Introduction to Nike’s Option Trading

The global sportswear giant, Nike, has been a prominent player in the stock market for decades. In recent years, options trading has emerged as a popular strategy for investors seeking to enhance their returns or manage risk. Understanding the average option daily trading volume for Nike is crucial for informed decision-making in the options market.

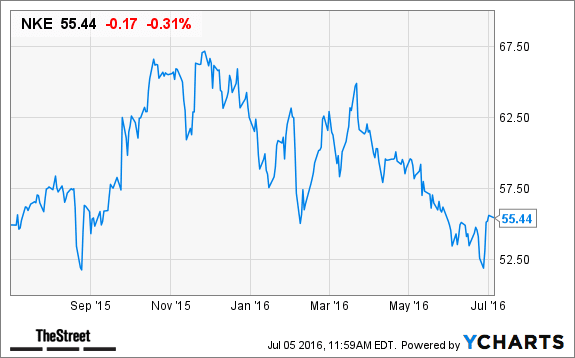

Image: www.thestreet.com

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. The daily trading volume of an option refers to the number of contracts exchanged between buyers and sellers on a particular day.

Nike Option Trading Volume Analysis

Nike’s option trading volume has experienced significant growth in recent years, reflecting the increasing popularity of options trading among investors. According to data from the OCC (Options Clearing Corporation), the average daily trading volume for Nike options exceeded 1 million contracts in 2022, a remarkable increase compared to previous years. This high volume indicates a deep and liquid options market for Nike, providing ample opportunities for traders and investors.

The average daily trading volume can vary significantly depending on market conditions, news events, and the release of company-specific financial data. For instance, during periods of market volatility or when Nike announces significant earnings results, option trading volume tends to surge as investors seek to speculate on potential price movements or hedge their existing positions.

Factors Influencing Nike Option Daily Trading Volume

Several factors contribute to the average daily trading volume of Nike options:

- Market Volatility: When the overall market is experiencing high volatility, characterized by sharp price swings, investors tend to trade more options as a risk-management tool or to capture quick profits.

- News Events: Significant news events, such as product launches, earnings announcements, or company-specific developments, can trigger increased option trading volume as investors react to new information and adjust their positions.

- Earnings Releases: Nike’s quarterly earnings releases are closely watched by investors, analysts, and traders. The release of financial results can lead to substantial option trading activity as investors speculate on the company’s future performance.

- Seasonality: Option trading volume tends to increase during certain times of the year, such as quarterly earnings seasons or major sporting events, when market activity is typically higher.

Significance of Nike Option Trading Volume

The average daily trading volume for Nike options holds several implications for traders and investors:

- Liquidity: High trading volume ensures liquidity in the Nike options market, making it easier for investors to buy and sell contracts without experiencing significant price slippage.

- Price Discovery: Active trading helps determine fair market prices for Nike options, ensuring efficient price discovery and minimizing price disparities.

- Risk Management: A liquid options market allows investors to employ hedging strategies using options to manage risk and protect existing investments.

- Volatility Assessment: Option trading volume data can provide insights into market sentiment and implied volatility, aiding traders in making informed decisions and adjusting trading strategies.

Image: www.advisorperspectives.com

Tips and Expert Advice for Nike Option Trading

Based on experience and insights from expert traders, here are some tips and expert advice for effective Nike option trading:

- Define Trading Objectives: Before entering the Nike options market, clearly define your trading objectives, whether seeking short-term profits or long-term risk management.

- Research and Due Diligence: Conduct thorough research on Nike’s financial performance, industry dynamics, and overall market conditions to make informed trading decisions.

- Manage Risk: Use options in conjunction with other investment strategies to manage risk and diversify your portfolio. Consider hedging techniques to reduce potential losses.

- Stay Informed: Monitor Nike-specific news and announcements, as well as broader market trends, to make timely and well-informed trading decisions.

- Consider Technical Analysis: Utilize technical analysis tools to identify potential trading opportunities, such as support and resistance levels, and trend analysis.

Frequently Asked Questions about Nike Option Trading Volume

Here are some common questions and answers related to Nike option trading volume:

Q: What is a high daily trading volume for Nike options?

A: A daily trading volume of over 1 million contracts is considered high for Nike options.

Q: What factors contribute to high option trading volume?

A: Market volatility, news events, earnings releases, and seasonality.

Q: What are the benefits of trading Nike options with high volume?

A: Liquidity, price discovery, risk management, and volatility assessment.

Nike Average Option Daily Trading Volume

Image: www.nasdaq.com

Conclusion

The average daily trading volume for Nike options provides invaluable insights for both retail and institutional investors navigating the options market. By understanding the factors influencing volume, utilizing tips and expert advice, and leveraging market data, traders can make informed decisions, manage risk, and potentially enhance their returns through Nike option trading.

Are you interested in delving deeper into the world of Nike option trading? Explore other resources online, consult financial professionals, and continue staying updated on market trends and analysis to optimize your trading strategies effectively.