A Tale of Two Approaches

In the dynamic realm of options trading, understanding the nuances between credit and debit spreads is paramount. Each approach presents distinct advantages, risks, and implications that can impact your trading strategy. While both offer the potential for profit, it is crucial to grasp their fundamental differences to navigate the market effectively.

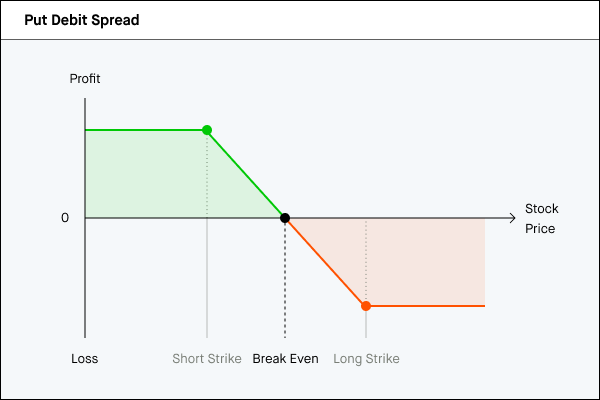

Image: learn.robinhood.com

What’s the Difference?

Simply put, a credit spread involves selling an option at a price higher than you paid for it, resulting in an immediate cash inflow. On the other hand, a debit spread entails purchasing an option at a price exceeding the premium you receive, leading to an initial cash outflow. Credit spreads are considered bullish strategies as they profit from rising prices or declining volatility, whereas debit strategies favor bearish market conditions.

Delving into Credit Spreads

- Profit Potential: Credit spreads offer limited profit potential, capped at the net premium received at the outset. The maximum gain is realized when the underlying asset’s price remains within the spread’s range.

- Risk Profile: Credit spreads are generally associated with a lower risk than debit spreads due to the initial cash inflow. However, the potential for loss is significant if the underlying asset moves outside the spread’s range.

- Suitable for: Credit spreads are ideal for market-neutral strategies, where the focus is on profiting from volatility rather than directional price movements. They are also preferred by traders who prioritize capital preservation.

Exploring Debit Spreads

- Profit Potential: Debit spreads allow for unlimited profit potential, as the underlying asset’s price can continue moving in the desired direction. The maximum gain is realized when the spread is held to expiration and the underlying asset moves significantly beyond the entry point.

- Risk Profile: Debit spreads carry a higher risk than credit spreads due to the initial cash outflow. The potential for loss is limited to the debit paid at the outset, but adverse price movements can result in significant losses.

- Suitable for: Debit spreads are commonly employed by traders seeking speculative profits from directional price movements. They are also appropriate for strategies that benefit from a specific price target being reached within a certain timeframe.

Image: tax.modifiyegaraj.com

Riding the Market Trends

The world of options trading is constantly evolving, with new insights emerging from news sources, forums, and social media platforms. Keeping abreast of these trends is essential for making informed trading decisions.

- Implied Volatility: Monitor implied volatility levels as they impact the premiums charged for options. Elevated volatility boosts credit spreads and challenges debit spreads.

- Economic Events: Stay alert to scheduled economic events that can influence market sentiment and price movements. This knowledge aids in adjusting strategies accordingly.

- News and Rumors: Quickly respond to market-moving news or rumors by assessing their potential impact on underlying assets’ prices.

Expert Advice to Guide Your Decisions

Experienced traders have accumulated invaluable insights that can enhance your trading approach. Here are some expert tips:

- Consider Your Risk Appetite: Thoroughly assess your risk tolerance before choosing between credit or debit spreads. Credit spreads are suitable for cautious traders, while debit spreads cater to those willing to accept higher risks for potentially greater rewards.

- Plan Your Exit Strategy: Establish a clear exit strategy before entering any trade. Identify the profit目標 and止損 levels to safeguard your trading capital.

- Practice with Paper Trading: Virtual trading platforms allow you to hone your skills and test different strategies without risking real money. This practice enhances your understanding of options trading concepts and techniques.

Unveiling the Common Queries

Q: Which strategy is best for beginners?

A: Credit spreads are generally considered a more beginner-friendly approach due to their lower risk profile and potential for capital preservation.

Q: Can I make a profit with credit spreads if the market goes down?

A: Yes, credit spreads can profit from declining or stagnant market conditions as long as the underlying asset remains within the spread’s range.

Q: How do I determine the expiration date for my options?

A: The expiration date is the date on which the options contract expires. Consider the holding period and volatility levels when selecting an appropriate expiration date.

Credit Versus Debit In Options Trading

Image: www.youtube.com

Conclusion

Navigating the intricacies of credit versus debit in options trading requires a comprehensive understanding of their fundamental differences, risk profiles, and market trends. Credit spreads offer lower risk but limited profit potential, while debit spreads boast higher risk and potentially unlimited profits. By incorporating expert advice and regularly monitoring market movements, you can make informed trading decisions and harness the power of options to enhance your financial strategies. Are you ready to delve deeper into the captivating realm of options trading?