In the ever-evolving financial landscape, the world of options trading often presents a shroud of complexity and potential pitfalls. Option fair trading emerges as a crucial aspect, ensuring the integrity and equity of this market. Delve into this comprehensive guide to unravel the intricacies of option fair trading and empower yourself with the knowledge to navigate its intricacies.

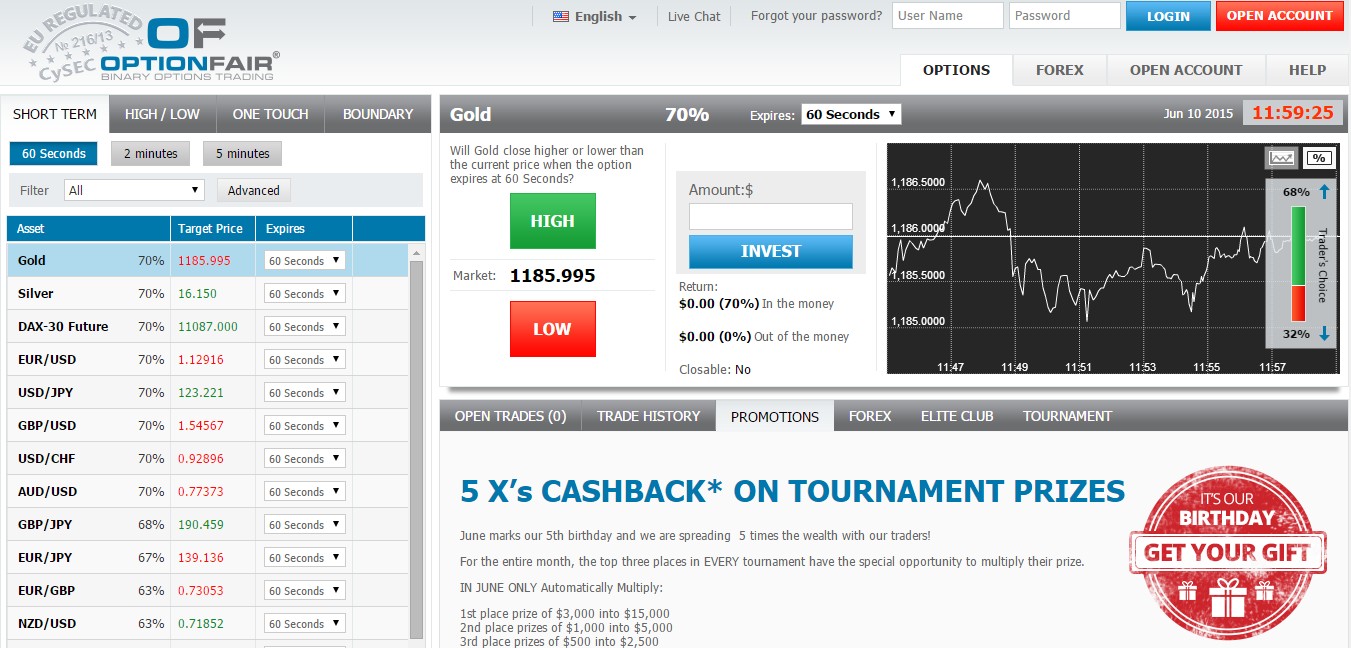

Image: binarydiaries.com

Understanding Option Fair Trading: The Fundamentals

Option trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell a specific asset at a pre-determined price within a specified time frame. Fair trading in this context entails adhering to ethical guidelines and practices to maintain a level playing field for all participants. Essentially, it demands transparency, disclosure of material information, and a commitment to fair and orderly markets.

Historical Evolution of Option Fair Trading: A Legacy of Market Integrity

The concept of option fair trading has its roots in the early origins of financial markets. As options trading gained prominence, the need to establish rules and regulations to prevent manipulation and unethical practices became paramount. Over the decades, regulators worldwide have implemented a robust framework to safeguard market integrity and protect investors’ interests.

Basic Concepts: Demystifying the Terminology

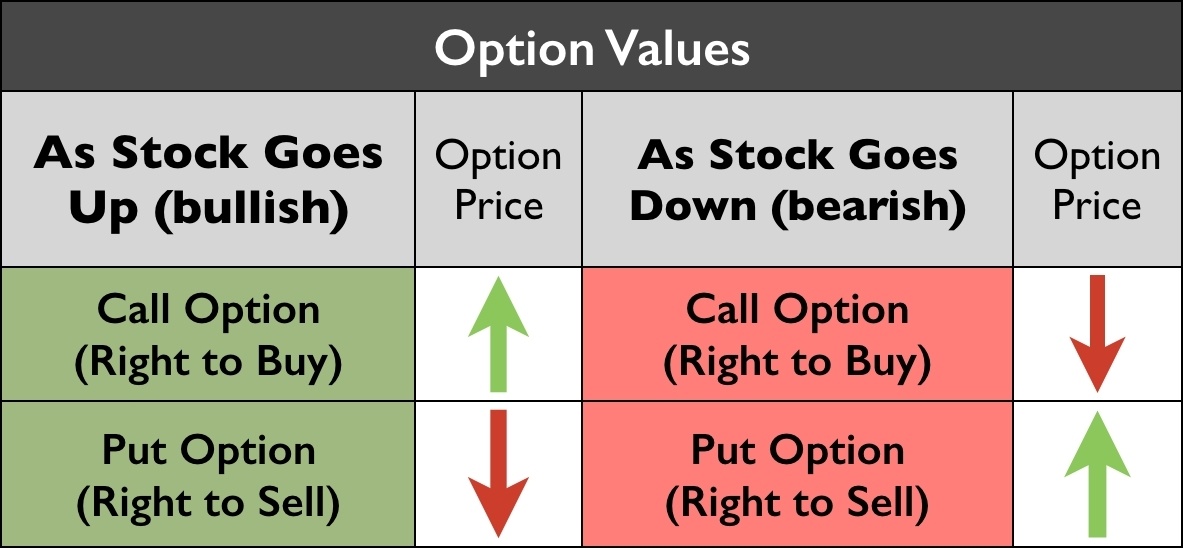

To grasp the intricacies of option fair trading, it’s essential to understand some key concepts:

- Call Option: Grants the buyer the right to purchase an underlying asset at a specified price (strike price) on or before a chosen date (expiration date).

- Put Option: Grants the buyer the right to sell an underlying asset at a specified strike price on or before the expiration date.

- Premium: The price paid by the buyer of an option contract for the right to buy or sell the underlying asset.

- Strike Price: The pre-determined price at which the buyer can exercise the right to buy or sell the underlying asset.

Image: tradesmartu.com

Importance of Fair Trading in Option Markets: Protecting Investor Interests

Upholding fair trading practices in option markets is crucial to ensure:

- Market Transparency and Integrity: Fair trading fosters an open and honest market environment, preventing unfair advantages or manipulation by any party.

- Investor Protection: Ethical trading practices safeguard investors from unethical tactics, such as front-running or insider trading, ensuring a fair and equitable marketplace.

- Efficient Price Discovery: Fair trading promotes transparent and orderly markets, allowing for accurate and reliable price discovery of underlying assets.

Challenges and Pitfalls to Ethical Option Fair Trading

Despite regulations and guidelines, challenges still arise in ensuring ethical option fair trading:

- Insider Trading: Acquiring and using confidential information to gain an unfair advantage in trading is strictly prohibited but remains a persistent threat.

- Market Manipulation: Artificial or deceptive practices aimed at influencing option prices or trading activity are unethical and can disrupt market equilibrium.

- Conflicts of Interest: Unaddressed conflicts of interest, such as a broker trading for their own account while representing clients, can undermine trust in the market.

Modern Developments and the Role of Technology

Technological advancements play a vital role in shaping option fair trading today:

- Electronic Trading Platforms: Automated trading platforms provide greater transparency, efficiency, and accessibility to the option market.

- Data Analytics: Sophisticated data analytics and surveillance systems enhance market monitoring, enabling regulators to detect and deter unethical practices more effectively.

- Blockchain Technology: Blockchain’s immutability and transparency have the potential to revolutionize option trading, further strengthening market integrity.

Option Fair Trading

Image: www.pinterest.co.uk

Conclusion: The Path to Ethical Option Fair Trading

Option fair trading is a cornerstone of ethical and efficient financial markets. Understanding the fundamental concepts, historical evolution, and importance of fair trading empowers investors and practitioners alike to safeguard market integrity. Navigating the complexities of the option market requires a commitment to ethical practices, transparent disclosure, and constant vigilance against potential pitfalls. By embracing these principles, we pave the way for a more equitable and sustainable financial landscape for all.