Trading options is a vast and complex field. Swing trading is a popular options trading strategy that is suitable for traders of all levels. It is a less risky way to trade options than day trading and can be more profitable than long-term investing. This article looks at what swing trading is, discusses basic concepts, and provides advanced strategies. Below, you’ll find a downloadable PDF that covers everything in exhaustive detail.

Image: www.weeklyoptionsusa.com

What is Swing Trading Options?

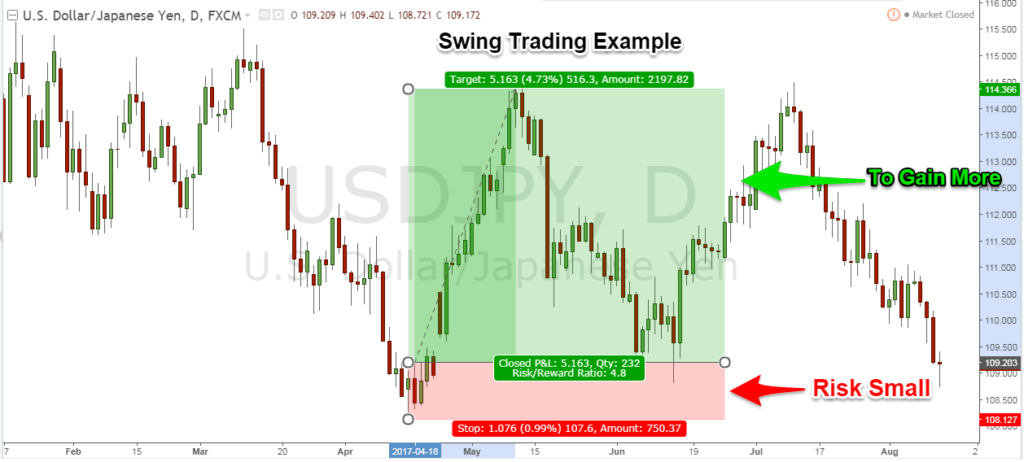

Swing Trading Options is a strategy that involves holding options positions for multiple days or weeks, aiming to profit from short-term price swings. It targets capturing small to medium-sized periodic market movements instead of large one-directional moves

Swing traders analyze technical indicators, such as moving averages, support and resistance levels, and candlestick patterns, to identify trading opportunities. They use this analysis to predict whether the price of an asset is likely to rise or fall in value.

Understanding Swing Trading Options

In swing trading, options traders buy or sell options contracts based on technical analysis, anticipating a price movement for the underlying asset in the short to medium term. It involves a higher level of risk than long-term investing but lower risk compared to day trading.

The holding period for swing trades can vary from a few days to several weeks. Traders look for opportunities to profit from short-term price fluctuations without being obligated to buy or sell the underlying asset.

Basic Swing Trading Concepts

Swing trading options is based on the following core concepts:

-

Technical Analysis: Identifying trading opportunities based on past price movements and patterns rather than fundamental analysis.

-

Trend Following: Swing traders aim to capitalize on price trends by buying options when an uptrend is identified and selling when a downtrend is anticipated.

-

Trade Management: Traders aim to maximize profits and minimize losses by using risk management techniques like stop-loss orders and position sizing.

Image: abovethegreenline.com

Advanced Swing Trading Options Strategies

Beyond basic strategies, swing traders often employ advanced techniques to enhance their trading performance:

-

Delta Neutral: Setting up a portfolio that minimizes exposure to price changes in the underlying asset.

-

Iron Condors: A combination of four options that is designed to generate income from time decay especially in range-bound markets.

-

Multi-leg Options Strategies: Using combinations of multiple options (spreads, straddles, and strangles) to gain more sophisticated exposure to market conditions and define profit or loss outcomes.

Swing Trading Options Pdf

Image: unbrick.id

Conclusion

Swing trading options is a popular options trading strategy that offers opportunities to capitalize on short-term price movements in the market. It requires sound technical analysis skills, a comprehensive understanding of options trading, and a disciplined approach to risk management. This article provided a comprehensive overview of swing trading and its key concepts. Interested traders can download the attached PDF for more in-depth insights and guidance on successful swing trading.