Options Trading: Unlocking Profit Potential as an Options Buyer

Image: investobull.com

Introduction:

In the realm of financial markets, options trading presents a thrilling opportunity to trade calculated risks for potential rewards. As an options buyer, you have the unique ability to purchase a contract that grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This article will delve into the exciting world of options trading option buyers, guiding you through the intricacies and empowering you with practical strategies for maximizing your profits.

Demystifying Options Trading

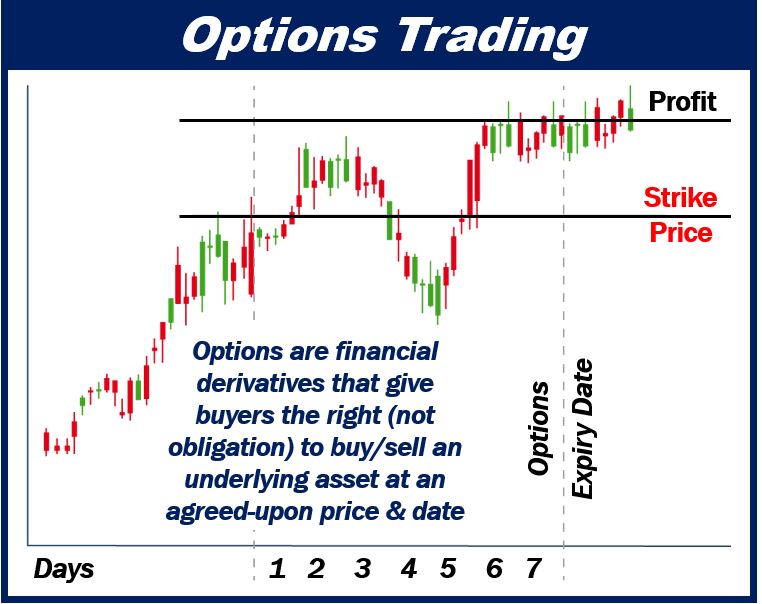

An option is a financial instrument that bestows upon its holder the right, not the obligation, to purchase or sell an underlying asset at a specific price (strike price) on or before a predetermined date (expiration date). As an options buyer, you pay a premium to purchase this contract, giving you the opportunity to speculate on the future price movements of the underlying asset in the hope of profiting from such fluctuations.

Types of Options Buyers

There are two primary types of options buyers:

- Speculators: Aim to profit from short-term price movements of the underlying asset, buying and selling options within the life of the contract.

- Hedgers: Seek to mitigate risks associated with changes in the price of the underlying asset they hold or trade.

Strategies for Options Buyers

As an options buyer, you have access to a range of strategies tailored to your specific preferences and trading goals. These include:

- Call Buying: You purchase a call option if you believe the price of the underlying asset will rise above the strike price.

- Put Buying: You purchase a put option if you believe the price of the underlying asset will fall below the strike price.

- Hedging with Options: You use options to protect against potential losses in your portfolio of the underlying asset.

- Vertical Spreads: You combine two options of the same underlying asset but different strike prices to create a customized risk-reward profile.

Expert Insights

According to Mark Douglas, a renowned trading psychologist, “Trading is a business of probabilities, not certainties. The goal is not to be right all the time, but to make more money when you’re right than when you’re wrong.” This underscores the importance of risk management and the need for a clear trading plan, even as an options buyer.

Actionable Tips

- Conduct thorough research on the underlying asset and market conditions.

- Seek guidance from reputable trading platforms or mentors.

- Start small and gradually increase your trading volume as you gain experience.

- Set reasonable expectations and avoid emotional decision-making.

Conclusion

Options trading offers a myriad of opportunities for discerning investors and traders to tap into the profit potential of financial markets. By understanding the concepts and strategies involved, you can harness the power of options as an options buyer, making calculated trades with the potential for significant returns. Remember, knowledge is the key to unlocking success in this exciting arena. So, delve into the world of options trading, embrace the adrenaline, and unleash your financial prowess.

Image: tradeproacademy.com

Options Trading Option Buyer

Image: marketbusinessnews.com