The Art of Backtesting

The world of options trading is a complex and often unpredictable one, where strategic decision-making is crucial for success. Backtesting emerged as a revolutionary tool in the trader’s arsenal, allowing investors to test the efficacy of their strategies before risking capital in real-world markets.

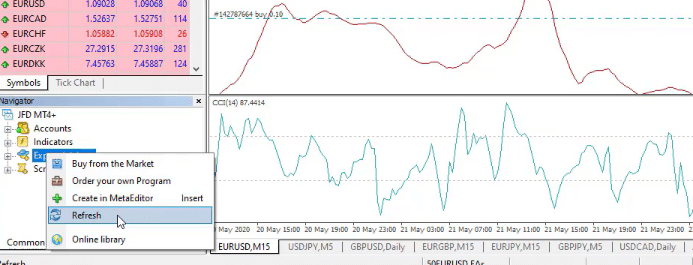

Image: admiralmarkets.com

In essence, backtesting involves simulating historical market conditions in a controlled environment, enabling traders to gauge the performance of their trading plans without incurring actual financial exposure. This invaluable process empowers traders to refine their strategies, optimize entry and exit points, and manage risk effectively.

Unlocking Market Insights Through Backtesting

Backtesting provides investors with a roadmap to navigate the ever-fluctuating options market. By recreating historical scenarios, traders can gain insights into strategy robustness, identify potential weaknesses, and make data-driven decisions to enhance their trading performance.

The ability to simulate different market conditions and evaluate strategy resilience under various scenarios is unparalleled. Backtesting allows traders to test strategies during periods of both market stability and volatility, thereby equipping them with a thorough understanding of strategy behavior in diverse market environments.

Maximizing Strategy Success with Expert Advice

- Assess Strategy Viability: Before committing to a strategy, subject it to rigorous backtesting. This critical step helps determine the strategy’s compatibility with your risk tolerance, trading style, and market expectations.

- Historical Data Quality Matters: The foundation of successful backtesting lies in utilizing historical data that is accurate, comprehensive, and representative of real-world market conditions. Inaccurate or incomplete data can lead to flawed results, undermining the reliability of your analysis.

- Optimize Parameters: Backtesting empowers traders to optimize strategy parameters, such as entry and exit signals, risk management rules, and position sizing. This iterative process involves fine-tuning parameters to enhance strategy performance and maximize returns.

- Beware of Overfitting: Avoid the temptation of fitting the strategy too closely to historical data, known as overfitting. Overfitted strategies may perform exceptionally well in historical simulations but struggle in the real market due to their lack of adaptability to changing conditions.

- Seek Expert Guidance: Consulting with experienced options traders, financial analysts, or professional advisors can provide invaluable insights into strategy development and execution. Their expertise can accelerate your learning curve and enhance your trading performance.

Decoding the Options Backtesting FAQ

Q: What is the primary goal of backtesting?

A: Backtesting aims to evaluate the performance and robustness of options trading strategies in simulated historical market conditions.

Q: How does backtesting aid in risk management?

A: By simulating various market scenarios, backtesting provides insights into strategy behavior under different risk environments, enabling traders to make informed risk management decisions.

Q: What historical data factors influence backtesting accuracy?

A: Data accuracy, comprehensiveness, and representativeness of real-world market conditions are crucial factors that impact the reliability of backtesting results.

Q: How do I prevent overfitting in my backtested strategies?

A: To avoid overfitting, traders must strike a balance between optimizing strategy parameters to historical data and ensuring adaptability to changing market conditions.

Image: eatradingacademy.com

Backtest Options Trading Strategies

Conclusion

Backtesting is an indispensable tool for options traders seeking to navigate the complex and ever-changing market landscape. By following best practices, leveraging expert advice, and continuously refining strategies through backtesting, traders can unlock market insights, optimize their approach, and establish a solid foundation for successful options trading.

Are you ready to embark on your journey as a skilled options trader? Embrace the power of backtesting, seek knowledge from experienced mentors, and refine your strategies relentlessly. The path to market mastery lies before you – take the first step today!