Introduction

In the ever-evolving financial landscape, discerning investors seek strategies that harness market volatility while mitigating risk. Swing trading, a hybrid approach combining elements of day trading and long-term investing, has emerged as a popular choice for astute traders. By exploiting short-term price fluctuations, swing traders aspire to capitalize on market swings and generate consistent profits. In this article, we unveil the intricacies of swing trading options strategies, empowering you with the knowledge and techniques to navigate market uncertainties and maximize your trading potential.

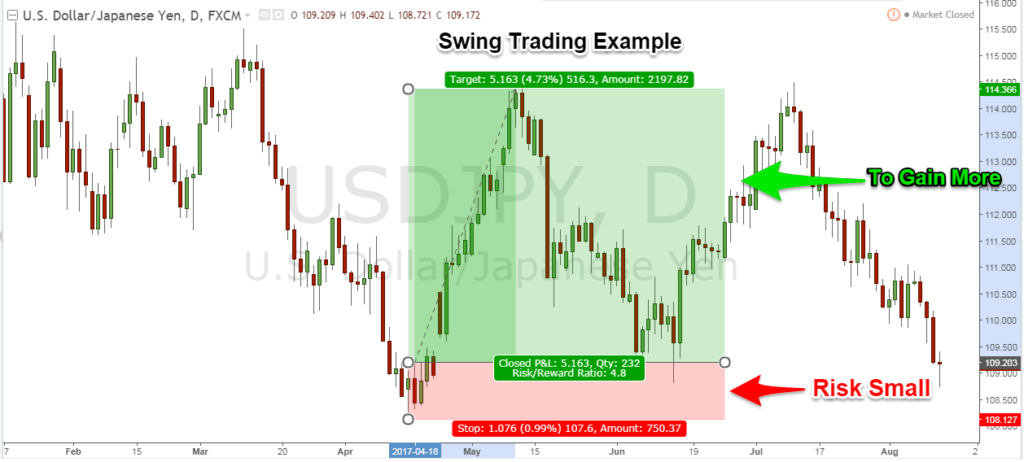

Image: abovethegreenline.com

Defining Swing Trading Options

Swing trading involves holding positions in underlying assets or options contracts for a period typically ranging from a few days to several weeks, capturing price movements within short-term market swings. Unlike day traders who close positions within the same trading day, swing traders ride price trends for a more extended timeframe, aiming to profit from broader market movements. Options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset at a specified price and date, offer swing traders flexibility and leverage in executing their strategies.

Benefits of Swing Trading Options

- Time Efficient: Compared to day trading, swing trading requires less frequent monitoring and active involvement, freeing up time for other pursuits.

- Higher Profit Potential: Swing trading leverages price swings over a longer timeframe, offering the potential for higher returns than day trading.

- Flexibility: Options provide traders with customizable tools, allowing them to tailor strategies to their risk tolerance and profit goals.

- Diversification: Swing trading options can complement other investment strategies, reducing portfolio risk and enhancing overall returns.

Choosing the Right Options for Swing Trading

- Expiration Date: Consider options with expiration dates that align with your anticipated holding period.

- Strike Price: Select strike prices that provide an optimal balance between risk and potential reward.

- Underlying Asset: Choose assets with well-defined trends and high liquidity to increase the probability of successful trades.

- Volatility: Assess market volatility to determine the appropriate options premiums and risk levels.

Image: forexuseful.com

Effective Swing Trading Techniques

- Technical Analysis: Utilize technical indicators and chart patterns to identify potential price trends and entry and exit points.

- Trend Following: Identify and trade with the prevailing market trend, riding momentum for profit.

- Price Action Trading: Analyze price action without technical indicators, relying on price movements and volume to make trading decisions.

- Options Strategies: Implement various options strategies, such as covered calls, cash-secured puts, or bullish/bearish spreads, to manage risk and enhance returns.

Risk Management in Swing Trading Options

- Position Sizing: Manage your risk by allocating appropriate capital to each trade, considering potential market fluctuations.

- Stop-Loss Orders: Establish stop-loss orders to limit potential losses in case of adverse market movements.

- diversification: Diversify your option holdings across different underlying assets and strategies to minimize konzentrierten Risk.

- Emotional Control: Maintain discipline and avoid letting emotions influence your trading decisions.

Swing Trading Options Strategy

Conclusion

Swing trading options offers a multifaceted approach to harness market swings, generating consistent profits while managing risk. By understanding the principles outlined in this article, traders can equip themselves with the knowledge and techniques necessary to excel in swing trading options. Embrace the challenges of market volatility and unlock the potential of this rewarding investment strategy.