In the ever-evolving financial landscape, fair value option trading securities have emerged as a sophisticated tool that can help investors unlock value while effectively managing risk. Fair value options, also known as FVOs, are an alluring class of financial instruments that allow investors to proactively adjust the fair value of assets or liabilities on their balance sheets. By delving into the world of FVOs, this article aims to illuminate their intricacies, highlight their benefits, and provide a practical roadmap to harness their potential for financial success.

Image: etrendystock.com

Unlocking the Power of Fair Value Option Trading Securities

Essentially, fair value option trading securities empower investors with the ability to actively manage the fair value of their assets and liabilities, allowing them to optimize their financial position. These instruments are often used to:

-

Reduce volatility: FVOs can serve as a hedge against potential market fluctuations, shielding portfolios from unfavorable price movements.

-

Enhance portfolio performance: Strategic use of FVOs can enhance overall portfolio performance by capturing value from both favorable and unfavorable market conditions.

-

Meet regulatory requirements: Fair value options can support compliance with accounting regulations, such as IFRS 13, and enable transparent reporting of assets and liabilities.

Demystifying Fair Value Option Trading Securities

Fair value options are complex instruments, but understanding their fundamental concepts is crucial for effective application. Here are the key components:

-

Underlying asset: The FVO derives its value from an underlying asset, which can be equity, fixed income, or other financial instruments.

-

Strike price: Similar to traditional options, FVOs have a strike price, which represents the reference point against which the underlying asset’s value is compared.

-

Settlement date: The predefined date on which the FVO expires and the net settlement occurs.

-

Cash settlement: Unlike traditional options, FVOs are typically settled in cash, making them more flexible and convenient.

Practical Considerations for Fair Value Option Trading

Navigating the world of fair value option trading requires careful consideration of several practical factors:

-

Market liquidity: Liquidity is essential for trading FVOs; markets with ample liquidity offer better execution prices and reduce market impact.

-

Pricing models: Accurate pricing of FVOs is critical for informed decision-making. Investors should leverage appropriate pricing models to assess the fair value of the underlying asset and the option premium.

-

Counterparty risk: Selecting a reputable and creditworthy counterparty is crucial to mitigate settlement risk and ensure the reliability of transactions.

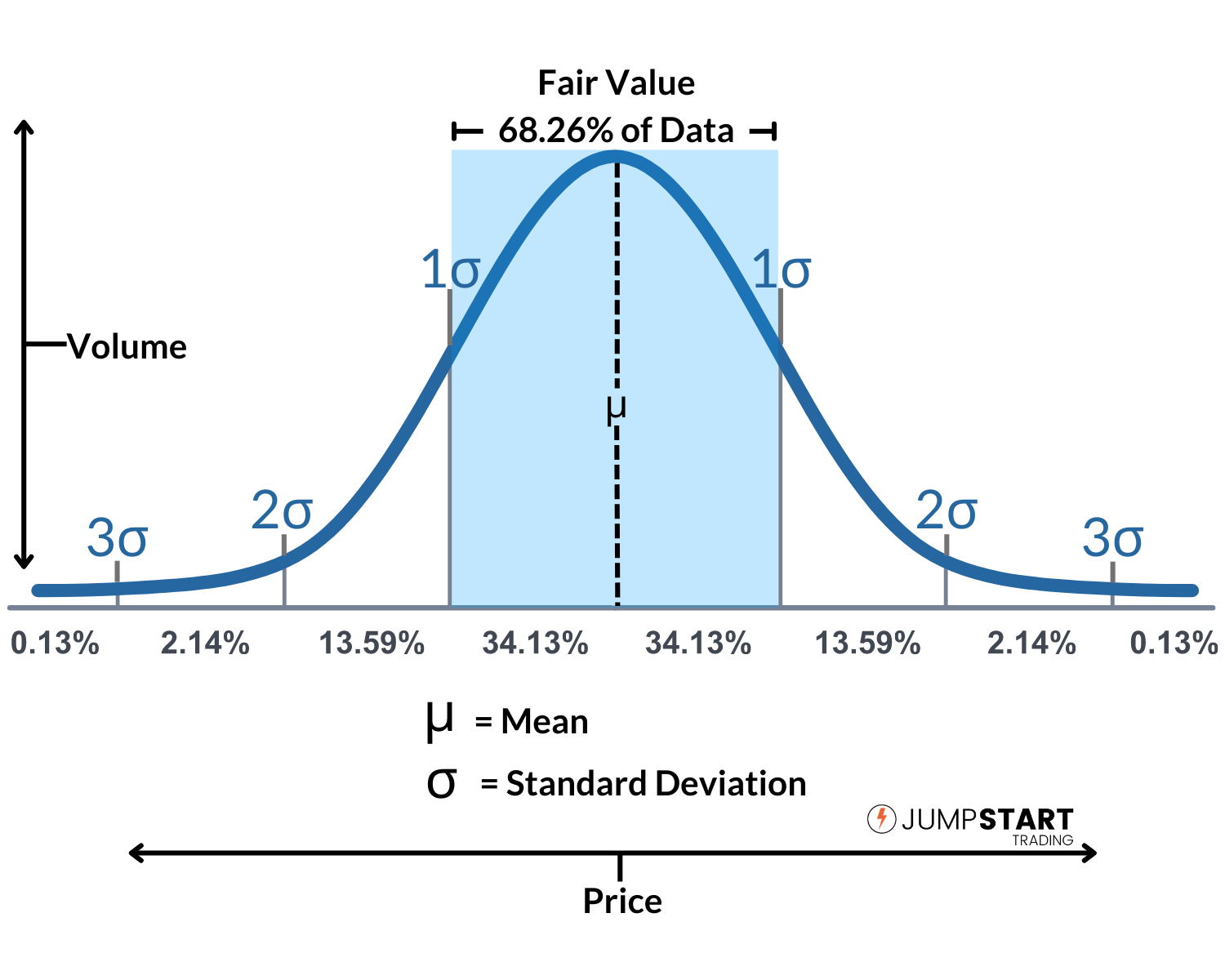

Image: www.jumpstarttrading.com

Fair Value Option Trading Securities

Image: etrendystock.com

Conclusion

Fair value option trading securities provide investors with a powerful tool to proactively manage risk and enhance portfolio performance. By understanding the concepts, advantages, and practical considerations associated with FVOs, investors can confidently leverage these instruments to unlock value in their financial endeavors. Remember, thorough research, prudence, and a solid understanding of the market are essential to harness the full potential of fair value option trading securities.