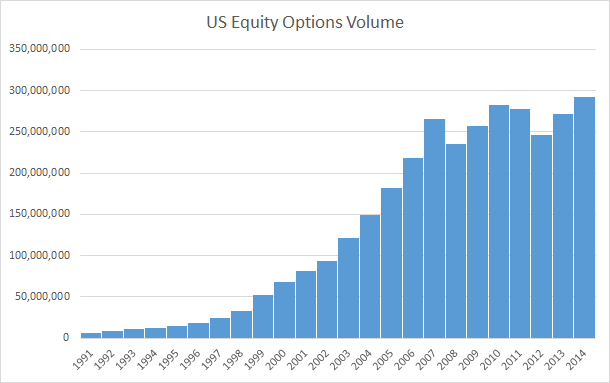

Dive into the annals of option trading, where volumes tell tales of market sentiment and trading dynamics.

Option trading, a realm where speculation and strategy converge, has witnessed a remarkable history of volume fluctuations. These fluctuations, a testament to ever-evolving market conditions, offer insights into investor behavior, risk appetite, and the overall financial landscape. Join us on a journey through the annals of option trading volume history, where we uncover the secrets concealed within these numbers.

Image: www.jumpstarttrading.com

Early Beginnings: A Seed Planted in Uncertainty

The origins of option trading can be traced back to ancient Greece, where prudent merchants sought refuge from volatile grain prices through a primitive form of options. However, it was not until the advent of formal exchanges in the 18th century that option trading truly blossomed. In 1720, Europe’s burgeoning commercial centers witnessed the establishment of the London Stock Exchange, a cradle for early option contracts known as “puts” and “calls.” These financial instruments allowed traders to hedge against market uncertainty, laying the foundation for the sophisticated derivatives market we know today.

A Roaring Bull: Volume Surges in a Bullish Market

The 20th century marked a watershed moment for option trading, as the rise of standardized options contracts propelled volumes to unprecedented heights. The establishment of the Chicago Board Options Exchange (CBOE) in 1973 marked a pivotal turning point, providing a centralized marketplace for standardized option contracts. Amidst a backdrop of surging stock prices and heightened investor optimism, option trading volume soared, mirroring the euphoric sentiments of a bull market.

Bears Take Charge: Volume Peaks Amidst Market Turmoil

The bursting of the dot-com bubble in the early 2000s ushered in an era of market volatility and investor uncertainty. As fear gripped the markets, option trading volume reached new peaks, driven by investors seeking refuge from the tumbling stock prices. Option contracts, with their inherent ability to hedge downside risk, became the armor of choice for traders navigating treacherous market conditions. This surge in volume underlined the counter-cyclical nature of option trading, flourishing during times of uncertainty when the need for risk management intensifies.

Image: forexvolumestrategies.blogspot.com

The Rise of Retail Traders: Volume Amplified by Accessibility

The advent of online trading platforms in the late 20th century democratized access to financial markets, empowering retail traders with the ability to participate in option trading. As trading commissions plummeted, retail traders flocked to option markets, driving volumes to new heights. The ease of execution and the potential for outsized returns lured both experienced and novice traders, contributing to a vibrant and diverse trading ecosystem.

Option Trading Volume History

Image: www.optiontradingtips.com

Conclusion: A Tapestry Woven by Volume

The ebb and flow of option trading volume have woven a rich tapestry of market history, reflecting investor sentiment, risk appetite, and evolving market dynamics. From the humble beginnings in ancient Greece to the sophisticated exchanges of today, option trading volume has served as a barometer of financial landscapes and a catalyst for trading strategies. As we delve into the future of option trading, technological advancements and geopolitical events will undoubtedly continue to shape volume patterns, adding new chapters to this ever-evolving narrative.