The realm of finance has witnessed a pivotal transformation with the advent of options trading, an intricate practice that has revolutionized the way investors navigate risk and pursue exponential returns. Among the many groundbreaking breakthroughs in this sphere, the Black-Scholes model stands tall as a beacon of innovation, forever etching its name in the annals of financial history. This comprehensive exploration delves into the fascinating history of Black-Scholes, unraveling its origins, key concepts, and the profound impact it has had on the world of option trading.

Image: www.chegg.com

The Genesis of an Idea: Risk and Uncertainty in the 1960s

The 1960s marked an era of unprecedented volatility in the financial markets, with uncertainty looming large over the future. Amidst this turbulent landscape, two brilliant minds emerged, each grappling with the inherent risks associated with options trading. Fischer Black, an economics professor at the Massachusetts Institute of Technology (MIT), and Myron Scholes, a finance professor at the University of Chicago, recognized the urgent need for a reliable method to quantify and manage option risk.

The Black-Scholes Formula: A Breakthrough in Risk Assessment

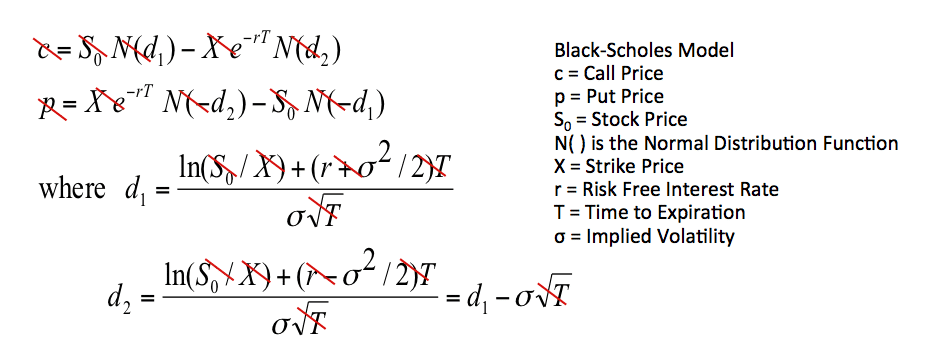

In 1973, the academic world witnessed the publication of Black and Scholes’ groundbreaking paper, “The Pricing of Options and Corporate Liabilities.” This seminal work introduced a groundbreaking formula that revolutionized the way options were priced and evaluated. The Black-Scholes formula provided a theoretical framework for determining the fair price of an option based on a set of underlying variables, including the price of the underlying asset, the strike price, the time to expiration, and the risk-free interest rate.

The Nobel Prize: Recognition of a Paradigm Shift

The profound impact of the Black-Scholes model on the financial industry cannot be overstated. Its ability to quantify risk and determine fair value transformed option trading, making it more accessible and less speculative. The model’s precision and accuracy earned Black and Scholes the prestigious Nobel Prize in Economic Sciences in 1997, a testament to the transformative power of their groundbreaking work.

Image: irudivupic.web.fc2.com

Option Trading Takes Center Stage: Practical Applications

The Black-Scholes model has had a profound impact on the practical aspects of option trading. It has enabled investors to make informed decisions about option pricing, empowering them to manage risk and maximize returns. The model has also facilitated the development of sophisticated trading strategies, such as hedging and arbitrage, further enhancing the efficiency and liquidity of the options market.

The Legacy of Black-Scholes: Continuous Evolution

Over the decades since its inception, the Black-Scholes model has undergone continual refinement and adaptation. While its fundamental principles remain intact, the model has been extended to accommodate various complexities and nuances of the financial markets. These refinements have ensured the continued relevance of Black-Scholes, solidifying its position as the cornerstone of modern option trading.

Black Scholes Option Trading History 100000 0

Image: optionalpha.com

Conclusion: A Monument to Financial Innovation

The Black-Scholes model stands as a testament to the ingenuity and creativity that drive progress in the financial world. Its ability to quantify risk, determine fair value, and facilitate sophisticated trading strategies has revolutionized the practice of option trading. As the financial landscape continues to evolve, the legacy of Black-Scholes will endure, serving as an enduring testament to the power of innovation in shaping the future.