Understanding the fundamental differences between the fair value option and held for trading is crucial for effective financial reporting and decision-making. This article delves into the nuances of these two accounting treatments, discussing their definitions, applications, advantages, and disadvantages to empower readers with the knowledge to navigate the complexities of financial instruments.

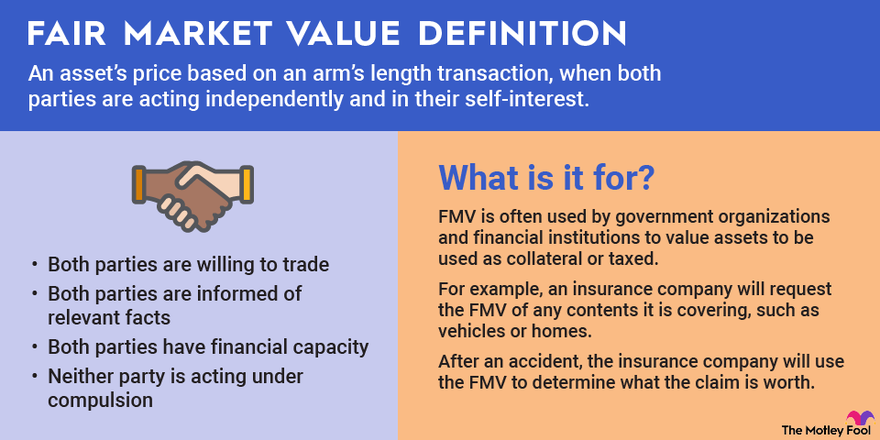

Image: www.fool.com

Financial instruments represent a significant component of many businesses’ operations and balance sheets. Properly accounting for these instruments is essential for providing transparent and accurate financial information. The fair value option and held for trading are two distinct accounting treatments that can be applied to a company’s financial instruments, each with specific characteristics and implications.

Fair Value Option

Definition and Application

The fair value option allows companies to record financial instruments at their current fair market value, rather than at their initial cost. This accounting treatment provides a more up-to-date representation of the instrument’s value on the balance sheet and thus impacts the company’s net income and equity.

Advantages

- Increased Transparency: Provides a more accurate reflection of the instrument’s value, enhancing transparency and comparability between different reporting periods.

- Improved Risk Management: Reflects changes in market value, enabling companies to monitor risk more effectively.

Image: www.youtube.com

Disadvantages

- Volatility in Income: Market price fluctuations can lead to significant changes in net income, potentially distorting profitability assessments.

- Potential Misstatement: Subjective judgments in determining fair value can introduce the risk of misstatement or manipulation.

Held for Trading

Definition and Application

Held for trading (HTF) is an accounting treatment specifically designed for trading securities and similar financial instruments intended to be actively bought and sold within a short time horizon. HTF instruments are recorded at their fair value, with gains or losses on sales recognized in the income statement, such as trading revenue.

Advantages

- Accurate Reflection of Trading Activity: HTF aligns with the intent of trading activities, where frequent buying and selling of instruments is a part of normal business operations.

- Simplified Reporting: Gains/losses on HTF instruments are directly recognized in the income statement, avoiding the need for complex adjustments.

Disadvantages

- Limited Scope: Only applicable to trading securities intended for short-term gains, restricting its use for other financial instruments.

- Potential Impact on Earnings: Fluctuations in market value can significantly impact earnings, potentially inflating or deflating reported profits.

Which Treatment Is Right for You?

The right accounting treatment depends on the specific circumstances and objectives of the company. The fair value option provides a more accurate but volatile valuation, while HTF offers a simpler and more aligned treatment for trading activities.

Expert Advice

Financial professionals recommend considering the following factors when selecting the appropriate treatment:

- Nature and Intent of Investment: Is the instrument held primarily for trading or as a strategic investment?

- Materiality of Market Price Fluctuations: Does the expected volatility in fair value materially affect the financial statements?

- Internal Control and Valuation Expertise: Does the company have robust internal controls and valuation capabilities to support fair value accounting?

FAQs

Q: Can all financial instruments be reported under the fair value option?

A: No, the fair value option is limited to certain classes of financial instruments, such as marketable equity securities, debt securities, and derivatives.

Q: How does Held for Trading treatment impact income tax reporting?

A: Gain/loss on HTF instruments is generally recognized for tax purposes in the year of sale, unlike fair value accounting, where unrealized gains/losses affect income only. This difference can create tax implications for the company.

Q: What are the disclosure requirements for fair value treatments?

A: Companies applying fair value accounting must provide detailed disclosures in their financial statements regarding the valuation methods, assumptions, and uncertainties involved, ensuring transparency and user understanding.

Fair Value Option Vs Held For Trading

Image: laptrinhx.com

Conclusion

Understanding the fair value option vs. held for trading is crucial for making informed accounting decisions and fostering accurate financial reporting. Each treatment has distinct applications, advantages, and disadvantages. By carefully considering the factors outlined above and seeking expert advice when needed, entities can select the appropriate treatment that best suits their specific circumstances, enhancing financial transparency and decision-making effectiveness.

Are you further interested in the implications and considerations surrounding fair value option vs. held for trading?