Introduction

Image: optionstradingiq.com

In the realm of financial markets, where every decision can mean the difference between profit and loss, having a reliable method to evaluate your trading strategies is paramount. Enter options trading backtesting, a powerful tool that allows you to test your strategies on historical data, providing valuable insights into their potential performance. This article delves into the world of options trading backtesting, empowering you with the knowledge and tools to optimize your trading decisions.

Understanding Options Trading Backtesting

Options trading backtesting is the process of simulating your options trading strategies on historical data to assess their performance. It involves recreating real-world trading conditions by incorporating variables such as market prices, volatility, and time decay. By analyzing the results of these simulated trades, you can gain valuable insights into the potential risks and rewards of your chosen strategy before putting real money on the line.

Benefits of Options Trading Backtesting

The benefits of options trading backtesting are numerous:

- Validate Trading Strategies: Backtesting helps you determine the effectiveness of your trading strategies by analyzing their historical performance.

- Optimize Parameters: You can fine-tune the parameters of your strategies, such as entry and exit points, to maximize their potential profitability.

- Identify Weaknesses: Backtesting reveals potential shortcomings in your strategies, allowing you to make necessary adjustments to minimize risk.

- Develop Confidence: Positive backtesting results can boost your confidence in your trading decisions, giving you a psychological edge in the markets.

Steps Involved in Options Trading Backtesting

- Define Trading Strategy: Clearly outline the rules of your trading strategy, including entry and exit criteria, risk management parameters, and trading time frame.

- Gather Historical Data: Acquire reliable historical market data that covers a sufficient period of time to represent the different market scenarios your strategy may encounter.

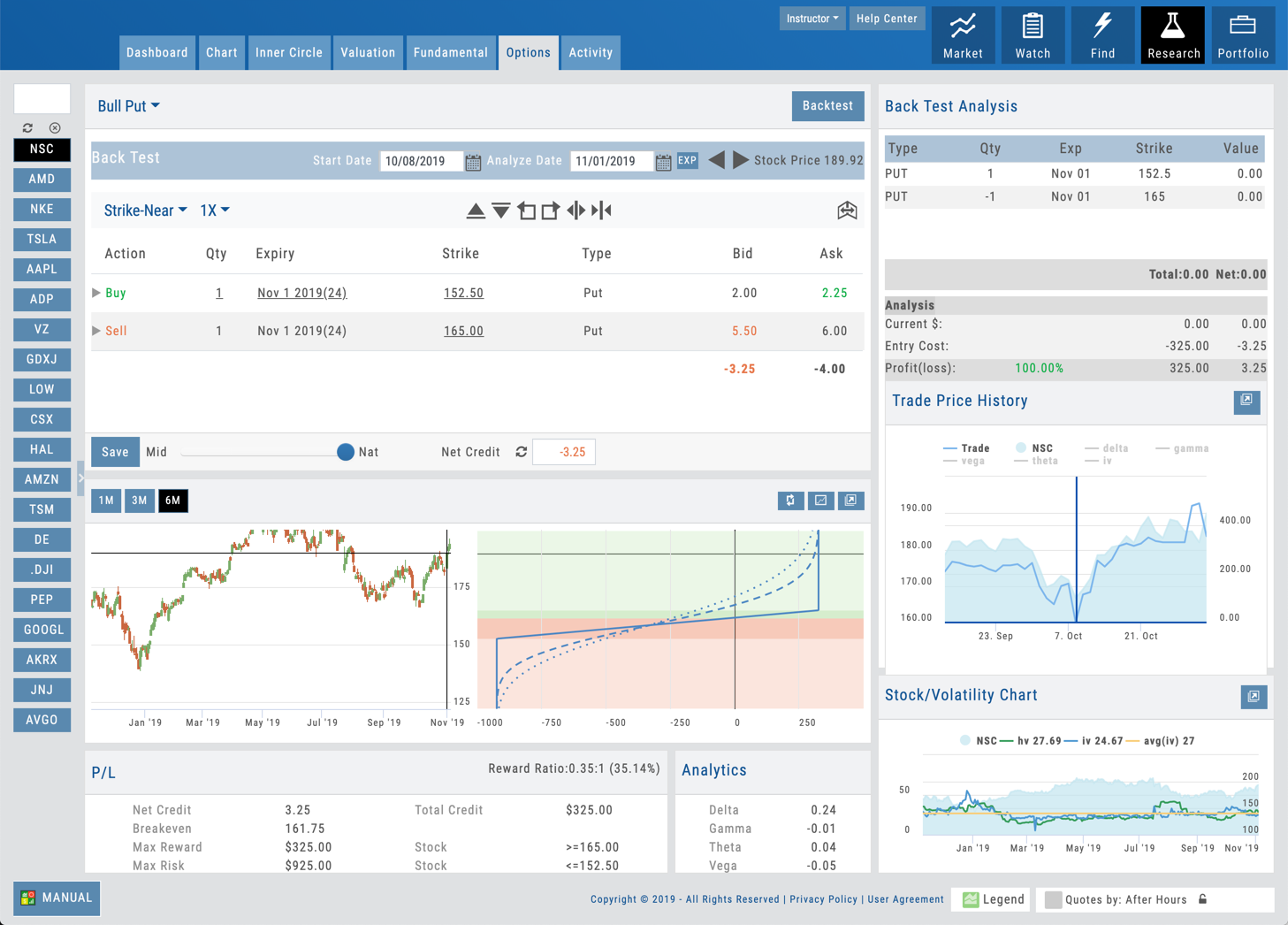

- Simulation Platform: Choose a backtesting software or platform that allows you to input your trading strategy and historical data to simulate trades.

- Performance Analysis: Evaluate the results of your simulated trades, including metrics such as profit factor, win rate, and average holding period.

- Interpret Results: Carefully analyze the backtesting results to identify strengths, weaknesses, and areas for improvement in your trading strategy.

Expert Insights and Actionable Tips

- “Backtesting is not a substitute for live trading, but it is an invaluable tool for identifying strategies that are more likely to succeed.” – Mark Douglas, trading psychologist

- “Don’t overfit your strategies to the historical data. Backtesting should provide insights into the overall performance of your strategy, not specific market conditions.” – Josh Waitzkin, chess prodigy and hedge fund manager

- “Focus on creating repeatable trading systems that consistently identify profitable opportunities.” – Ed Seykota, legendary commodity trader

Conclusion

Options trading backtesting is a powerful instrument that can elevate your options trading endeavors to new heights. By meticulously simulating your strategies on historical data, you gain an invaluable advantage in the markets. Use this knowledge to refine your strategies, identify potential risks, and improve your overall trading performance. Remember, while backtesting is a crucial step, it is only one part of the trading process. Leverage it wisely, apply sound risk management principles, and consistently improve your skills to achieve lasting success in the unpredictable world of options trading.

Image: www.chartsbytradeway.com

Options Trading Backtesting