With the burgeoning popularity of options trading, understanding the rules and regulations governing this dynamic financial realm is paramount. The National Stock Exchange of India (NSE), a prominent player in derivatives trading, has established a comprehensive framework of rules to ensure a fair and transparent marketplace for option trading participants. This article delves into the intricate world of NSE option trading rules, empowering traders with the knowledge they need to navigate the market successfully.

Image: www.1investing.in

Defining Option Trading and Its Significance

Option trading involves contracts that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. These contracts, known as option premiums, can generate significant profits or losses based on market fluctuations. As a versatile financial instrument, options provide traders with the flexibility to speculate on market trends, hedge risk, and enhance portfolio returns.

Exploring NSE’s Option Trading Framework

The NSE, India’s leading stock exchange, has meticulously designed its option trading framework to foster a robust and transparent marketplace. Complying with these rules is not only a legal obligation but also essential for ensuring the integrity and efficiency of the trading ecosystem.

Understanding Basic Concepts

Before delving into the specific trading rules, it’s necessary to grasp fundamental concepts:

- Option Premiums: Premiums are the prices paid by buyers to option sellers for acquiring the right to buy (call options) or sell (put options) the underlying asset.

- Strike Price: This is the predetermined price at which the buyer can buy or sell the asset if they choose to exercise their right.

- Underlying Assets: These represent stocks, indices, or other financial instruments on which options contracts are based.

- Expiry Date: This is the last day an option contract can be exercised before it expires worthless.

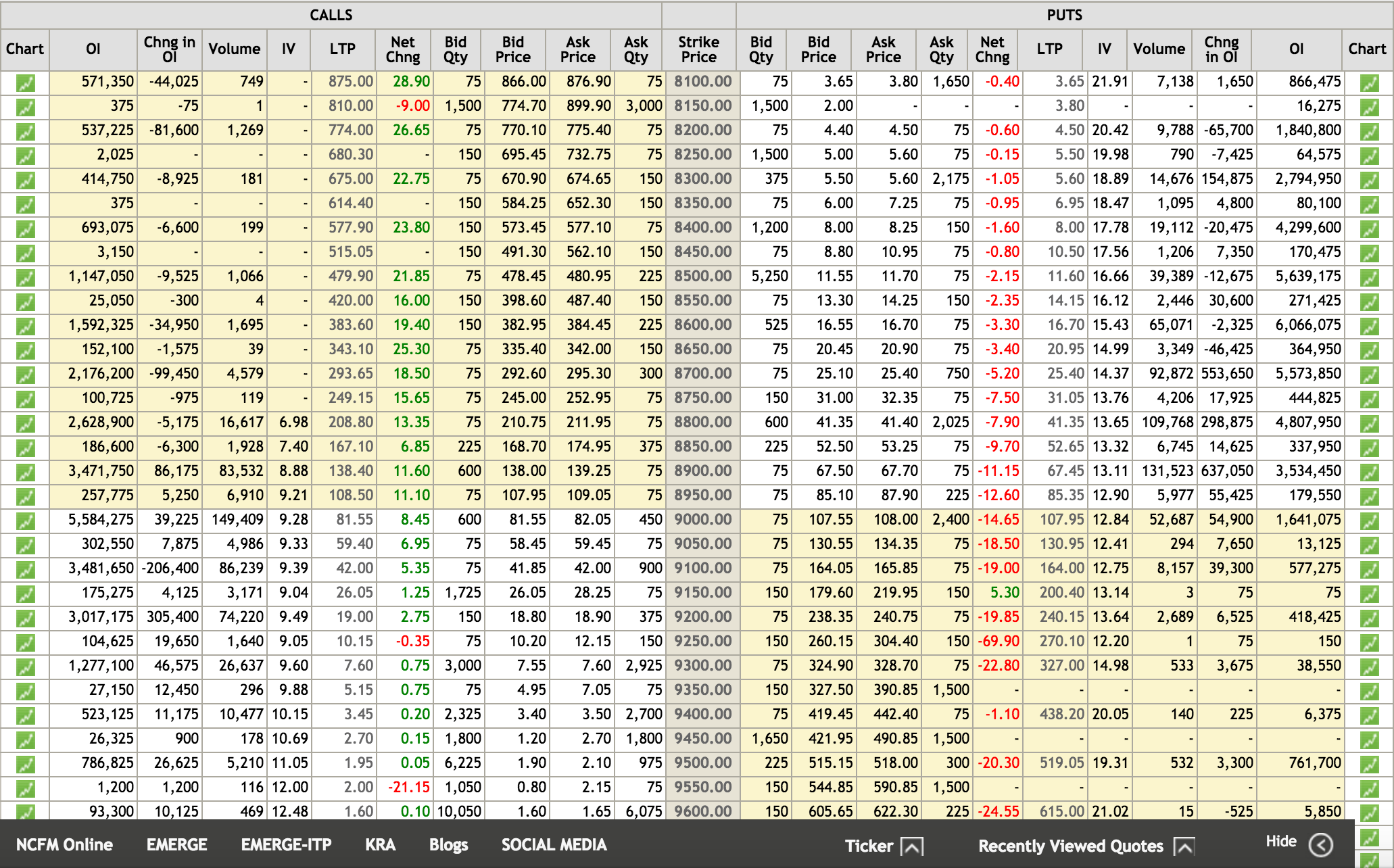

Image: www.stockmaniacs.net

Navigating NSE Option Trading Rules

NSE’s option trading regulations encompass various aspects, ensuring orderly and responsible trading practices:

1. Trading Session and Market Timings:

- Option trading occurs during the dedicated “derivatives segment” within the exchange’s trading hours, typically 9:15 AM to 3:30 PM.

2. Eligibility and Membership Criteria:

- Individuals or institutions seeking to trade options must meet specific eligibility criteria and become members of the NSE.

- Traders are required to possess adequate knowledge and experience in financial markets, demonstrating a thorough understanding of option trading principles and risk management techniques.

3. Trading Lot Size and Tick Size:

- NSE prescribes specific lot sizes and tick sizes for different underlying assets. These determine the minimum quantity and price movement per trade.

4. Contract Specifications:

- Each option contract has predefined details, including strike price, expiry date, and premium price.

- Traders must carefully review and understand these specifications before executing any trades.

5. Margin Trading and Clearing:

- NSE mandates traders to maintain adequate margin to cover potential losses in option trades.

- Clearing corporations act as intermediaries between buyers and sellers, facilitating the settlement of trades and reducing counterparty risk.

6. Risk Management Measures:

- NSE has implemented comprehensive risk management protocols to safeguard market stability, including position limits, price bands, and circuit breakers.

- These measures prevent excessive market volatility and protect traders from sudden price fluctuations.

7. Reporting and Surveillance:

- Traders are required to adhere to reporting and surveillance guidelines, providing transparency and accountability in the market.

- The exchange closely monitors trading activity to detect any irregularities or market manipulation.

Nse Option Trading Rules

Image: www.stockmarkethindi.in

Conclusion

Navigating the world of NSE option trading requires a thorough understanding of its rules and regulations. By adhering to these guidelines, traders can mitigate risks, increase their chances of success, and contribute to the overall health and integrity of the Indian derivatives market. Embracing these rules empowers traders to make informed decisions, optimize their trading strategies, and maximize their returns while safeguarding their financial well-being.