Introduction

In the realm of investing, options trading stands as a versatile tool that empowers investors to navigate market volatility, hedge risks, and pursue significant returns. Experienced traders rely on various strategies to maximize their profit potential and mitigate potential losses. In this comprehensive guide, we delve into the intricacies of option trading strategies, exploring their mechanisms, benefits, and potential pitfalls. Whether you’re a seasoned investor or just starting your journey, this article equips you with the knowledge and insights to harness the power of options.

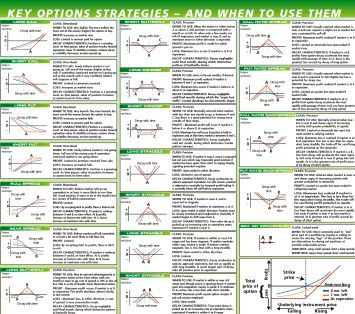

Image: alphabetastock.com

We begin by examining the fundamental principles of options trading, defining the different types of options and explaining their unique characteristics. We then delve into the key strategies employed by successful traders, providing clear and concise descriptions of their strengths and weaknesses.

Strategy 1: Covered Call Writing

Definition and Mechanism

Covered call writing involves selling (writing) a call option while simultaneously holding the underlying security (e.g., stock). The call option grants the buyer the right, but not the obligation, to purchase the underlying security at a specified price (strike price) by a certain date (expiration date). The seller of the call option receives a premium in exchange for this right.

Covered call writing generates income through the premium received, which compensates for the potential loss if the underlying security rises above the strike price and the buyer exercises the option. However, it also limits the trader’s upside potential should the security continue to appreciate.

Strategy 2: Protective Put Buying

Image: www.pinterest.com

Definition and Mechanism

Protective put buying involves purchasing a put option while holding the underlying security. A put option grants the buyer the right, but not the obligation, to sell the underlying security at a specified price (strike price) by a certain date (expiration date). The buyer of the put option pays a premium in exchange for this right.

Protective put buying offers protection against potential losses in the value of the underlying security. If the security’s price declines below the strike price, the buyer can exercise the put option to sell the security at the pre-determined strike price. This limits the trader’s potential loss to the difference between the security’s price and the strike price minus the premium paid for the option.

Strategy 3: Bull Call Spread

Definition and Mechanism

A bull call spread involves buying one call option at a lower strike price and simultaneously selling another call option at a higher strike price, with the same expiration date. The trader expects the underlying security to rise in value but is less bullish than in a covered call writing strategy.

The bull call spread provides limited potential loss, which is the difference between the purchase price of the call option at the higher strike price and the sale price of the call option at the lower strike price minus any premium received. The maximum profit potential is the difference between the strike prices minus the net premium paid for the options.

Strategy 4: Bear Put Spread

Definition and Mechanism

A bear put spread involves selling one put option at a higher strike price and simultaneously buying another put option at a lower strike price, with the same expiration date. The trader expects the underlying security to decline in value but is less bearish than in a protective put buying strategy.

The bear put spread provides limited potential loss, which is the difference between the sale price of the put option at the higher strike price and the purchase price of the put option at the lower strike price minus any premium received. The maximum profit potential is the difference between the strike prices minus the net premium received for the options.

Strategy 5: Iron Condor

Definition and Mechanism

An iron condor involves selling two call options at different strike prices and buying two put options at different strike prices, with the same expiration date. The call options are sold at higher strike prices, and the put options are sold at lower strike prices. The trader expects the underlying security to remain within a relatively narrow range, with limited volatility.

The iron condor provides limited potential profit, which is the net premium received from selling the options. The maximum potential loss is the difference between the difference between the strike prices of the call and put options sold and the difference between the strike prices of the call and put options purchased. An iron condor is considered a neutral strategy, appropriate for a trader with a neutral market outlook.

Option Trading Strategies Trading

Image: www.marketsmuse.com

Conclusion

Option trading strategies offer a diverse and flexible set of tools for managing risk and maximizing returns in the financial markets. By leveraging these strategies, traders can tailor their investments to their unique risk tolerance, market outlook, and financial goals. While options trading involves inherent risks, thorough understanding, careful planning, and sound execution can help unlock its full potential.

Whether you seek to generate income, hedge risks, or capitalize on specific market movements, option trading strategies provide a powerful means to navigate the complexities of the financial world. Are you eager to tap into the world of option trading and explore the strategies discussed in this article? Leave a comment below and let’s start the conversation!