Headline: Navigating the Labyrinth of Option Trading Language: A Comprehensive Guide

Image: fintrakk.com

Introduction

In the dynamic and often complex world of finance, option trading emerges as a sophisticated investment strategy with its own distinct vocabulary. As you venture into this realm, it becomes imperative to grasp the terminology that defines it. This comprehensive article serves as your ultimate guide, demystifying the language of option trading and equipping you with the knowledge to navigate this intricate domain.

Unveiling the Jargon of Option Trading

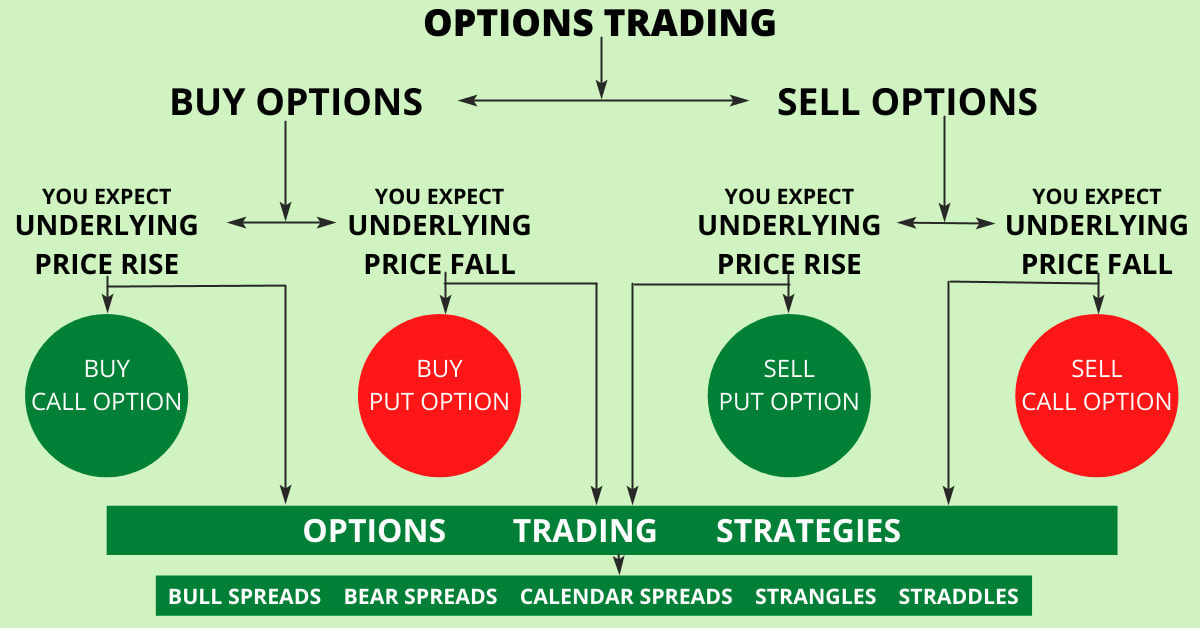

Calls and Puts: These fundamental terms refer to the two primary types of options. A call option grants the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Conversely, a put option entitles the buyer to sell the underlying asset under the same conditions.

Options Chain: This comprehensive listing displays all available options contracts for a particular underlying asset. It provides critical information such as strike prices, expiration dates, and premiums (the cost to buy or sell an option).

Delta: This Greek letter measures the sensitivity of the option’s price to changes in the underlying asset’s price. A delta of 0.5 indicates that for every $1 increase in the underlying asset’s price, the option’s price will increase by $0.50.

Theta: Theta represents the rate at which the option’s price decays as time passes. As expiration approaches, the value of an option decreases due to the diminishing probability of the underlying asset reaching the strike price.

Vega: This Greek letter gauges the option’s price sensitivity to changes in implied volatility. Implied volatility estimates the expected volatility of the underlying asset, which significantly influences option pricing.

Expert Insights and Actionable Tips

According to renowned options trader Tony Lucca, “Understanding option trading language is paramount to making informed decisions. A clear comprehension empowers traders to effectively communicate with brokers and maximize their profit potential.”

To enhance your understanding, consider the following tips:

- Practice visualizing option positions using charts and graphs.

- Join online forums or discussions dedicated to options trading to engage with experienced traders.

- Seek guidance from qualified financial advisors or attend specialized workshops to deepen your knowledge.

Conclusion

Navigating the language of option trading can seem daunting at first, but with dedication and the resources provided herein, you can unlock its secrets. This article has illuminated essential terms, concepts, and strategies, equipping you with the foundation to confidently explore and harness the potential of option trading. By embracing this lexicon, you empower yourself to make informed decisions and unlock the complexities of the financial markets.

Image: stewdiostix.blogspot.com

Option Trading Language

Image: www.youtube.com