Introduction

Options trading, a popular investment strategy, is undergoing a significant transformation in India due to new regulations recently announced by the Securities and Exchange Board of India (SEBI). These new rules aim to improve transparency, reduce risks, and enhance protection for investors. In this article, we will provide a detailed overview of these new SEBI rules and their implications for option traders.

Image: bse2nse.com

Options are financial instruments that provide investors with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a特定日期. The recent volatility in global markets has led to increased participation in options trading, prompting SEBI to introduce new rules to ensure orderly and transparent trading.

Overview of New SEBI Rules

The new SEBI rules for option trading cover various aspects, including eligibility criteria, margin requirements, and trading hours. Let’s explore each of these in detail:

-

Eligibility Criteria: SEBI has revised the eligibility criteria for option trading. Individual traders must now have a minimum net worth of ₹2 lakh to trade in options, a significant increase from the earlier requirement of ₹50,000.

-

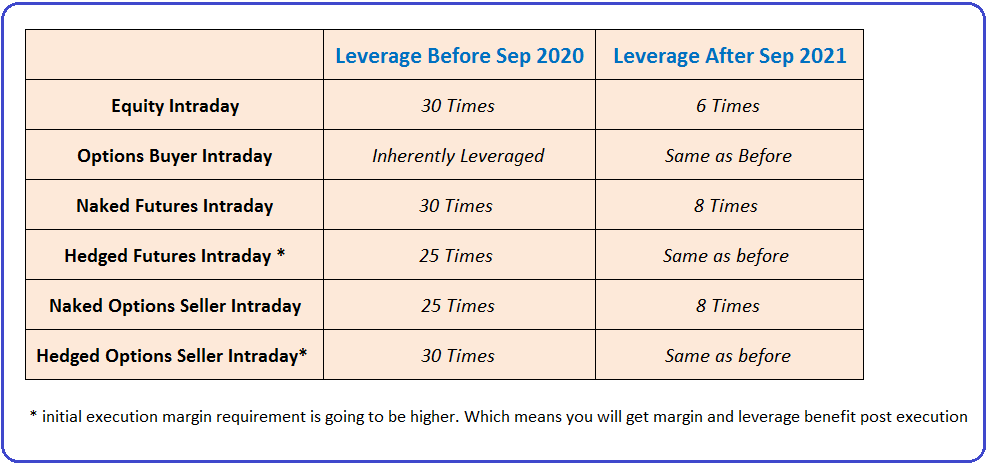

Margin Requirements: To reduce risks, SEBI has increased the margin requirements for option trading. Traders must maintain a higher margin when trading in options, which reduces leverage and limits potential losses.

-

Trading Hours: SEBI has extended the trading hours for options. Optionen trading will now be available from 9:15 AM to 3:30 PM, providing traders with more time to place and manage their trades.

Understanding the Implications

These new SEBI rules have far-reaching implications for option traders. Firstly, the stricter eligibility criteria and increased margin requirements may limit participation for some traders, especially those with a lower net worth or risk tolerance.

Secondly, the extended trading hours provide greater flexibility for traders, allowing them to better manage their positions and react to market movements. However, it also increases the potential risks for traders who may make impulsive decisions outside of conventional trading hours.

Tips and Expert Advice for Option Traders

To navigate the new SEBI rules and trade options effectively, here are some tips and expert advice:

-

Know Your Eligibility: Ensure you meet the revised eligibility criteria before engaging in option trading. If you do not qualify, consider alternative investment options.

-

Manage Your Risk: The increased margin requirements emphasize the importance of risk management. Carefully calculate your risk appetite and trade within your means.

-

Educate Yourself: Options trading can be complex. Stay updated on the latest market trends and regulations to make informed decisions.

-

Use Stop-Loss Orders: Stop-loss orders can help limit your losses by automatically closing positions when the market price reaches a predetermined level.

Image: www.moneycontain.com

FAQs on New SEBI Rules for Option Trading

Q: Are the new SEBI rules applicable to all option traders?

A: Yes, the new rules apply to all individual and institutional investors participating in option trading in India.

Q: What is the minimum net worth required for option trading now?

A: The minimum net worth required has been increased to ₹2 lakh.

Q: Have the trading hours for option trading been changed?

A: Yes, the trading hours have been extended from 9:15 AM to 3:30 PM.

Q: How do the new margin requirements affect option trading?

A: Increased margin requirements require traders to maintain a higher margin when trading options, which reduces leverage and limits potential losses.

New Sebi Rules For Option Trading

Conclusion

The new SEBI rules for option trading are a significant step towards enhancing the safety and transparency of this investment instrument. These regulations impact eligibility criteria, margin requirements, and trading hours, and it is essential for traders to understand their implications. By embracing these changes, investors can navigate the option trading landscape more effectively, manage risks, and potentially enhance their returns.

We encourage all readers to research the new SEBI rules thoroughly, seek professional advice if needed, and trade responsibly. Option trading can be a rewarding investment strategy, but it also carries risks, and it is crucial to proceed with caution and knowledge.