Introduction

Image: ungeracademy.com

The allure of options trading lies in its potential for exponential returns, but success in this complex market requires a methodical approach that leverages solid trading knowledge and diligent backtesting. Backtesting is a pivotal process that enables traders to simulate and evaluate trading strategies using historical market data. By doing so, traders can refine their strategies, identify profit-generating setups, and minimize risk exposure before deploying real capital.

What is Backtesting in Options Trading?

Backtesting involves applying a trading strategy to historical market data through specialized software to assess its performance, profitability, and risk-reward profile. This process involves simulating trades over various time frames, market conditions, and asset classes to gauge how the strategy would have fared under real-world scenarios.

Benefits of Backtesting Options Trading

- Objective Strategy Evaluation: Backtesting eliminates the influence of emotions and biases, providing an unbiased analysis of trading performance.

- Historical Market Insights: By simulating trades on past market data, traders gain valuable insights into how strategies would have behaved in different economic and market conditions.

- Optimization of Parameters: Backtesting allows traders to experiment with various trading parameters, such as entry and exit signals, profit targets, and stop-loss levels, to find the optimal settings.

- Risk Assessment: By identifying winning and losing trades, backtesting unveils potential risks associated with a strategy, enabling traders to adjust their risk management measures accordingly.

Step-by-Step Guide to Backtesting Options Trading

1. Choose a Trading Strategy: Define your trading strategy, outlining entry and exit signals, trading time frame, targeted markets, and underlying asset classes.

2. Select Backtesting Software: Utilize specialized backtesting software, such as TradingView, Thinkorswim, or MetaTrader 5, that cater to options trading and provide historical market data.

3. Import Historical Data: Gather comprehensive historical data for the underlying assets, including price, volume, Greeks, and market indices.

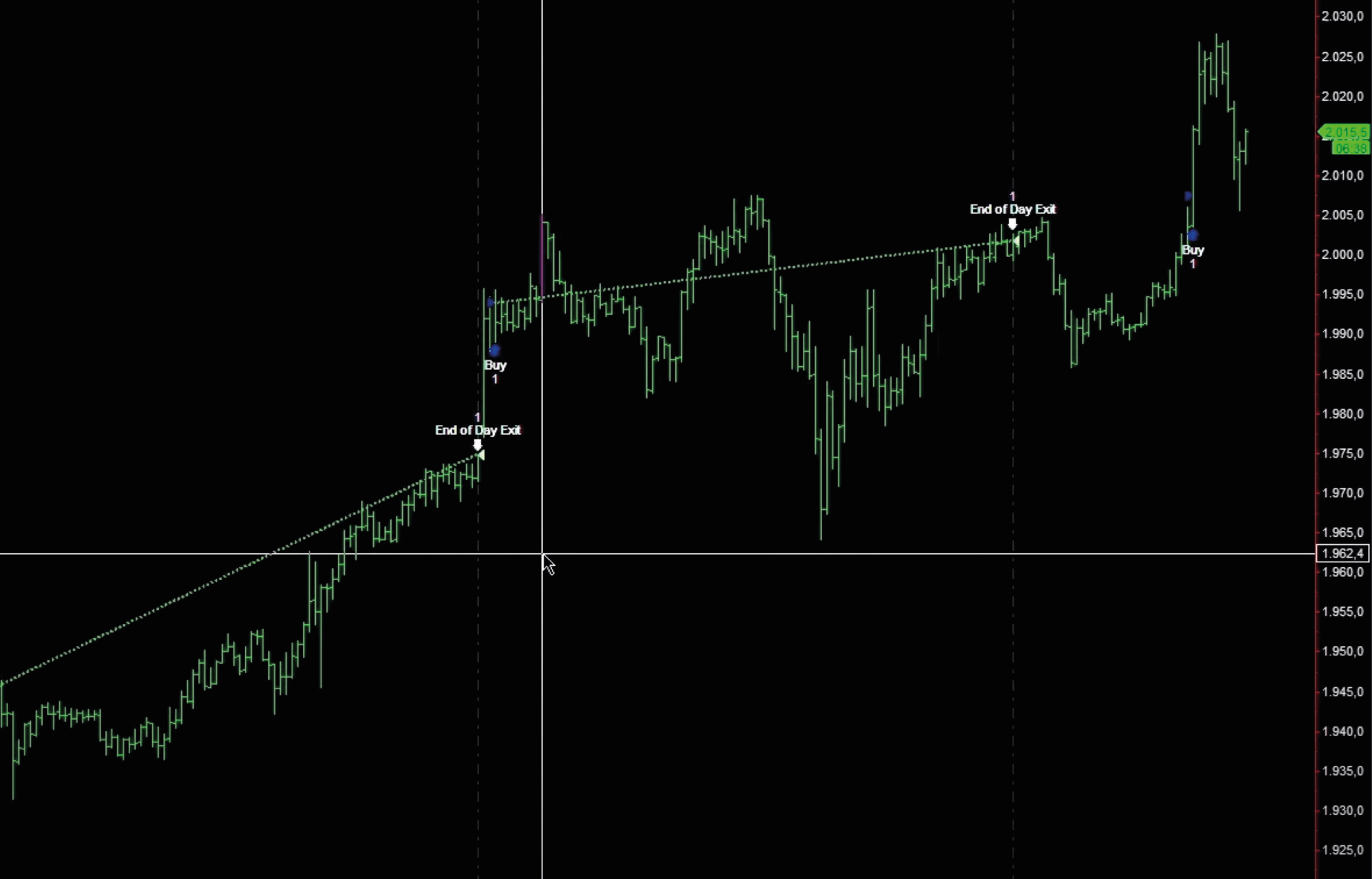

4. Simulate Trades: Apply your trading strategy to the historical data, simulating trades based on your entry and exit signals, trade size, and position management rules.

5. Measure Performance: Evaluate the simulated trading results by analyzing metrics such as return on investment (ROI), profit factor, Sharpe ratio, and risk-reward ratios.

6. Analyze Drawdowns: Identify periods of significant decline in account value (known as drawdowns) and assess their frequency, duration, and severity.

7. Adjust and Refine: Based on the backtesting results, tweak your trading strategy by adjusting parameters, incorporating new signals, or redefining risk management rules.

Conclusion

Backtesting options trading is a crucial step toward achieving trading success. By simulating trades on historical market data, traders gain a comprehensive understanding of their trading strategy’s performance, risk profile, and potential profitability. Through consistent backtesting and refinement, traders can develop robust strategies that meet their risk tolerance, return objectives, and trading style, and confidently navigate the volatile world of options trading using ample historical data and analysis to predict future market trends.

Image: learnpriceaction.com

How To Backtest Options Trading

Image: www.xtremetrading.net