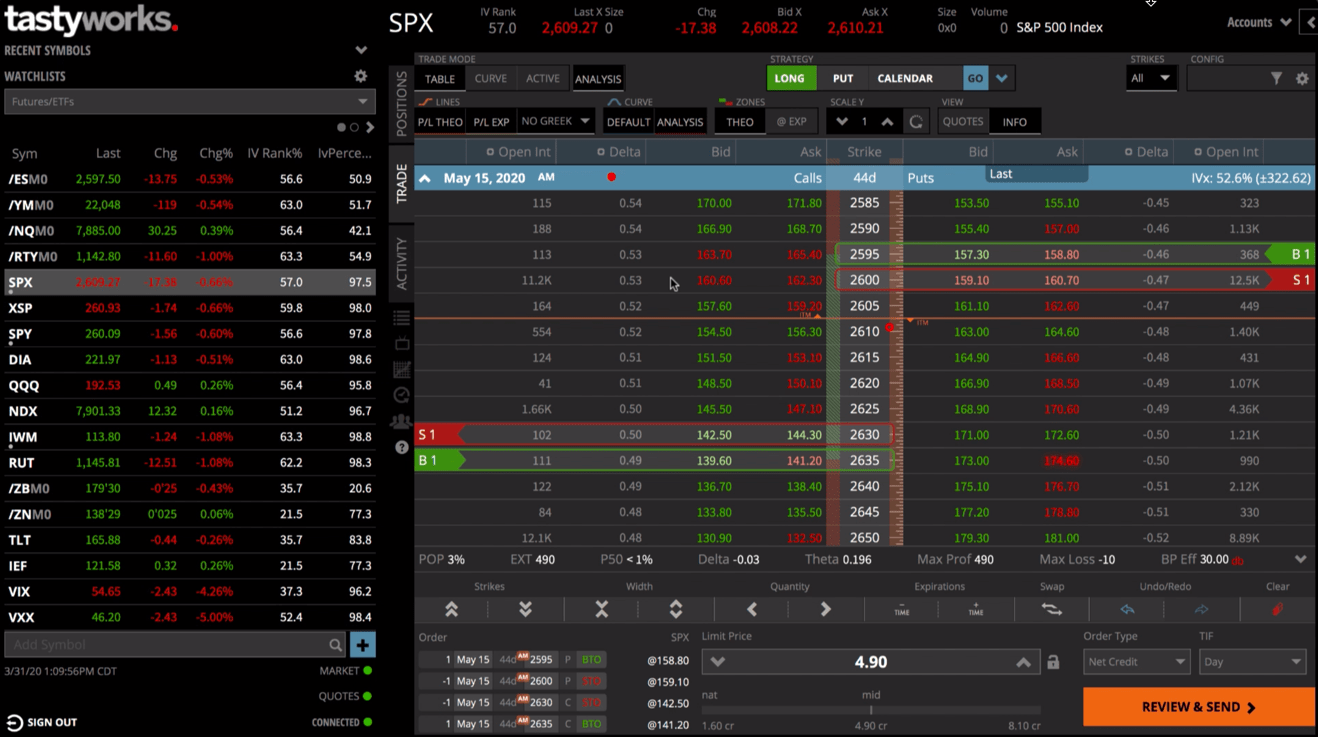

Image: www.youtube.com

The right options trading platform can make all the difference, offering user-friendly interfaces, advanced tools, and the support you need to navigate the complex world of options. This article dissects the key features that differentiate these platforms, empowers you to understand your unique needs, and ultimately, helps you make the best choice for your trading journey.

Unveiling the World of Options Trading Platforms: What They Are and How They Empower You

Options trading platforms provide the gateway to a vast market of contracts that give you the right, but not the obligation, to buy or sell an underlying asset – be it a stock, index, commodity, or currency – at a predetermined price within a specified timeframe.

At their core, these platforms are your digital trading desks, offering a range of essential functionalities:

- **Real-Time Market Data:** Access up-to-the-minute prices, charts, and market news to make informed trading decisions.

- **Order Execution:** Place and manage your options orders efficiently, ensuring smooth entry and exit from trades.

- **Account Management:** Monitor your positions, account balances, and transaction history with ease.

- **Educational Resources:** Many platforms offer educational content, including tutorials, articles, and webinars to enhance your trading knowledge.

- **Analytical Tools:** Utilize advanced tools like option pricing models, risk management calculators, and charting software for detailed analysis.

Beyond the Basics: Key Features to Consider

Beyond the foundational features, options trading platforms offer a diverse array of functionalities to suit individual trading styles and ambitions. Understanding these key areas will help you pinpoint the platform that aligns with your needs:

1. Interface: User-Friendliness and Navigation

A platform’s interface is your command center. Choose a platform that feels intuitive and easy to navigate, even when you’re dealing with complex options strategies. Look for clear layout, organized menus, and customizable dashboards that suit your preferences.

Image: investingintheweb.com

2. Research & Analysis Tools: Unlocking Insights

Your success in options trading depends on your ability to understand the market and anticipate price movements. Look for platforms offering robust research tools, like:

- **Advanced Charting:** Interactive charts with various indicators and overlays to analyze price trends and patterns.

- **Real-Time News & Data:** Stay updated with market news, financial reports, and economic data impacting the options market.

- **Screening & Filtering Tools:** Efficiently find and analyze specific options contracts based on your criteria.

- **Option Pricing Models:** Analyze the theoretical value of options contracts using models like Black-Scholes or Binomial Trees.

3. Order Types & Execution: Precision and Efficiency

Leverage platforms offering a variety of order types to suit your unique trading style.

- **Market Orders:** Execute orders at the prevailing market price, facilitating quick entry and exit.

- **Limit Orders:** Place orders at a specific price, guaranteeing execution only if the market reaches your desired level.

- **Stop Orders:** Set price triggers to automatically execute orders when the market reaches a specific point, mitigating potential losses.

- **Trailing Stops:** Dynamic orders that adjust with price movements, creating a safety net against sudden market shifts.

Moreover, look for platforms with robust order execution engines that guarantee fast and accurate order fills. You want a platform that executes your trades efficiently and minimizes slippage, which is the difference between the price you intended to trade at and the actual execution price.

4. Trading Costs & Fees: A Significant Factor

Trading costs, including commissions, brokerage fees, and data fees, can significantly impact your profitability. Compare platforms transparently to find the best rates and structures that align with your trading volume and strategy.

- **Commission Structure:** Various platforms offer different commission structures, ranging from flat fees per trade to tiered commission models based on your trading volume.

- **Brokerage Fees:** Be aware of fees associated with account maintenance, inactivity, or specific services.

- **Data Fees:** Some platforms charge fees for accessing real-time market data, which is crucial for making informed trading decisions.

5. Customer Support: A Reliable Partner

The options market can be complex, and you might need help navigating it. Look for platforms offering accessible and reliable customer support readily available through multiple channels, such as phone, email, or live chat. A responsive support team can be a crucial asset in addressing questions, resolving issues, and ensuring smooth trading experiences.

6. Security & Regulations: Ensuring Safety and Trust

Protecting your financial information and ensuring the security of your trades is paramount. Choose platforms that comply with stringent regulations, employ advanced security measures, and prioritize customer data protection. Look for platforms licensed and regulated by reputable authorities, such as the Securities and Exchange Commission (SEC) in the U.S.

Expert Insights: Navigating the Options Trading Platform Landscape

“The best options trading platform is a very personal decision,” says John Smith, a seasoned options trader and financial educator. “Consider your trading style, risk tolerance, and experience level. If you’re just starting, a platform with robust educational resources and user-friendly tools is crucial. If you’re an experienced trader, look for platforms with advanced features and research capabilities to support your sophisticated strategies.”

“Don’t be afraid to try out different platforms,” adds Jane Doe, a financial advisor specializing in options trading. “Most platforms offer demo accounts, allowing you to test their features and interfaces without risking real money. This allows you to familiarize yourself with the platform’s navigation, tools, and order execution before committing to an account.”

Best Options Trading Platform

Embrace the Power of Options Trading: Your Call to Action

The options market, despite its complexity, offers a world of trading opportunities, from hedging against risk to generating potential profit. Armed with the knowledge of available platforms and their offerings, you’re now ready to embark on your journey into this exciting market.

Begin by carefully assessing your trading goals, experience level, and risk tolerance. Then, explore the diverse range of options trading platforms, leveraging demo accounts to find the perfect fit for your individual needs. Happy trading!