Introduction: The Art of Backtesting

Options trading, like any financial endeavor, requires a methodical approach to mitigate risks and maximize profit potential. Backtesting, a cornerstone of this approach, involves evaluating a trading strategy using historical data to simulate its performance in various market conditions. It’s an indispensable tool that helps you refine your strategies, identify winning patterns, and mitigate losses.

Image: howtotrade.com

Understanding the Basics of Backtesting

Backtesting is essentially recreating past market scenarios using a fixed set of rules to determine how your strategy would have performed. It allows you to:

- Simulate realistic market conditions without risking capital.

- Test multiple strategies simultaneously to compare their effectiveness.

- Identify optimal entry and exit points for trades.

- Quantify potential returns and risks associated with the strategy.

Latest Trends and Developments in Backtesting

- Enhanced Data Analysis: Advanced algorithms and data science techniques now enable more precise simulations, allowing traders to refine their strategies based on deeper insights.

- AI-Powered Backtesting: Artificial intelligence (AI) optimizes backtesting processes by automating data analysis and strategy validation, saving time and improving accuracy.

- Cross-Market Analysis: Backtesting now incorporates data from multiple markets and asset classes, providing a comprehensive view of the strategy’s performance in diverse market conditions.

Tips and Expert Advice for Backtesting Options Strategies

- Use Historical Data with Caution: While historical data provides insights, it may not fully predict future performance. Consider multiple scenarios and test the strategy’s robustness in different market environments.

- Set Realistic Parameters: Don’t overoptimize your strategy to match historical data; ensure the parameters align with the underlying assumptions and market conditions.

- Analyze Results Objectively: Backtesting should be a rigorous process without emotional biases. Evaluate the results carefully, identify areas for improvement, and adjust your strategy accordingly.

Image: eatradingacademy.com

FAQs on Backtesting Options Strategies

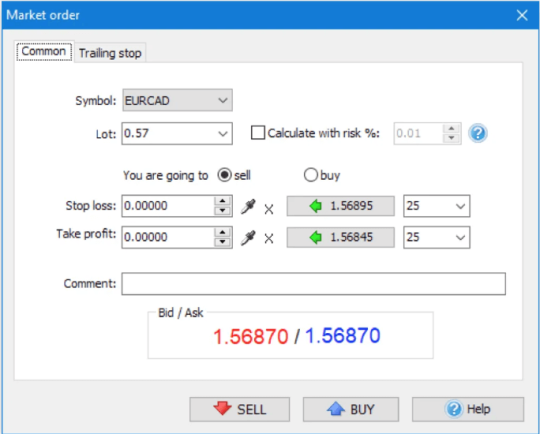

Q: What’s the best backtesting software available?

A: Several reputable options are available, including TradeStation, MetaTrader 5, NinjaTrader, and Amibroker. Choose software that aligns with your trading style and analysis needs.

Q: How often should I backtest my strategies?

A: Regular backtesting is crucial, at least quarterly or when significant market changes occur. It ensures that your strategy remains aligned with evolving market dynamics.

How To Backtest Options Trading Strategy

Image: www.xtremetrading.net

Conclusion: A Resilient Foundation for Options Trading

Backtesting is the cornerstone of successful options trading, providing a robust foundation for strategy development and refinement. By leveraging the latest tools, following expert advice, and continuously analyzing results, you can optimize your strategies and increase your chances of success in the dynamic options market.

Are you interested in learning more about backtesting options trading strategies? Share your thoughts and questions in the comments below.