Introduction

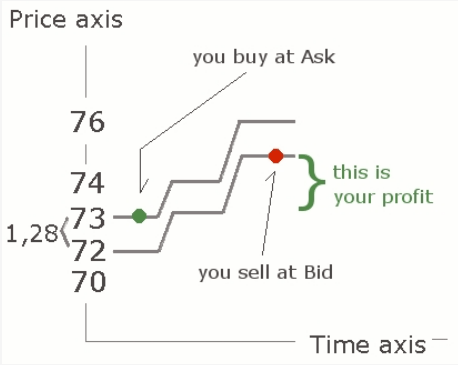

In the realm of financial markets, options trading presents a unique opportunity to capitalize on fluctuations in underlying assets like stocks or commodities. Understanding the bid and ask prices in options trading is crucial for informed decision-making. Like two sides of a coin, the bid price represents the maximum amount a buyer is willing to pay for an option contract, while the ask price denotes the lowest amount a seller is prepared to accept. Navigating the intricate dance between these prices is essential for success in this dynamic market.

Image: thetradingbible.com

Delving into the Bid-Ask Spread

The bid-ask spread, the difference between the bid and ask prices, plays a pivotal role in options trading. It reflects the level of market liquidity and demand for a particular option contract. A wider bid-ask spread typically indicates lower liquidity, making it more challenging to execute trades quickly and efficiently. In contrast, a tighter spread suggests higher liquidity, enabling traders to enter or exit positions with greater ease. Market makers, who facilitate the buying and selling of options contracts, determine the spread based on various factors, including supply and demand dynamics, volatility, and time to expiration.

Anatomy of a Market Order

When placing a market order, traders indicate their willingness to buy or sell an option contract at the prevailing market price. However, it’s crucial to note that market orders can result in executions at prices that deviate from the displayed bid or ask price, especially in fast-moving markets. Limit orders, on the other hand, allow traders to specify their desired execution price, ensuring they only trade at or better than that price.

Understanding Bid and Ask in Relation to Market Sentiment

The bid and ask prices offer valuable insights into market sentiment. A rising bid price indicates increased optimism and buying interest, while a falling ask price suggests pessimism and selling pressure. Conversely, a narrowing bid-ask spread often signals a consensus among market participants, while a widening spread may reflect uncertainty or indecision. By monitoring these price dynamics, traders can make informed judgments about market trends and potential trading opportunities.

Image: learningcenter.fxstreet.com

Maximizing Success in Options Trading

Equipping oneself with a solid understanding of bid and ask prices is paramount for successful options trading. Traders should constantly monitor market data, news events, and economic indicators to stay abreast of factors that can influence option prices. By carefully considering the bid-ask spread and market sentiment, traders can strategically place orders, manage risk, and increase their chances of profitability.

Expert Insights on Bid and Ask Analysis

“The bid-ask spread is like a window into the market’s pulse,” says renowned options trader Michelle Siegel. “By analyzing the spread, we can gauge market liquidity, volatility, and overall sentiment – invaluable information for making informed trading decisions.”

Echoing this sentiment, market analyst David Winton advises, “Understanding the interplay between bid and ask prices is a fundamental skill for options traders. It enables them to anticipate market movements and identify potential trading opportunities, maximizing their chances of success.”

Bid Vs Ask Options Trading

Image: whatdoesme.blogspot.com

Conclusion

The intricate relationship between bid and ask prices in options trading opens up a world of possibilities and challenges for traders. By delving into the complexities of these prices, market participants can make informed decisions, manage their risk effectively, and capitalize on the opportunities presented by this dynamic market. Whether you’re a seasoned trader or just beginning your journey into options, a deep understanding of bid and ask prices will undoubtedly elevate your trading strategies and bring you closer to financial success.