Growing up, I always admired my father’s passion for the stock market. As a young adult, I often observed him meticulously analyzing charts and news articles while making strategic investment decisions.

Image: www.pinterest.com

His enthusiasm for stock trading rubbed off on me, and I found myself intrigued by the complexities of the financial markets. Years of personal research and market observation have equipped me with a deep understanding of both stock options and equities, which I am eager to share with my readers in this comprehensive article.

Understanding the Stock Market: A Gateway to Trading

The stock market serves as a platform for the trading of stocks, which represent ownership interests in publicly traded companies. These companies issue shares to raise capital and allow investors to participate in their growth and profitability.

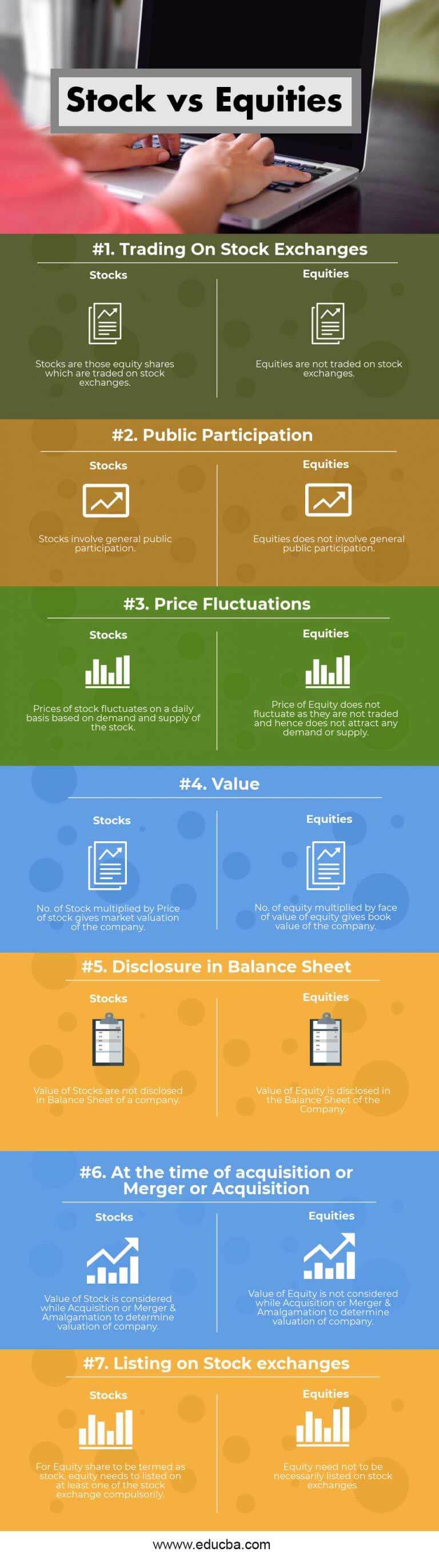

Within the stock market, there are two primary categories of securities: options and equities. Equities, commonly referred to as stocks or shares, represent direct ownership in a company. Options, on the other hand, are contracts that give the buyer the right but not the obligation to buy (call options) or sell (put options) a specific number of shares at a predetermined price within a defined timeframe.

The Allure of Options Trading

Options trading offers several unique advantages over traditional stock investment. Options provide leverage, meaning that traders can control substantial positions with relatively small capital. This leverage can amplify both gains and losses, requiring careful risk management.

Additionally, options enable traders to implement complex strategies that can hedge against market volatility or speculate on specific price movements. This flexibility makes options a versatile tool for managing risk and potentially enhancing returns in a dynamic market environment.

Navigating the Options Market: A Comprehensive Overview

The options market consists of standardized contracts that are traded on exchanges. Each contract represents 100 shares of the underlying stock. Traders can choose from a range of strike prices, or the price at which they have the option to buy or sell, and expiration dates.

The premium of an option, or its price, is influenced by several factors, including the price of the underlying stock, the time until expiration, and the market’s perception of volatility. Understanding these factors is crucial for successful options trading.

Image: www.educba.com

Options Trading Strategies: The Art of Strategic Investing

There are numerous options trading strategies available to traders, each with its unique risk and reward profile. Some common strategies include long calls (betting on a price increase), short puts (selling the right to sell), covered calls (selling options against owned shares), and iron condors (creating a defined range of potential profit).

The choice of strategy depends on the trader’s market outlook, risk tolerance, and trading objectives. Regardless of the strategy employed, it is essential to implement sound risk management practices, including the use of stop-loss orders and position sizing.

Expert Insights and Tips for Successful Trading

As a seasoned stock trader, I have learned valuable lessons that I believe can benefit aspiring traders.

- Start with a Solid Trading Plan: Define your investment objectives, trading strategy, and risk tolerance before entering the market.

- Conduct Thorough Research: Understand the companies and industries you are investing in before making any trading decisions.

- Manage Risk Effectively: Limit your trading positions and use stop-loss orders to mitigate potential losses.

Stay Informed about Market Trends: Monitor financial news, company announcements, and economic indicators that can impact your trades.

Frequently Asked Questions (FAQs) About Stock Trading

Q: What is the difference between a call and a put option?

A: Call options give the buyer the right, but not the obligation, to buy a stock at a specified price on or before a certain date. Put options give the buyer the right, but not the obligation, to sell a stock at a specified price on or before a certain date.

Q: What is the purpose of an options premium?

A: The options premium is the price paid to the seller of an option contract in exchange for the rights granted to the buyer. The premium is influenced by factors such as the stock price, time to expiration, and market volatility.

Q: How do I determine the risk associated with options trading?

A: The risk associated with options trading depends on the type of option and the strategy employed. It is crucial to understand the potential gains and losses before entering any trades.

Stock Trading Options And Equities

Image: www.youtube.com

Conclusion: Embarking on the Exciting Journey of Stock Trading

Stock trading, encompassing both options and equities, is a dynamic and potentially rewarding endeavor. By acquiring a comprehensive understanding of the stock market, options strategies, and risk management techniques, traders can navigate the markets with confidence.

Whether you are a seasoned trader or just starting your investment journey, I encourage you to delve deeper into the world of stock trading. With careful planning, thorough research, and sound risk management practices, you can harness the power of the financial markets to meet your financial goals. Are you ready to embark on this exciting adventure?