Welcome to the captivating world of options trading, where the power of leverage and the allure of potential returns merge. In this insightful article, we’ll delve into the intricate details of option pricing, empowering you with the knowledge to navigate these financial markets with confidence.

Image: www.tradethetechnicals.com

Demystifying Options Trading: A Beginner’s Guide

Options contracts, derivatives of underlying assets, grant traders the right, but not the obligation, to buy or sell a specific asset at a predetermined price and expiration date. This flexibility offers both opportunities and risks, making options a compelling choice for both experienced and novice traders.

Unveiling the Factors that Influence Option Pricing

The price of an option is a reflection of several intertwining factors, each contributing to its intrinsic value:

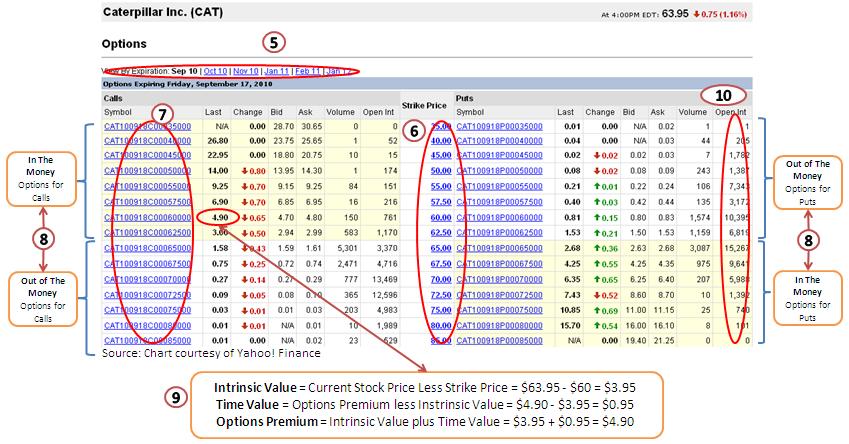

- Intrinsic Value: The fundamental worth of an option, representing the difference between the option’s strike price (target price for exercising the option) and the current market price of the underlying asset.

- Extrinsic Value: An additional premium paid for the time remaining until expiration and the volatility of the underlying asset. Higher volatility and longer expiration time increase the extrinsic value.

- Time Decay: As an option nears expiration, its extrinsic value gradually diminishes, known as time decay.

- Volatility: Options on assets with high volatility are typically more expensive due to the increased likelihood of significant price fluctuations, which enhances the potential for profit but also amplifies the risk.

Practical Applications of Option Pricing

Understanding option pricing is crucial for making informed trading decisions. For instance, traders can:

- Hedge Against Risks: Cover themselves against potential losses by purchasing a protective option contrary to their existing position.

- Increase Leverage: Leverage options to control and trade larger quantities of an underlying asset, amplifying potential returns but proportionally increasing risk.

- Speculate on Future Prices: Speculate on the future performance of an asset by trading options that align with their predictions.

Image: www.strike.money

Expert Insights: Navigating the Intricacies

Seasoned options traders often emphasize the importance of:

- Understanding Greeks: These metrics quantify an option’s sensitivity to various factors, providing insights into its performance under different scenarios.

- Position Sizing: Prudent risk management dictates sizing positions appropriately to optimize returns while minimizing losses.

- Constant Monitoring: Market conditions are dynamic, warranting constant tracking of option positions to make necessary adjustments.

Options Trading Price Of The Option

Image: www.qarya.org

Empowering You to Conquer Options Trading

Demystifying option pricing unveils the gateway to unlocking the potential of options trading. Embrace the learning curve and continuously refine your understanding. Seek guidance from reputable sources, attend workshops, and engage in simulated trading to sharpen your skills.

By meticulously evaluating factors influencing option pricing and honing your trading instincts, you will navigate options markets with newfound confidence and the potential to reap substantial rewards. As the adage goes, “The more you know about options, the more profitable they can be.”

Remember, options trading, while alluring, entails inherent risks. Approach it with vigilance and appropriate diversification. May this article serve as a beacon on your journey towards mastering options trading, a realm where informed decisions and prudent risk management lead to financial empowerment.