The fast-paced world of finance presents a myriad of opportunities for savvy investors to capitalize on market fluctuations. One such avenue is the intriguing arena of US stock options trading, where traders navigate the complexities of derivatives to enhance their investment strategies. In this comprehensive guide, we delve into the intricacies of US stock options trading, unraveling its history, essential concepts, and the nuances of real-world applications.

Image: seekingalpha.com

Navigating the Ebb and Flow: A Historical Perspective

The origins of stock options trace back to the early 20th century when the Chicago Board of Trade introduced standardized contracts that solidified the concept of trading options. Over the decades, stock options have evolved from mere financial instruments to sophisticated tools employed by investors seeking to mitigate risks, amplify returns, and gain exposure to underlying assets.

Defining the Essence: Understanding Stock Options

In essence, stock options are contracts that grant the holder the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific number of shares of an underlying stock at a predetermined price, also known as the strike price, within a specified time frame. This unique mechanism affords traders the flexibility to make informed decisions based on their market outlook and risk appetite.

Unveiling the Symphony of Applications

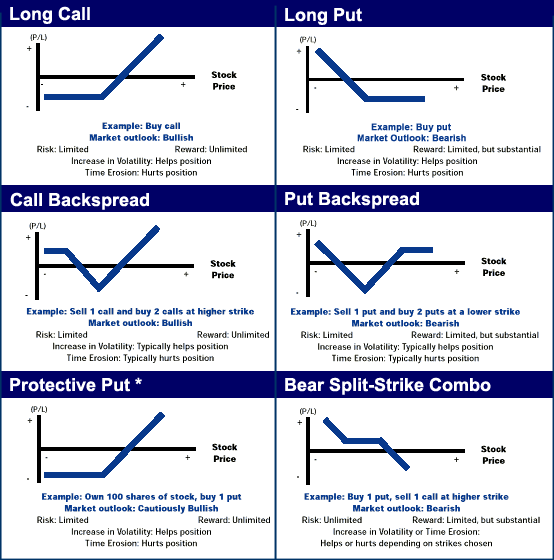

The versatility of stock options extends beyond their primary role as risk management tools. They offer a range of strategic applications that cater to diverse investment objectives. From hedging against potential losses to leveraging market movements for profit maximization, the world of stock options provides a versatile canvas for traders to express their financial acumen.

Image: www.tradestation.com

Hedging Strategies: Shelter from the Storm

In the face of market uncertainty, stock options emerge as powerful instruments for risk mitigation. By employing protective put options, investors can safeguard their portfolios against potential downturns, ensuring a certain level of downside protection while preserving their long-term investment goals.

Profit Enhancement: Riding the Market’s Rhythm

The flip side of the coin reveals the potential of stock options to amplify returns when market conditions align favorably. Traders with a bullish outlook can harness call options to capitalize on rising prices, while those anticipating a decline can utilize put options to profit from market corrections.

Leverage and Flexibility: Unlocking Investment Horizons

At the heart of stock options trading lies the concept of leverage, empowering traders to control a larger number of shares with a fraction of the capital required to purchase them outright. This inherent leverage amplifies both potential gains and losses, demanding a keen understanding of market dynamics and risk management principles. Moreover, the flexibility offered by options allows traders to fine-tune their strategies, adjusting strike prices and expiration dates to align with their investment horizons and risk tolerance.

Mastering the Nuances: Advanced Concepts

Venturing beyond the basics of stock options trading, we delve into the intricate tapestry of advanced concepts that shape this dynamic realm.

Implied Volatility: Unraveling the Market’s Expectations

Implied volatility, a key metric in options pricing, unveils the market’s collective assessment of future price fluctuations for the underlying asset. By factoring in the time value of the option and the risk-free rate, traders can gauge the market’s expectations and make informed decisions regarding option premiums.

Options Strategies: orchestrating a Symphony of Trades

The artistry of stock options trading is exemplified through the strategic combination of multiple options contracts. These multifaceted strategies, encompassing vertical spreads, horizontal spreads, and complex combinations, enable traders to craft customized risk-return profiles that align with their investment objectives and market outlook.

Exotics: Uncharted Waters in Option Trading

On the cutting edge of options trading lie exotic options, financial instruments that transcend the boundaries of vanilla options. With their intricate structures and specialized applications, exotics cater to sophisticated traders seeking to navigate complex market scenarios and tailor their strategies to specific market conditions.

The Art of Risk Management: Sailing through Market Storms

In the realm of stock options trading, risk management is not merely a cautious afterthought but an integral part of every decision. Traders must constantly assess their risk tolerance, monitor position exposure, and implement appropriate risk management strategies to navigate market turbulence and preserve their financial well-being.

Us Stock Options Trading

https://youtube.com/watch?v=o8gTYwV14ss

Conclusion: Unveiling the Potential of US Stock Options Trading

US stock options trading unfolds as a captivating dance between risk and reward, offering traders a powerful toolset to enhance their investment strategies. By understanding the historical context, essential concepts, and advanced nuances of this dynamic arena, traders can unlock the full potential of stock options, empowering them to navigate market fluctuations with confidence and pursue their financial aspirations with a discerning eye.