Are you curious about options trading but hesitant to dive in due to the perceived complexity? Our free video series is here to change that. We’ve designed these videos to make options trading accessible and empowering for all, regardless of your experience level.

Image: www.youtube.com

Together, we’ll embark on an educational journey that will unravel the intricacies of options trading and equip you with the knowledge and confidence to navigate this dynamic market effectively.

Delving into Options Trading: An Overview

Options trading involves the purchase or sale of contracts that offer the option to buy or sell a specific asset, such as a stock or commodity, at a predefined price within a specified timeframe. Unlike futures contracts, options provide investors with the flexibility to exercise the option or not, enabling them to capitalize on price fluctuations without the obligation to execute the trade.

Options trading offers a multitude of strategies, from hedging against potential losses to generating income. Whether you’re seeking to protect your portfolio, enhance returns, or speculate on market movements, options trading provides a versatile tool to meet your investment goals.

Understanding Option Contracts

At the core of options trading lies the understanding of option contracts. An option contract comprises three key elements: the underlying asset, the strike price, and the expiration date.

The underlying asset refers to the security or commodity on which the option contract is based. The strike price represents the predefined price at which the investor can buy or sell the underlying asset. The expiration date specifies the final day on which the investor can exercise the option contract.

Options come in two primary types: calls and puts. Call options grant the holder the right to buy the underlying asset at the strike price before the expiration date. Conversely, put options give the holder the right to sell the underlying asset at the strike price before the expiration date.

Tips and Expert Advice for Navigating Options Trading

Embarking on your options trading journey with the right knowledge and guidance is crucial. Our team of experts has compiled invaluable tips to help you navigate the market confidently:

- Start with Education: Before trading, invest in learning the fundamentals of options trading. This will lay a solid foundation for successful decision-making.

- Diversify Your Portfolio: Spread your investments across multiple options contracts to mitigate risk and enhance the stability of your portfolio.

- Manage Risk Effectively: Utilize stop-loss orders and other risk management strategies to prevent substantial losses.

Furthermore, seek guidance from experienced professionals and reputable sources to continuously expand your knowledge and stay informed about market trends.

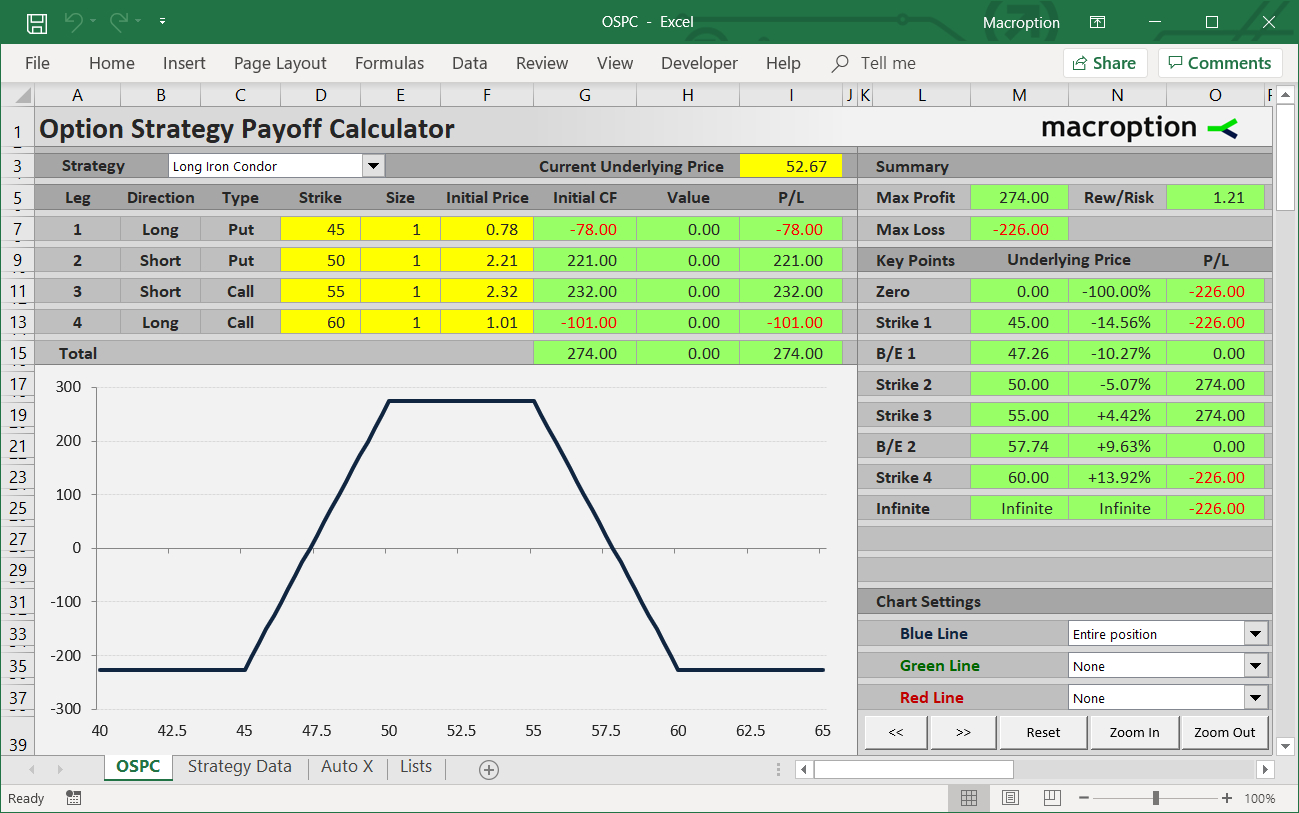

Image: db-excel.com

Free Options Trading Videos

Image: riset.guru

FAQs: Answering Your Pressing Options Trading Questions

To complement our free video series, we’ve curated a comprehensive FAQ section addressing the most common questions surrounding options trading:

- Q: What are the risks associated with options trading?

- Q: How do I determine the value of an option contract?

- Q: Where can I learn more about options trading?

A: Options trading carries potential risks, including the loss of capital and the obligation to buy or sell the underlying asset at an unfavorable price.

A: The value of an option contract is influenced by factors such as the underlying asset’s price, volatility, time to expiration, and interest rates.

A: In addition to our free video series, there are numerous resources available online, including educational materials, forums, and industry publications.

Start Your Options Trading Journey Today

If you’ve been intrigued by the potential of options trading, now is the perfect time to take the first step. Our free video series is meticulously designed to provide you with the knowledge and confidence to make informed decisions in the options market. Embrace this opportunity and embark on a rewarding journey of financial empowerment.