Introduction

In the labyrinthine world of finance, options trading stands as a captivating yet enigmatic realm. At its heart lies the Black-Scholes model, a mathematical tapestry woven by Fischer Black and Myron Scholes that revolutionized option pricing and birthed a multi-trillion-dollar industry. This article unravels the intricate history of Black-Scholes option trading, its profound impact on financial markets, and the intriguing prospects that lie ahead.

Image: dollarexcel.com

Delving into the Black-Scholes Genesis

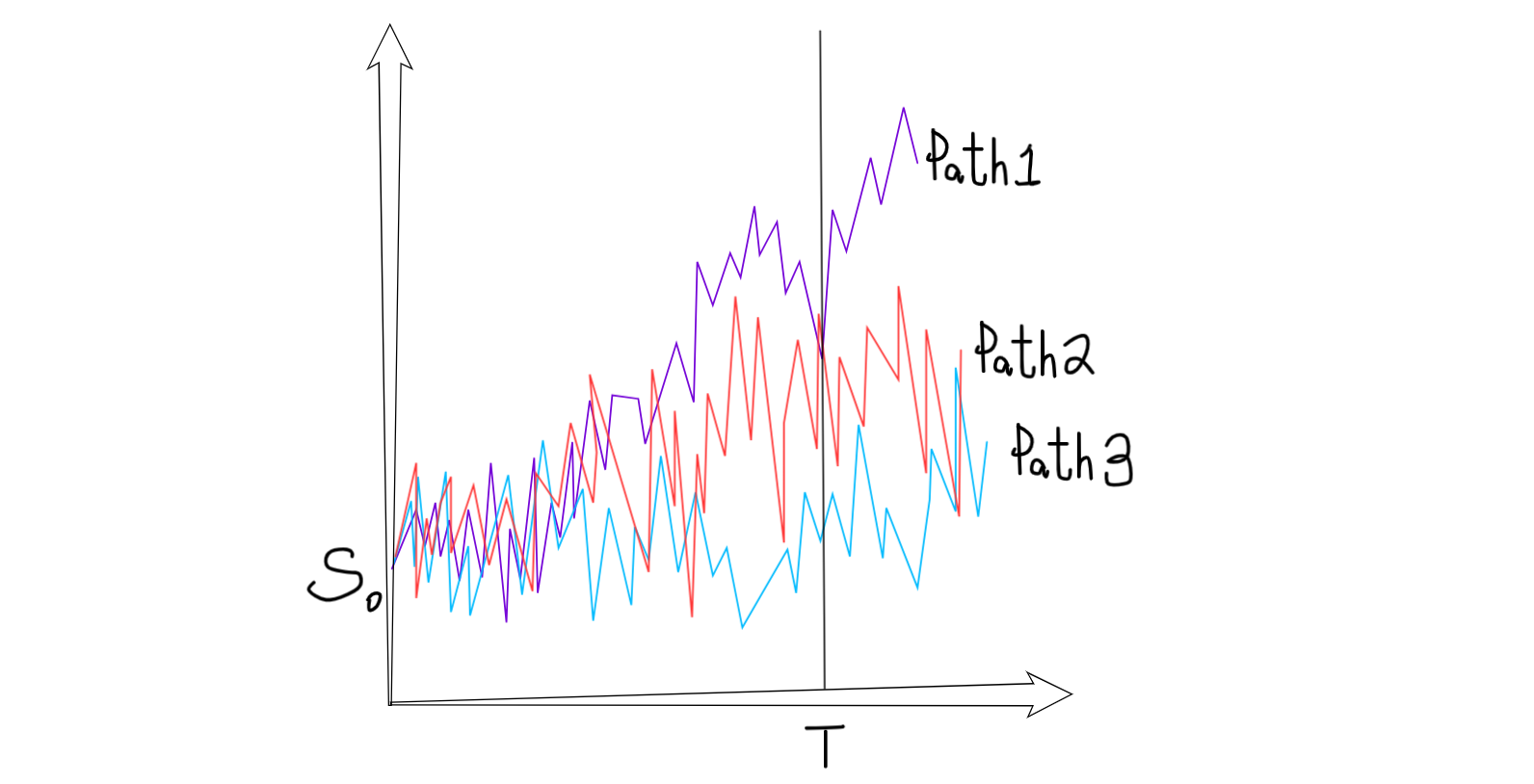

The genesis of the Black-Scholes model can be traced back to the early 1970s, where Fischer Black, a mathematician at the Massachusetts Institute of Technology, embarked on an intellectual journey to decipher the enigma of option pricing. Recognizing the limitations of existing models, Black delved into the mathematical toolbox of Brownian motion and stochastic calculus, laying the groundwork for a groundbreaking approach to option valuation.

Simultaneously, Myron Scholes, a financial economist and student of Black, refined this theoretical framework, incorporating crucial assumptions about market dynamics such as constant volatility and frictionless trading. Together, Black and Scholes crafted a mathematical symphony that would forever alter the landscape of options trading.

Redefining Option Pricing: A Paradigm Shift

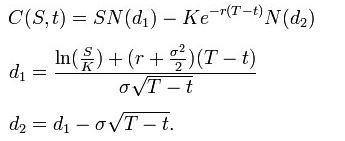

Prior to the advent of the Black-Scholes model, option pricing was shrouded in a veil of subjectivity and guesswork. Traders relied heavily on intuition and rudimentary techniques that often yielded unreliable results. The Black-Scholes model emerged as a beacon of mathematical precision, introducing a rigorous and analytical approach to option valuation.

The model’s elegance and accuracy captivated financial professionals, transforming the haphazard art of option trading into a scientific discipline. It empowered traders with the ability to accurately price options, enabling them to make informed decisions and mitigate risks.

Conquering Wall Street: The Rise of an Industry Giant

The Black-Scholes model’s impact on the financial world was swift and profound. It propelled the growth of the options market, providing a standardized framework for pricing and trading options. The Chicago Board Options Exchange (CBOE), the first exchange to offer standardized options contracts, experienced a meteoric rise in trading volumes, solidifying its position as a global options trading hub.

The Black-Scholes model also played a pivotal role in the development of sophisticated financial instruments such as index options, currency options, and interest rate options. These instruments expanded the horizons of options trading, allowing investors to hedge risks and speculate on a wider range of underlying assets.

Image: content.personalfinancelab.com

The Model’s Part in the 2008 Financial Crisis: A Cautionary Note

While the Black-Scholes model revolutionized options trading, its role in the 2008 financial crisis cannot be overlooked. The model’s assumptions about constant volatility proved inadequate during the crisis, leading to widespread underestimation of risks associated with complex financial instruments.

This experience served as a sobering reminder of the limitations of mathematical models when faced with extreme market conditions and the importance of due diligence and risk management in complex financial transactions.

Evolving with Time: Innovations and Future Directions

Despite its profound impact, the Black-Scholes model is not without its detractors. Some critics argue that its assumptions are too simplistic and fail to fully capture the complexities of real-world financial markets. Others point to the potential for model misuse and the need for continuous refinement.

Recognizing these limitations, researchers and practitioners are actively engaged in exploring innovative approaches to option pricing. Stochastic volatility models, volatility skew models, and machine learning techniques are among the promising avenues being explored to enhance the accuracy and applicability of the Black-Scholes model.

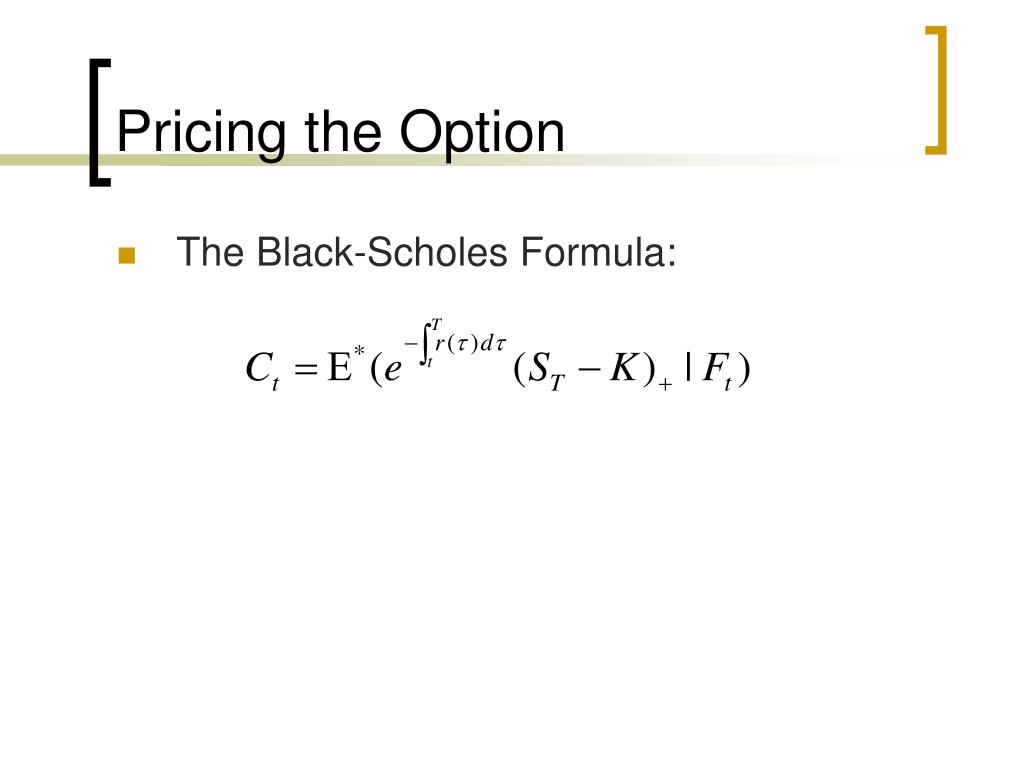

Black Scholes Option Trading History

Image: www.slideserve.com

Conclusion

The Black-Scholes option trading model stands as a testament to the power of mathematical innovation in shaping financial markets. Its influence has transformed the way options are priced and traded, enabling investors to make informed decisions and mitigate risks. While its limitations have been exposed during periods of extreme market turbulence, the model remains a cornerstone of options trading and continues to evolve with the ever-changing dynamics of financial markets. As researchers and practitioners delve deeper into the complexities of option pricing, the future holds the promise of further refinements and groundbreaking innovations, shaping the next chapter in the captivating history of Black-Scholes option trading.