In the realm of financial trading, where data and decisions hold immense sway, backtesting emerges as an indispensable tool. By harnessing the power of historical data, traders can meticulously scrutinize trading strategies, uncover patterns, and optimize their approaches to maximize returns. When it comes to options trading, where risk and reward dance in delicate balance, backtesting becomes even more crucial.

Image: eatradingacademy.com

A Deep Dive into Backtesting Trading Strategies

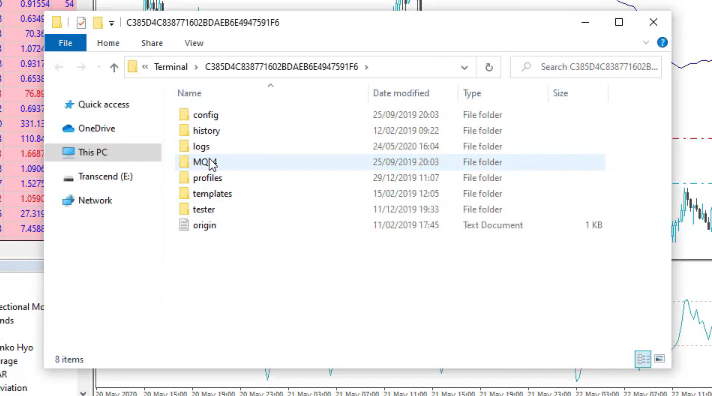

At its core, backtesting involves simulating trading strategies against historical data to assess their performance. Traders leverage specialized software or platforms that allow them to input their strategies, define parameters, and let the software execute trades based on the predefined rules. This simulated trading environment provides a safe and controlled space to experiment with different strategies without risking real capital.

Through backtesting, traders can evaluate key performance metrics such as profit factor, win rate, and risk-reward ratios. These metrics offer valuable insights into the strategy’s profitability, consistency, and risk tolerance. Moreover, backtesting helps identify potential weaknesses or areas where the strategy can be refined for improved performance.

Historical Data: The Foundation for Accuracy

The reliability of backtesting results heavily relies on the quality and accuracy of the historical data used. Traders must ensure that the data is comprehensive, covers an extended period, and is sourced from reputable providers. Incomplete or inaccurate data can skew results and lead to misleading conclusions.

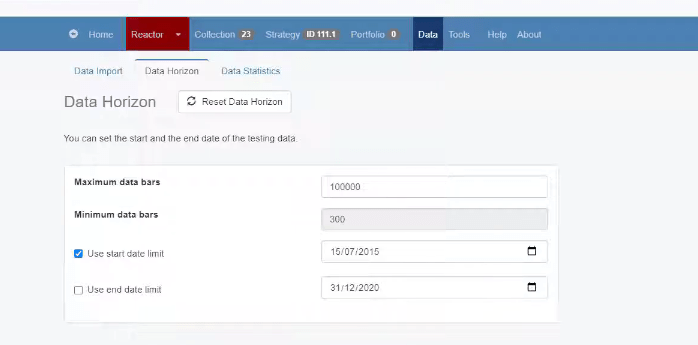

Historical data also enables traders to test their strategies across various market conditions, including bull markets, bear markets, and periods of high volatility. By simulating trades in different market scenarios, traders can assess the stability and adaptability of their strategies in diverse environments.

Unveiling Patterns and Optimizing Strategies

A thorough analysis of backtesting results empowers traders to pinpoint patterns and identify areas for optimization. They can fine-tune their strategies by adjusting entry and exit points, modifying risk parameters, or incorporating additional indicators. The goal is to create a strategy that consistently generates positive returns while managing risk effectively.

Advanced backtesting techniques go beyond basic simulations, incorporating elements like Monte Carlo analysis and stress testing. These approaches account for randomness and potential market downturns, providing a more robust evaluation of strategy resilience.

Image: eatradingacademy.com

Expert Insights: Unlocking the Potential of Options Data

Seasoned options traders emphasize the importance of backtesting in their decision-making process. “Backtesting allows me to experiment with different strategies, identify winning patterns, and refine my approach to maximize returns,” asserts renowned options expert John Carter.

Another expert, Larry McMillan, stresses the value of historical data analysis: “Historical data provides invaluable insights into how options have performed in the past. By studying historical trends, traders can make informed decisions about their own trading strategies.”

Taking Action: Enhancing Your Options Trading Journey

The insights gained from backtesting provide a solid foundation for enhancing your options trading strategies. Consider the following tips:

- Utilize reputable data sources to ensure the accuracy and reliability of your backtesting results.

- Test your strategies across diverse market conditions to assess their robustness and adaptability.

- Continuously optimize your strategies based on backtesting results and incorporate new learnings into your approach.

- Consult with experienced options traders and seek guidance to refine your understanding and decision-making.

Backtest Trading Startegies Using Options Data

Conclusion: Empowered Trading with Backtesting

Backtesting trading strategies using options data is a powerful tool that unlocks a world of possibilities. By leveraging historical data, traders can meticulously evaluate their strategies, identify areas for improvement, and optimize their approach for increased profitability and reduced risk. Embrace the power of backtesting and embark on a journey towards informed and profitable options trading decisions.