Trading options minutes before expiration is a high-stakes, volatile, and potentially lucrative strategy that requires immense skill and a deep understanding of options pricing. This technique allows traders to capitalize on significant price changes that often occur in the final minutes of an option’s life. Yet, it also carries substantial risks that can easily lead to hefty losses if not executed with precision. In this comprehensive guide, we will delve into the intricacies of trading options minutes before expiration, exploring its strategies, profitability potential, and the risks involved.

Image: tradenation.com

Understanding Last-Minute Option Trading

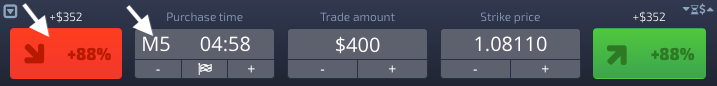

Traditionally, traders buy and sell options with defined expiries, ranging from a week to several months. However, last-minute option trading involves entering or exiting option positions mere minutes before the expiration time, typically within the final 5-10 minutes. This strategy takes advantage of the theta decay – the tendency of an option to lose value as it approaches expiration. As the remaining time for an option to exercise decreases, its time value diminishes, causing a proportional decrease in its premium.

The closer an option gets to its expiration, the more significant this decay becomes. This is because the likelihood of the option being profitable (or “in the money”) decreases as time runs out. Traders attempting this technique seek to enter options positions that they believe will expire in the money and quickly sell them for a profit just before expiration.

Strategies for Last-Minute Option Trading

Two strategies are commonly employed in last-minute option trading:

1. Zero-Day Options Trading:

Zero-day options trading involves buying or selling an option that is set to expire on the same day, with minutes or even seconds to spare before the market closes. The goal of this strategy is to purchase an option that is significantly “out of the money,” meaning it is highly unlikely to expire with intrinsic value. The trader’s intention is to capitalize on the final moments of theta decay, selling the option before expiration for a small profit.

Image: www.youtube.com

2. Rapid Fire Trading:

Rapid fire trading is a fast-paced strategy where traders aim to capture multiple small, quick profits throughout the last minutes of an option’s life. This involves buying and selling options multiple times within a short timeframe, seeking to secure small gains in each trade before expiration.

Profitability Potential and Risks

While last-minute option trading offers the potential for sizeable profits, it is crucial to be aware of the substantial risks involved. Market conditions, sudden price shifts, and timing errors can all play a significant role in determining the outcome of these trades. Patience and experience, along with a robust understanding of options and a disciplined trading strategy, can minimize the risks while enhancing profitability.

The potential reward-to-risk ratio for last-minute trading can be extensive, amplifying the allure of this strategy for experienced and risk-tolerant traders. However, it’s critical to acknowledge that losses can be substantial if the trade doesn’t go according to plan. Market volatility or unpredictable events can lead to significant price fluctuations that result in significant losses.

Suitability and Considerations

Last-minute option trading is not suitable for every trader. It requires traders who are:

- Highly skilled, experienced, and knowledgeable about options pricing and dynamics

- Comfortable with high-risk, fast-paced trading environments

- Able to remain calm and composed under intense market conditions

- Capable of making quick trading decisions and executing them swiftly and efficiently

- Willing to monitor the markets closely and react to rapidly evolving situations

Trading Options Minutes Before Expiration

Image: tradingwalk.com

Conclusion

Trading options minutes before expiration can be a powerful yet highly risky strategy. It requires a unique skill set, lightning-fast reaction times, and a deep understanding of options pricing. While the potential rewards can be significant, it’s crucial to acknowledge the substantial risks involved. Only experienced traders with a robust risk management strategy and a refined understanding of options trading principles should consider this technique. For those who possess the necessary skills, knowledge, and risk appetite, last-minute option trading offers the allure of capturing quick profits in the final moments before expiration.