In today’s fast-paced financial markets, intraday options trading has emerged as a popular strategy for traders seeking to capitalize on short-term market movements. This dynamic trading style involves buying and selling options contracts within a single trading day, offering both high rewards and risks.

Image: www.5paisa.com

To delve into the realm of intraday options trading, it’s crucial to understand its core concepts and the strategies employed by experienced traders. This comprehensive guide will provide you with the knowledge and techniques you need to navigate this exciting and challenging trading arena.

The Benefits of Intraday Options Trading

Intraday options trading offers several advantages, including:

- Limited Risk: Options contracts come with a predetermined risk profile, unlike stocks or futures, which can have unlimited loss potential.

- Profitability Flexibility: Traders can generate profits in various market conditions, whether the market rises, falls, or remains flat.

- High Leverage: Options offer traders the ability to control a large number of shares with a relatively small investment.

- Short Holding Period: Intraday trading allows traders to exit their positions quickly, minimizing the risks associated with overnight market fluctuations.

Essential Intraday Options Trading Strategies

To succeed in intraday options trading, traders employ various strategies, each tailored to specific market conditions and risk appetites:

Scalping

Scalping is a rapid-fire trading strategy that involves taking multiple small profits throughout the day. Scalpers typically enter and exit positions within minutes, aiming to profit from small price movements.

Image: lakshmishree.com

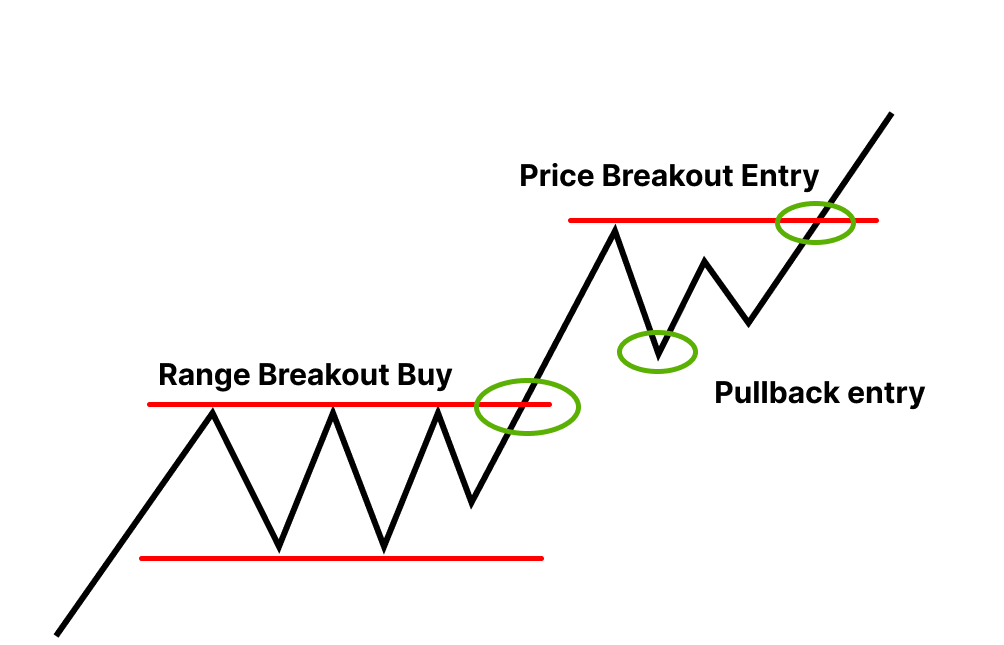

Range Trading

Range traders identify specific price levels that act as support and resistance. They then buy options when the price approaches the support level and sell when it reaches the resistance level, profiting from the range-bound market conditions.

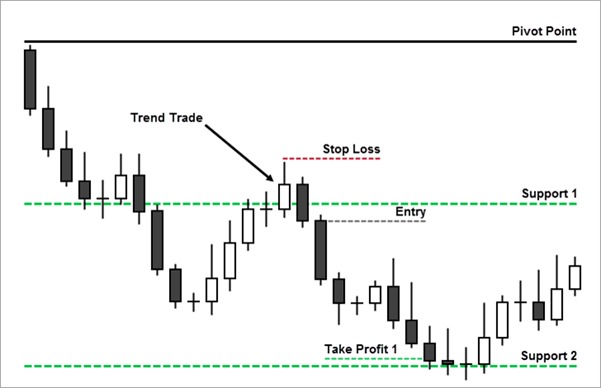

Trend Trading

Trend traders aim to capture larger market moves by riding the trend. They buy options in an uptrend and sell options in a downtrend, seeking to profit from sustained price momentum.

Earnings Trading

Earnings trading involves trading options contracts ahead of a company’s earnings announcement. Traders speculate on the potential impact of the earnings report on the stock price, buying call options if they anticipate a positive report and put options if they expect negative results.

Delta Hedging

Delta hedging is an advanced strategy used by sophisticated traders to manage the risk of their options positions. It involves buying or selling shares of the underlying asset to offset the delta exposure of their options contracts.

Expert Tips for Intraday Options Trading

Mastering intraday options trading requires a combination of knowledge, experience, and discipline. Here are some expert tips to enhance your success:

- Trade a small number of contracts: Limit your risk by trading a manageable number of contracts, especially when starting out.

- Manage your emotions: Control your emotions and trade with a clear and disciplined approach.

- Use limit orders: Set limit orders to execute your trades at specific prices, avoiding emotional and impulsive trading.

- Monitor your trades closely: Keep a close watch on the market and your options positions to adjust or exit as needed.

- Review your results: Regularly analyze your trading performance to identify areas for improvement.

Remember, intraday options trading comes with significant risks. It’s essential to understand the complexities and limitations of this trading style before putting your capital at risk.

FAQs on Intraday Options Trading

Q: What is the best strategy for intraday options trading?

A: The best strategy depends on your risk tolerance, trading style, and market conditions. There is no one-size-fits-all approach.

Q: How much capital do I need to start intraday options trading?

A: The amount of capital required varies depending on your risk tolerance and the size of your trades. It’s recommended to start with a small amount and gradually increase your risk as you gain experience.

Q: Can I learn intraday options trading on my own?

A: While it’s possible to self-educate, it’s advisable to seek guidance from experienced traders or reputable resources to minimize your risk.

Q: What software do I need to trade options?

A: You will need a reliable trading platform that offers options trading capabilities. Some popular options include TradeStation, Thinkorswim, and Interactive Brokers.

Intraday Options Trading Strategies

Image: boomingbulls.com

Conclusion

Intraday options trading provides a dynamic and potentially lucrative arena for experienced traders. By understanding the key strategies, implementing risk management techniques, and seeking expert advice, you can capitalize on the opportunities and navigate the challenges of this exciting trading domain. Remember, learning is an ongoing process, and the financial markets are ever-changing. Embrace the learning curve, refine your skills, and trade with discipline to maximize your success in intraday options trading.

Are you ready to embark on the captivating journey of intraday options trading? Comment below and let’s discuss your experiences, strategies, and insights!