In the ever-evolving world of financial markets, swing trading in options has emerged as a dynamic and lucrative strategy for discerning investors. Swing trading involves holding an options contract for a period of days or weeks, aiming to capitalize on short-term price swings in the underlying asset. This approach strikes a balance between the swift execution of day trading and the long-term horizon of buy-and-hold investing, offering potential rewards with controlled risks.

Image: 2ndskiesforex.com

To navigate the complexities of swing trading options successfully, a deep understanding of the foundational concepts and latest trends is paramount. This comprehensive guide will delve into the intricacies of this strategy, empowering you with the knowledge and insights to make informed decisions and maximize your returns.

Demystifying Swing Trading Options: A Historical Perspective

The genesis of swing trading can be traced back to the early days of options trading, when investors recognized the potential of leveraging short-term price movements. In the 1960s, traders began experimenting with holding options contracts for periods longer than a day, exploiting the fluctuations in the underlying asset’s price. As technology and market analysis techniques advanced, swing trading emerged as a distinct strategy, gaining widespread popularity among retail and institutional investors alike.

Core Concepts: Laying the Foundation for Success

At the heart of swing trading options lies the concept of time decay. Options contracts have a finite lifespan, and their value diminishes over time. Swing traders capitalize on this time decay by buying options contracts with near-term expiration dates and selling them before their value evaporates entirely. This approach allows them to capture substantial profits from even modest price movements in the underlying asset.

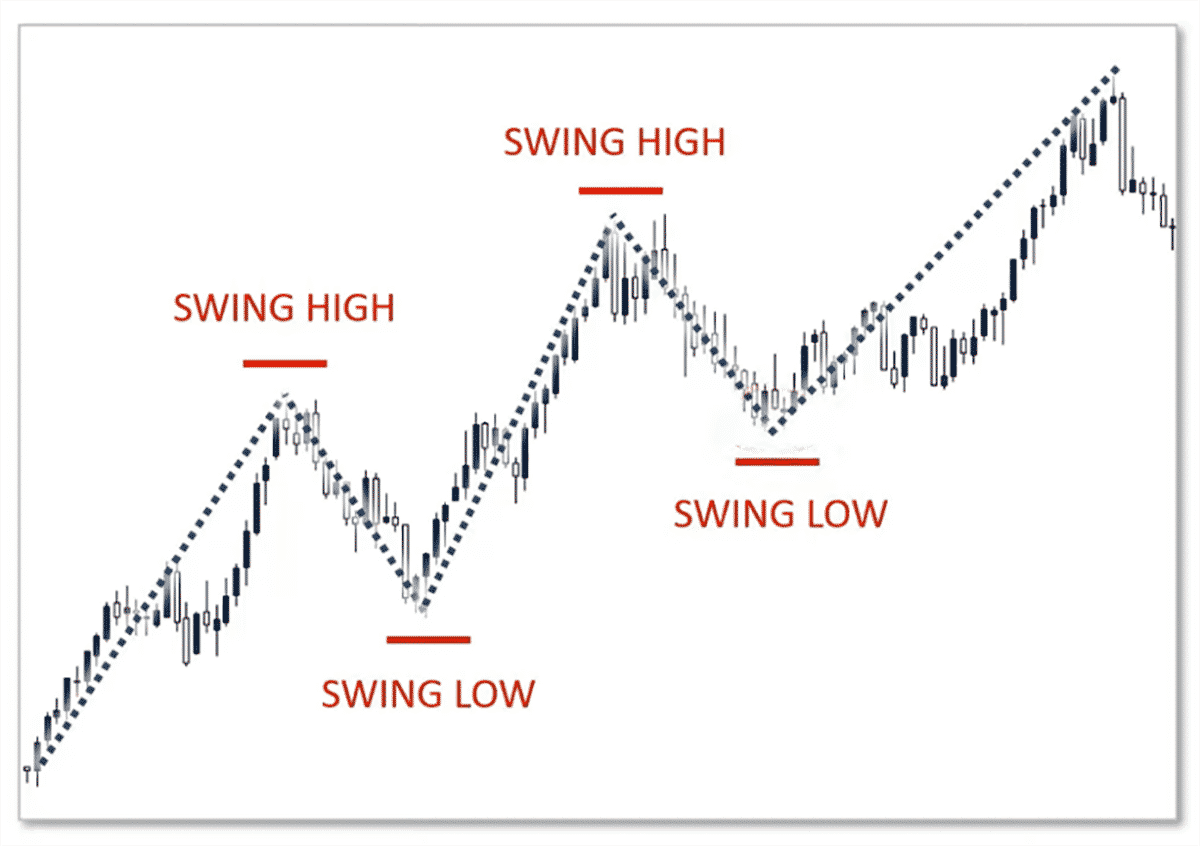

Furthermore, swing traders employ various technical analysis techniques to identify potential trading opportunities. Trend analysis, support and resistance levels, and momentum indicators are commonly used to gauge the direction and strength of the underlying asset’s price movements. By skillfully combining these methods, swing traders aim to enter and exit positions at optimal times, maximizing their profit potential while minimizing risk.

Real-World Applications: Putting Theory into Practice

The versatility of swing trading options makes it applicable to a wide range of market conditions. Swing traders can choose from various options types, including calls, puts, and spreads, to tailor their strategies to specific market scenarios. For instance, swing trading calls is a bullish strategy designed to benefit from rising prices, while swing trading puts is a bearish strategy that capitalizes on price declines. By adapting their approaches to the prevailing market conditions, swing traders can position themselves to capitalize on both uptrending and downtrending environments.

Moreover, swing trading options can be incorporated into broader investment strategies, such as diversification and hedging. By strategically allocating a portion of their portfolio to swing trading, investors can enhance their overall risk-adjusted returns. Additionally, options can be used as hedging instruments to offset potential losses in other investments, providing investors with a degree of downside protection.

Image: www.vectorvest.com

Expert Insights: Tapping into the Wisdom of Professionals

To further enhance your swing trading prowess, seek out the insights and guidance of seasoned experts in the field. Seasoned professionals have accumulated invaluable knowledge and experience that can help aspiring swing traders accelerate their learning curve. Consider attending industry workshops, webinars, or conferences where renowned experts share their insights and strategies. By leveraging the wisdom of those who have successfully mastered the art of swing trading, you can refine your approaches and increase your chances of success.

Actionable Tips: Empowering You for Success

In addition to seeking expert guidance, consider implementing these actionable tips in your swing trading endeavors:

- Define a clear trading strategy and stick to it. Discipline is key in swing trading, and a well-defined plan will keep you on track.

- Manage your risk effectively. Determine appropriate position sizing and utilize stop-loss orders to protect your capital.

- Continuously educate yourself. The world of swing trading is constantly evolving, so stay updated on the latest trends and advancements.

Swing Trading In Options

Conclusion: Unlocking the Potential of Swing Trading Options

Swing trading options can be a rewarding strategy when approached with the right knowledge, skills, and mindset. By understanding the core concepts, keeping abreast of market trends, and seeking out expert guidance, you can unlock the potential of swing trading and generate substantial returns while controlling risk.

Remember, the financial markets are inherently volatile, and no strategy guarantees success. However, by embracing a disciplined and evidence-based approach, you can navigate the complexities of swing trading options and position yourself for long-term success.