Introduction:

In the realm of financial markets, discerning investors are always seeking innovative techniques to enhance their decision-making. Option trading backtesting emerges as an invaluable tool that empowers traders with the ability to scrutinize trading strategies retrospectively, enabling them to refine their approaches and maximize their potential returns.

Image: corporatefinanceinstitute.com

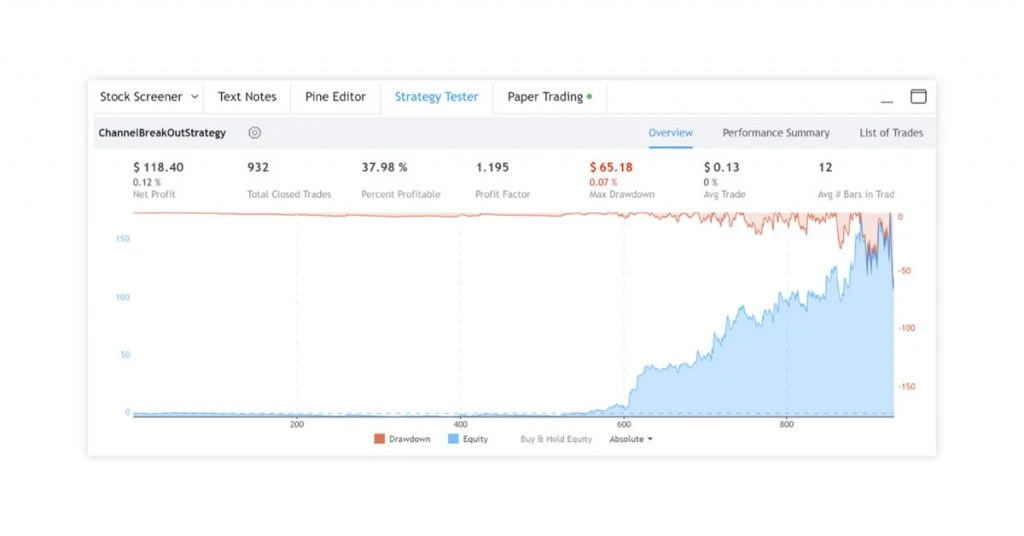

Backtesting involves simulating past market conditions and executing trades based on predefined parameters. By meticulously analyzing the results, traders can evaluate the effectiveness of their strategies, identify areas for improvement, and mitigate potential risks before committing real capital.

1. The Art of Backtesting

Backtesting finds its roots in the early days of finance when pioneers in the field recognized the importance of evaluating trading methodologies. With the advent of computers, backtesting evolved into a sophisticated technique that harness the computational prowess of modern technology to model complex trading scenarios and assess their outcomes.

2. The Mechanics of Backtesting

At its core, backtesting entails the acquisition of historical market data, incorporating it into a trading platform, and employing specific trading rules to generate simulated trades. These trades are executed in a sequential manner, mirroring the hypothetical decision-making process of a trader.

The parameters of backtesting are vast and customizable, giving traders the flexibility to test a multitude of variables, such as the timing of trade entries and exits, the selection of underlying instruments, and the management of risk.

3. Benefits of Backtesting

The benefits of backtesting are multifaceted and transformative for traders of all levels of experience. Let’s delve into the significant advantages it offers:

- Strategy Validation: Backtesting allows traders to validate their trading strategies in a risk-free environment, ensuring that they are viable and adaptable before deploying them in the real market.

- Risk Management: By simulating trades over a historical period, traders can gauge the potential risks associated with their strategies, helping them mitigate losses and maximize returns.

- Optimization: Backtesting provides an iterative process for refining trading strategies, enabling traders to experiment with different parameters and identify the most effective combination for their specific needs.

- Educational: The process of backtesting is a powerful educational tool, offering traders invaluable insights into market dynamics, trading psychology, and the art of risk management.

Image: www.techjockey.com

4. Practical Applications

The applications of backtesting in option trading are boundless. Let’s explore a few prominent examples that illustrate its versatility:

- Technical Analysis: Backtesting can be applied to assess the performance of technical indicators and trading systems, enabling traders to identify patterns and develop strategies that align with historical trends.

- Volatility Trading: Options are particularly susceptible to volatility, making backtesting essential for evaluating strategies that capitalize on fluctuations in volatility levels.

- Hedging Strategies: Backtesting is crucial for designing and optimizing hedging strategies using options, providing a safety net for managing risk in volatile markets.

5. Limitations and Considerations

Despite its benefits, it is important to acknowledge the limitations and considerations associated with backtesting:

- Historical Data: Backtesting relies on historical data, which may not accurately represent future market conditions, leading to potential discrepancies in performance.

- Optimization Pitfalls: Overfitting, a common pitfall in backtesting, occurs when a strategy is optimized too closely to historical data, leading to poor performance in real-world scenarios.

- Computational Complexity: Backtesting can be computationally intensive, especially for complex strategies involving multiple variables, requiring adequate computing resources.

6. Best Practices for Backtesting

To maximize the effectiveness of backtesting, adhere to these best practices:

- Robust Data: Utilize high-quality historical data from reliable sources to ensure the accuracy of your backtest.

- Validation and Verification: Split your data into training and testing sets to validate the robustness of your strategy and prevent overfitting.

- Multiple Scenarios: Test your strategy across different market conditions and scenarios to assess its adaptability and resilience.

- Risk Management: Incorporate risk management measures into your backtesting process to gauge the potential risks and develop appropriate risk mitigation strategies.

Option Trading Backtesting

7. Conclusion

Option trading backtesting has emerged as a formidable tool for traders, providing the means to refine strategies, manage risk, and make informed decisions. By embracing the power of backtesting, traders can gain a competitive edge in the dynamic world of options trading and enhance their quest for financial success. Remember, successful backtesting is an iterative process that requires patience, discipline, and a keen eye for continuous improvement. Let the lessons learned through backtesting guide your trading decisions, unlocking the full potential of option trading.