Navigating the financial markets can be a daunting task, especially for beginners. Two popular options for equity trading are equities (stocks) and equities options. While both these investment vehicles offer the potential for profit, they differ significantly in their workflow and trading style. Let’s delve into the key differences between equities and equities options trading:

Image: www.educba.com

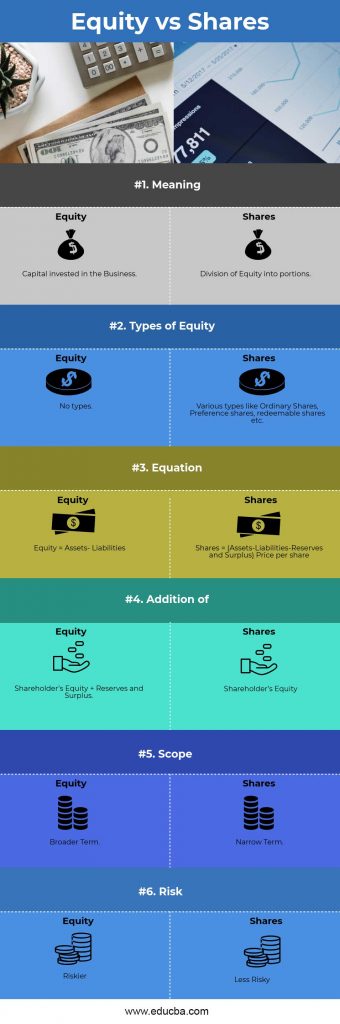

Equities: A Direct Stake in Ownership

Equities, commonly known as stocks, represent a fractional ownership in a public company. When you buy a stock, you acquire a small piece of the company, giving you the right to vote in shareholder meetings and receive a portion of the company’s profits in the form of dividends.

Equities Options: A Contract with a Choice

Equities options, on the other hand, are contracts that give the buyer or holder the right, but not the obligation, to buy or sell an underlying stock at a specific price within a specified time frame (the option’s expiration date). Equities options allow flexibility and leverage, but also introduce more complexity compared to trading equities.

Workflow Differences in Detail

- Trade Execution: Equities are traded directly on exchanges, where buyers and sellers meet to set prices. Equities options, however, are traded on options exchanges, where the buyer of the option enters into a contract with the seller (market maker).

- Pricing: Equity prices reflect the underlying value of the company, influenced by financial performance, market conditions, and investor sentiment. Equities options prices, however, are influenced not only by the underlying stock price but also by the option’s strike price, time to expiration, and market volatility.

- Profit Potential: Equities offer the potential for capital appreciation and dividend income. Equities options, on the other hand, provide leveraged profits or losses, enabling investors to amplify their returns or limit their downside risk.

- Risk and Flexibility: Equities involve direct investment in the underlying company and carry the full risk of loss or gain. Equities options, however, limit the maximum loss to the premium paid, but restrict the investor’s profit potential to a pre-determined figure. Options provide flexibility in terms of execution strategies, allowing investors to structure complex trades and manage risk effectively.

Image: www.educba.com

Expert Tips for Successful Trading

To navigate the equities and equities options markets effectively, consider these expert tips:

- Understand the Underlying: Familiarize yourself with the underlying stock or index when trading equities or equities options. Evaluate its financial performance, industry dynamics, and risk profile.

- Manage Risk Wisely: Equities options can amplify returns and losses, thus risk management is paramount. Choose strategies that align with your risk appetite and employ techniques like hedging to mitigate potential downsides.

- Stay Informed and Trade Cautiously: Keep pace with market trends, earnings reports, and geopolitical events that may impact equities or equities options prices. Avoid impulsive trades and seek professional advice when necessary.

Frequently Asked Questions (FAQs)

Q: What is the difference between an equities option and a futures contract?

A: While both options and futures provide rights to buy or sell an underlying asset, options offer flexibility and less risk than futures contracts. The buyer of a futures contract is obligated to complete the transaction at the agreed-upon price, whereas the option buyer has the right but not the obligation.

Q: What strategies can I use to trade equities options?

A: Options trading strategies can range from call buying to put selling, straddles to butterflies. Choose a strategy that aligns with your market outlook, risk tolerance, and capital allocation. Consider consulting a financial advisor for personalized guidance.

Q: Is equities options trading suitable for beginners?

A: Equities options trading involves inherent complexity and risk. While it can provide opportunities for skilled investors, beginners are advised to gain a thorough understanding of options and start with small, manageable positions.

Equities Vs Equities Options Trading Workflow Differences

Image: investingunder35.com

Conclusion

Equities and equities options trading offer distinct advantages and challenges. Equities provide direct ownership and long-term capital growth potential, while equities options offer flexibility, leveraged profits, and risk management strategies. By understanding the workflow differences and incorporating expert advice, traders can navigate the financial markets effectively. Whether you’re a seasoned investor or just starting out, the world of equities trading is vast and rewarding. Explore your options, trade wisely, and let your financial journey take flight.