Harnessing the Power of Trading Status Options

Navigating the complexities of the financial markets requires investors to be armed with a comprehensive understanding of the tools at their disposal. Trading status options emerge as a valuable asset in this regard, empowering investors with the flexibility to customize their investment strategies and capitalize on potential opportunities. In this comprehensive guide, we delve into the fascinating world of trading status options, exploring their intricacies, nuances, and applications.

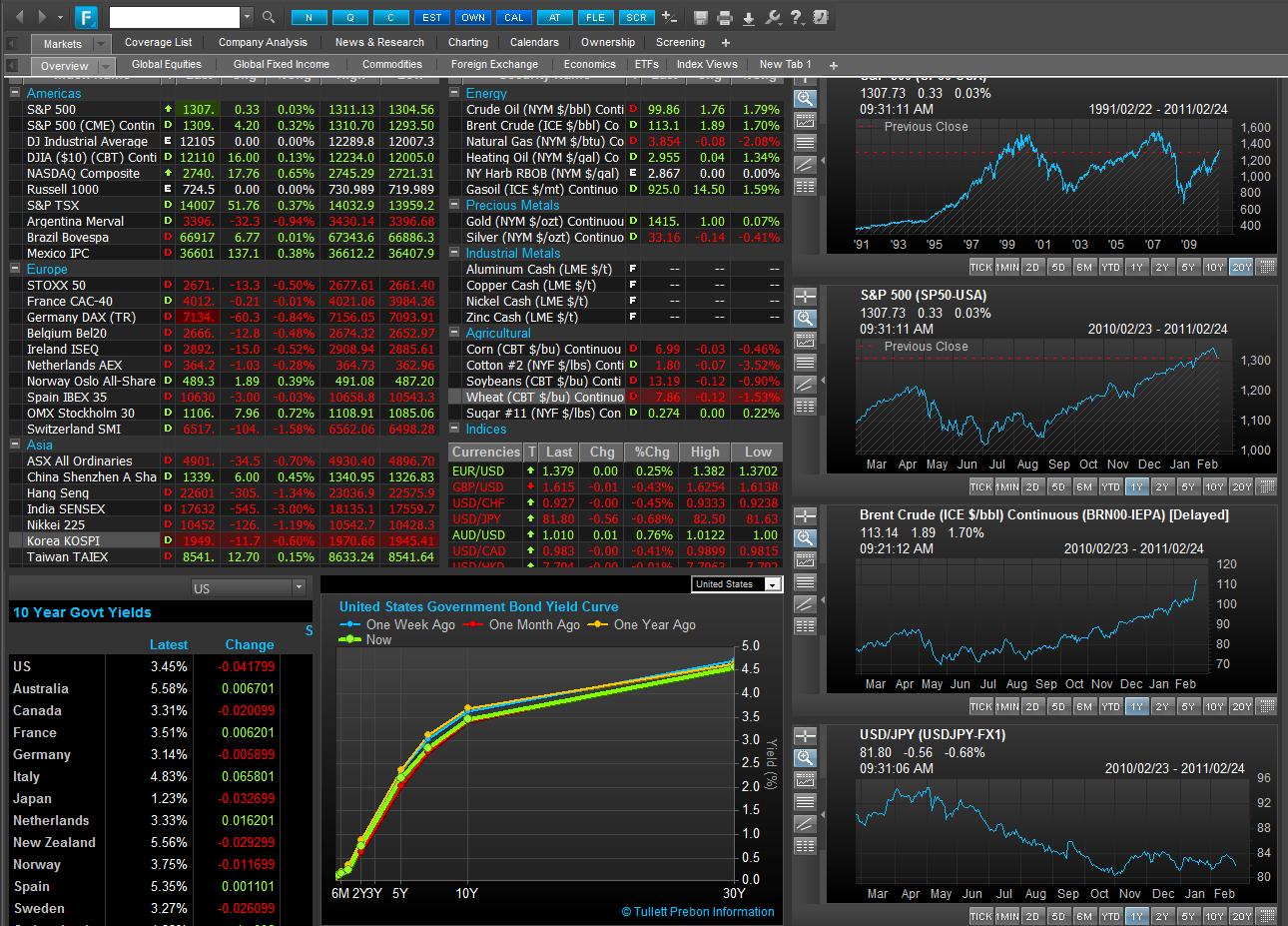

Image: www.stockbrokers.com

What are Trading Status Options?

Trading status options are financial instruments that grant investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. They provide investors with flexibility in tailoring their investment strategies and mitigating potential risks. Trading status options are typically traded on exchanges and can be used for various purposes, including speculation, hedging, and income generation.

Call Options

Call options provide investors with the right to buy an underlying asset at a predetermined price, known as the strike price. When an investor exercises a call option, they are obligated to purchase the underlying asset at the strike price, regardless of its current market value. Call options are typically used when investors anticipate an increase in the underlying asset’s price.

Put Options

Put options, on the other hand, grant investors the right to sell an underlying asset at a predetermined price. When an investor exercises a put option, they are obligated to sell the underlying asset at the strike price, regardless of its current market value. Put options are typically used when investors anticipate a decline in the underlying asset’s price.

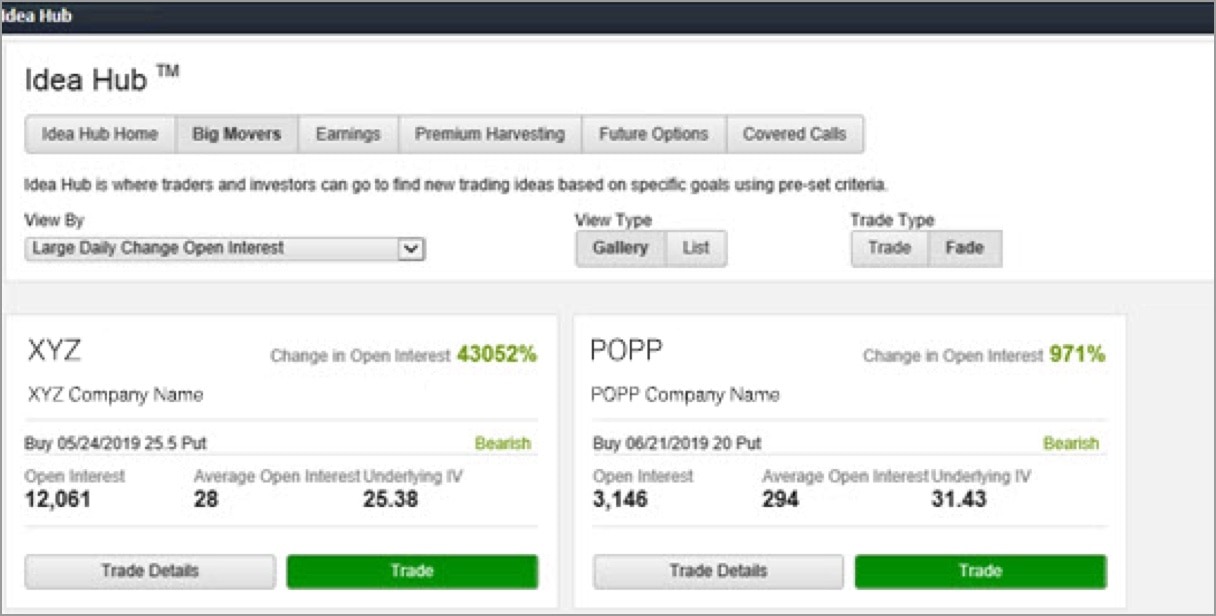

Image: www.stat.rice.edu

Types of Trading Status Options

Trading status options encompass several types, each catering to specific investment strategies. These include:

- American options: Can be exercised at any time before the expiration date.

- European options: Can only be exercised on the expiration date.

- Bermuda options: Can be exercised on specific dates before the expiration date.

Trading Status Options Strategies

Traders employ a diverse array of strategies when utilizing trading status options. Some of the most common strategies include:

- Covered call: Selling a call option while owning the underlying asset

- Naked call: Selling a call option without owning the underlying asset

- Collar strategy: Buying a put option while simultaneously selling a call option

Assessing Trading Status Options

Evaluating trading status options before investing requires careful consideration of several factors. These include:

- Underlying asset: The characteristics and performance of the underlying asset

- Strike price: The predetermined price at which the option can be exercised

- Expiration date: The date on which the option expires

- Option premium: The price paid for the option

FAQs on Trading Status Options

- Q: Who can trade trading status options?

- A: Trading status options are accessible to both experienced and novice investors.

- Q: What is the difference between a call option and a put option?

- A: A call option grants the right to buy, while a put option grants the right to sell.

- Q: How do I exercise a trading status option?

- A: Options are exercised through the exchange or broker where they were purchased.

Trading Status Options

Image: www.schwab.com

Conclusion: Empowering Investment Success

Trading status options emerge as indispensable tools for investors seeking to enhance their investment strategies and navigate the financial markets with precision. By comprehending the nuances and applications of call and put options, investors can harness the power of flexibility, control, and risk mitigation. Whether employed for speculation, hedging, or income generation, trading status options empower investors to make informed decisions and optimize their investment portfolios. As you venture into the realm of trading status options, we encourage you to explore the resources available, consult with financial advisors, and stay abreast of market developments. With knowledge as your ally, you can unlock the transformative potential of these versatile financial instruments.

Are you intrigued by the world of trading status options? Join the conversation and share your insights or ask questions in the comments section below!