Embarking on the Thrilling Journey of Financial Flexibility

In the ever-evolving world of finance, options trading presents a tantalizing opportunity for investors seeking both adrenaline and monetary rewards. Nike, the iconic sportswear giant, offers a compelling target for those желающий to navigate the market’s ups and downs with precision and potential for substantial returns.

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F40101053%2F0x0.jpg%3Ffit%3Dscale)

Image: www.forbes.com

Options contracts, like miniature financial levers, grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. By utilizing these versatile instruments, investors can unlock a realm of strategic possibilities that extend beyond traditional stock trading.

Decoding the Nuances of Nike Options Trading

To delve into the intricacies of Nike options trading, it’s imperative to grasp the fundamental concepts that govern this market. A basic understanding of options terminology, such as call and put options, strike prices, and expiration dates, serves as the foundation for informed decision-making.

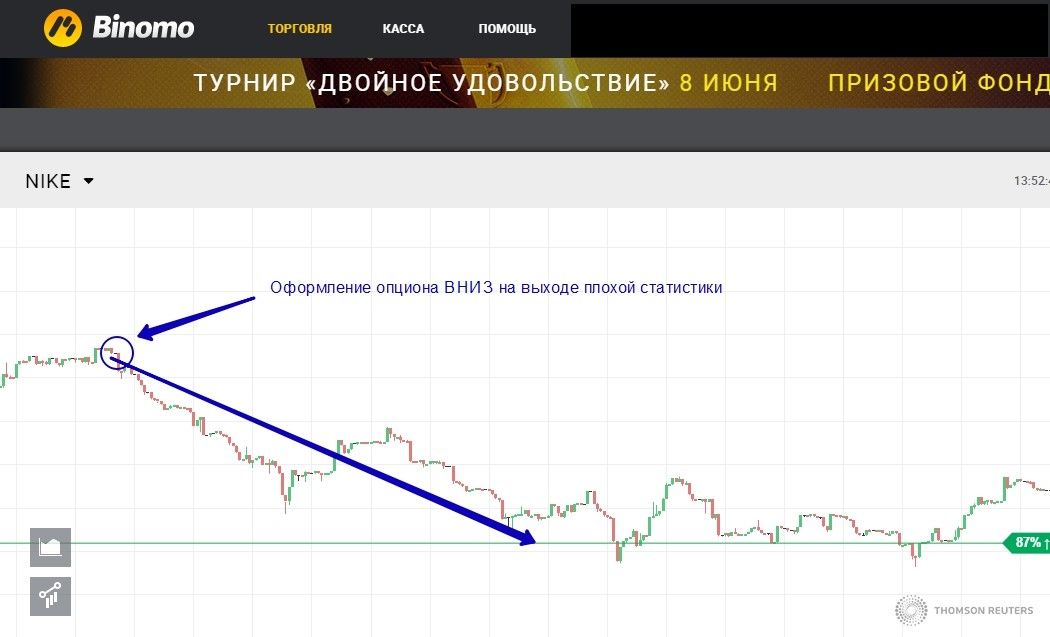

Like skilled surfers navigating tumultuous waves, successful options traders possess an intimate understanding of market trends, volatility, and risk management. By meticulously studying historical data, economic indicators, and company-specific news, traders can make educated predictions about the future direction of Nike’s stock price.

Unveiling the Potential Rewards and Risks

Options trading offers investors the tantalizing prospect of multiplying their returns, outpacing the gains achievable through conventional stock investments. However, this potential for amplified profits comes inextricably intertwined with heightened risks that must be carefully considered.

Options contracts possess a finite lifespan, expiring worthless if the underlying asset price fails to meet the predetermined strike price by the specified time. Moreover, options trading involves the concept of leverage, which magnifies both potential gains and losses, accentuating the need for prudent risk management strategies.

Empowering Strategies for Market Mastery

For those seeking to venture into the realm of Nike options trading, a wealth of strategies awaits, each tailored to specific market conditions and investment goals. Covered calls, for instance, provide a conservative approach, generating income while limiting potential upside, while naked puts offer a more aggressive strategy, capitalizing on market downturns.

By leveraging the wisdom of seasoned experts, aspiring options traders can glean invaluable insights and gain a competitive edge in this dynamic market. The prudent application of these strategies, coupled with disciplined execution, can empower investors to harness the market’s volatility to their advantage.

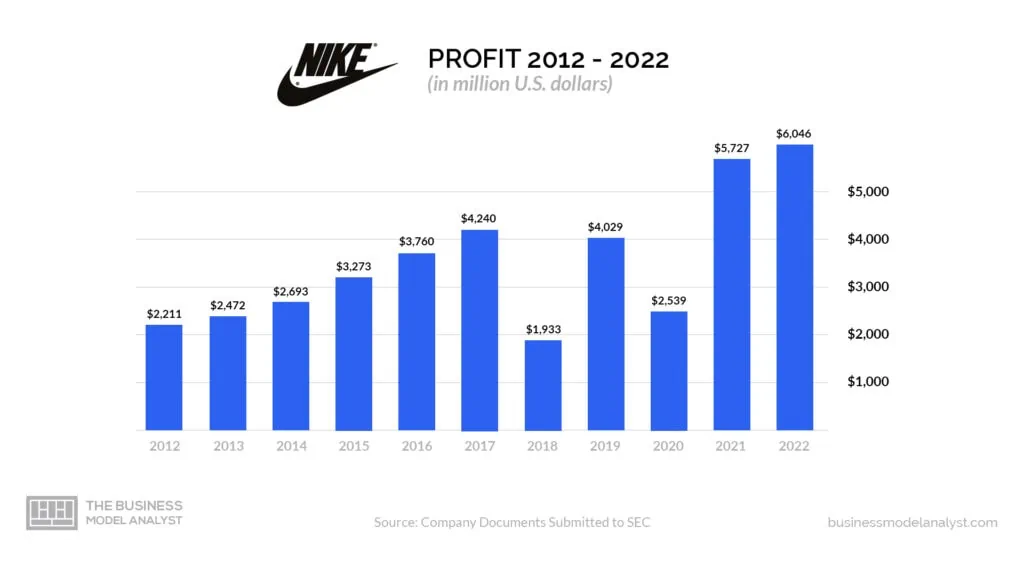

Image: businessmodelanalyst.com

Nike Options Trading

Image: revieweek.com

Embracing the Journey: Towards Financial Success

Embarking on the journey of Nike options trading requires a blend of analytical rigor, market savvy, and unwavering resilience. The path to financial success is paved with continuous learning, strategic decision-making, and the ability to navigate the market’s unpredictable currents with confidence.

Whether seeking to supplement income, enhance portfolio returns, or simply experience the thrill of the trading arena, Nike options trading presents a captivating avenue for those equipped with the knowledge, discipline, and unwavering determination to conquer financial challenges. Let the trading adventure begin!