In the bustling heart of Chicago, amidst the towering skyscrapers and relentless pulse of the financial district, the story of Black-Scholes option trading unfolded, forever etching its mark in the annals of market history. As a young economist at the University of Chicago, Fischer Black embarked on a groundbreaking research project that would revolutionize the world of options trading. Alongside mathematician Myron Scholes, he meticulously developed a model capable of pricing options, opening up unprecedented possibilities for investors and traders alike.

![2. [10 marks] Black-Scholes model: European claim. We | Chegg.com](https://media.cheggcdn.com/media/eff/effaf010-0771-4246-ad0d-7f560acc5979/phpxUGiLJ)

Image: www.chegg.com

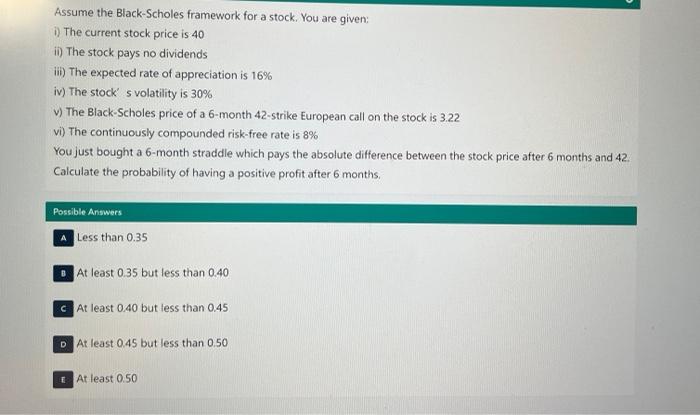

In 1973, Black and Scholes unveiled their groundbreaking paper, “The Pricing of Options and Corporate Liabilities,” forever altering the landscape of option trading. Their model, now known as the Black-Scholes model, provided a scientific foundation for valuing options, empowering investors to make informed decisions and sparking an explosion in the options market. From the humble beginnings of $100,000 in Chicago, Black-Scholes option trading has soared to unprecedented heights, becoming an integral part of modern financial markets.

The Rise of Black-Scholes Option Trading

The Black-Scholes model serves as a foundational framework for pricing options, accounting for essential factors such as the underlying asset’s price, volatility, strike price, time to expiration, and risk-free interest rate. By incorporating these variables, the model generates a fair value estimate for an option, enabling traders to assess its potential profitability and make strategic decisions.

In the early days of Black-Scholes option trading, traders and investors recognized its potential as a powerful tool for managing risk and generating substantial profits. They eagerly adopted the model, utilizing it to craft sophisticated options trading strategies that exploited market inefficiencies and captured market opportunities. As the options market burgeoned, the Black-Scholes model became indispensable, serving as the backbone for option pricing and risk assessment.

Latest Trends in Black-Scholes Option Trading

Despite its enduring legacy, the Black-Scholes model has not remained stagnant. Continuous advancements in technology, increased market complexity, and new derivative products necessitate ongoing enhancements and modifications to ensure its continued relevance in today’s dynamic financial landscape.

One notable trend is the incorporation of stochastic volatility models into the Black-Scholes framework. These models capture the dynamic nature of volatility, recognizing that it is not constant but rather subject to random fluctuations. This refinement provides a more precise representation of real-world market behavior, leading to improved option pricing accuracy.

Furthermore, the advent of high-frequency trading algorithms has transformed the options market. These algorithms leverage the power of advanced computing to make rapid trades, perpetually analyzing the market and seeking out arbitrage opportunities. The integration of these algorithms with the Black-Scholes model empowers traders to execute complex trading strategies with lightning-fast speed and precision.

Tips for Successful Black-Scholes Option Trading

While the Black-Scholes model provides a robust foundation for option trading, successful trading requires a combination of knowledge, skill, and experience. Here are some expert tips to enhance your options trading strategy:

- Master the Model: Develop a thorough understanding of the Black-Scholes model and its nuances. Appreciate its assumptions, limitations, and the impact of various parameters on option prices.

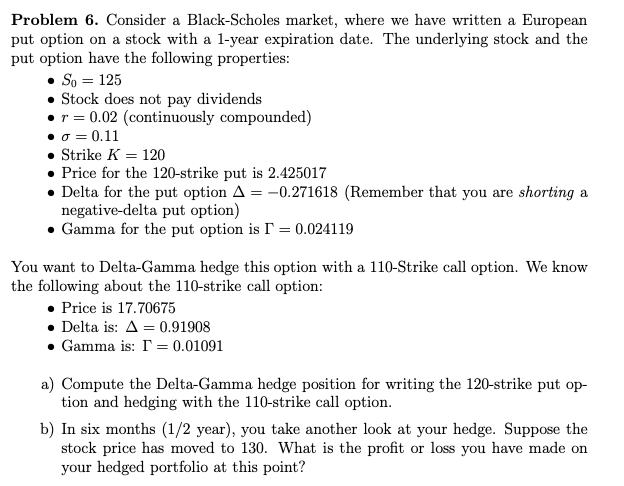

- Manage Risk Effectively: Recognize that option trading carries inherent risk. Implement effective risk management strategies, such as hedging, diversification, and position sizing, to mitigate potential losses.

- Monitor the Market: Keep a close eye on the underlying asset’s price movements, market volatility, and macroeconomic factors. Regular monitoring enables timely adjustments to your trading strategies.

By adhering to these expert tips, you can enhance your odds of success in the challenging world of Black-Scholes option trading.

Image: www.chegg.com

Frequently Asked Questions

Q: Is the Black-Scholes model infallible?

A: While the Black-Scholes model is a powerful tool, it has limitations. Assumptions like constant volatility and a normally distributed underlying asset price can deviate from real-world market conditions.

Q: Can I make a lot of money with Black-Scholes option trading?

A: Black-Scholes option trading has the potential for significant profits, but it also carries substantial risk. Success requires a deep understanding of the model, risk management strategies, and continuous monitoring of market conditions.

Q: Is Black-Scholes option trading suitable for beginners?

A: Black-Scholes option trading is not recommended for inexperienced traders. It requires advanced trading knowledge, risk management skills, and a thorough comprehension of the model. Beginners should consider gaining experience in less complex trading strategies before venturing into option trading.

Black Scholes Option Trading History 100 000 Chicago

Image: www.chegg.com

Conclusion

Black-Scholes option trading, born from the ingenuity of Fischer Black and Myron Scholes in Chicago, has transformed the financial world. The Black-Scholes model has provided a scientific basis for pricing options, opening up new avenues for profit and risk management. As the financial markets continue to evolve, the Black-Scholes model remains a cornerstone of modern option trading strategies.

For those captivated by the dynamic world of options trading, the journey of delving into Black-Scholes option trading is an enticing one. By embracing the knowledge shared in this article, you can embark on this exciting path, potentially unlocking substantial rewards while navigating the inherent risks involved.