Qualifying for options trading opens a door to a sophisticated world of financial markets, but the path to eligibility requires careful preparation and a deep understanding of the concepts involved. Options, derivative contracts that grant buyers the right (but not the obligation) to buy or sell an asset at a predetermined price and expiration date, offer a versatile instrument for managing risk, generating income, and speculating.

Image: www.strike.money

To qualify for options trading, aspiring traders must typically meet account balance, income, trading experience, and knowledge assessment criteria set by their preferred broker. Brokers may require minimum account balances to cover potential losses, evidence of sufficient income to support trading activities, prior trading experience (including simulation), and successful completion of knowledge tests demonstrating comprehension of options strategies and risks.

Core Concepts of Options Trading

Call Options: These contracts give buyers the right to buy the underlying asset at the strike price (specified price) on or before the expiration date. Traders expect the price of the asset to increase, allowing them to exercise the option to purchase at a lower price than the current market value.

Put Options: Conversely, put options grant holders the right to sell the underlying asset at the strike price on or before expiration. These options are favored by traders anticipating the price of the asset to decline, enabling them to sell at a higher price than the prevailing market rate.

Long vs. Short Positions: Buying an option creates a long position, giving the buyer the right to exercise at their discretion. Selling an option, on the other hand, creates a short position, obligating the seller to perform the underlying contract if the option is exercised.

Risk Management and Strategy

Options trading comes with inherent risks, so it’s crucial to adopt sound risk management practices. Understanding delta, gamma, theta, and vega – known as the Greeks – helps traders comprehend the sensitivity of options prices to changes in underlying asset prices, time decay, interest rates, and volatility.

Traders can engage in various strategies to suit their risk tolerance and market outlook. Covered calls, for example, involve selling a call option while owning the corresponding asset to minimize risk. Put spreads, on the other hand, combine buying a put option at a lower strike price and selling one at a higher strike price to wager on a decline in the underlying asset’s price.

Recent Trends and Developments

The options market has witnessed significant growth in recent years, driven by factors such as advancements in trading platforms and increased retail investor participation. The rise of automated trading and the incorporation of artificial intelligence (AI) have further transformed the industry.

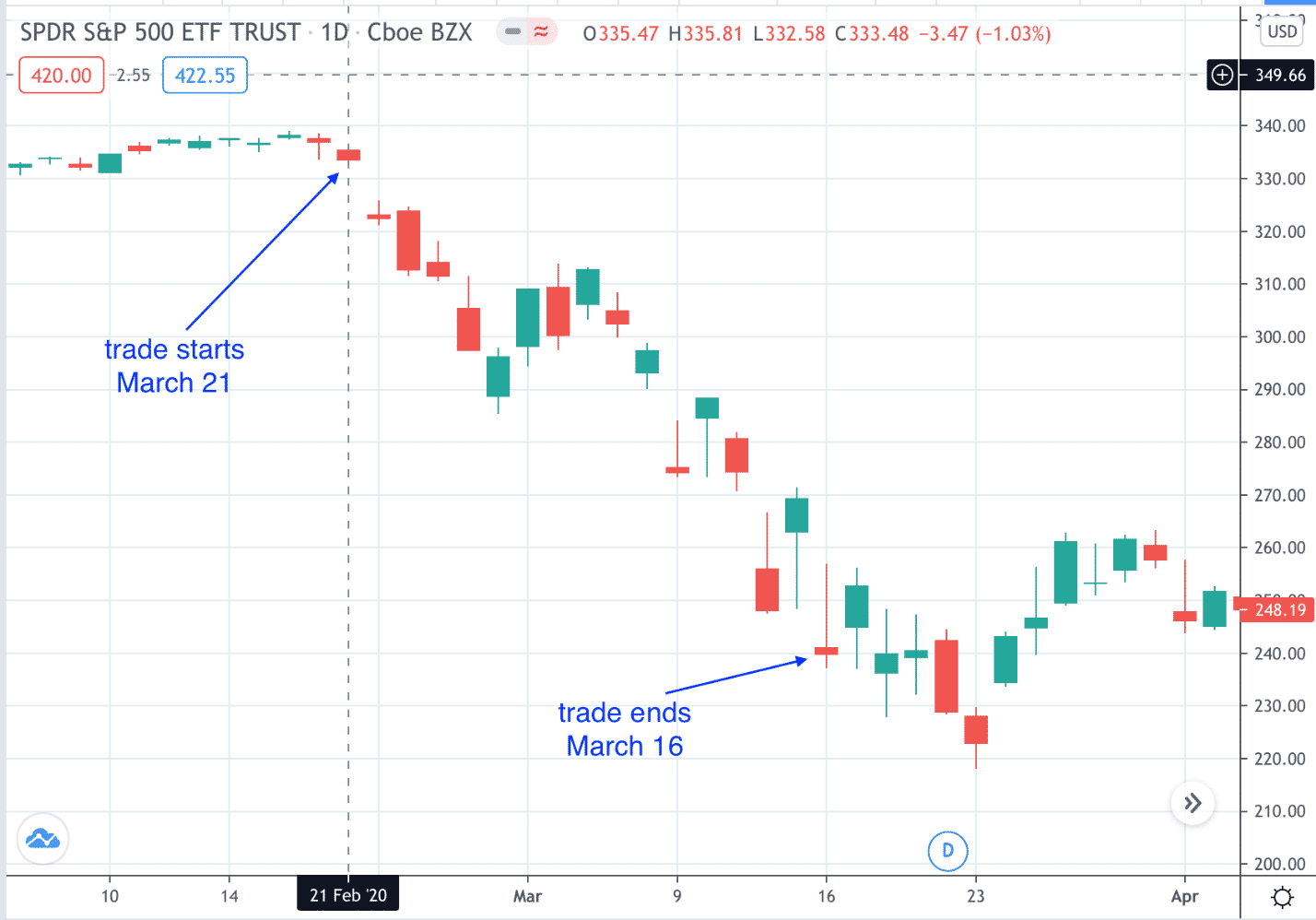

Moreover, the COVID-19 pandemic has led to heightened volatility in financial markets, increasing demand for options strategies to manage risk and hedge against uncertainty. Many traders have turned to options to mitigate portfolio losses or enhance their return potential.

Image: optionstradingiq.com

How To Qualify Options Trading

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Image: economiaenegocios.com

Conclusion

Qualifying for options trading unlocks a vast array of opportunities in the financial markets. By meeting brokerage criteria and gaining a thorough understanding of core concepts, risk management, and trading strategies, aspiring traders can navigate this complex realm.

Embracing continuous education, monitoring market trends, and practicing prudent risk management are essential keys to success. Options trading can be a lucrative and rewarding endeavor, but it’s equally important to recognize and mitigate the inherent risks involved.