Imagine you have an opportunity to partake in a game where you can potentially multiply your investment without actually owning an asset. Sounds fascinating, right? This is the essence of options trading, and in this article, we’ll delve deep into the intriguing world of call options, unveiling their mechanisms and equipping you with actionable knowledge.

Image: www.reddit.com

In the financial realm, options contracts provide a unique avenue for savvy investors to augment their returns or hedge against potential risks. Among the diverse array of options available, call options stand out as an instrument that offers the compelling opportunity to profit from an anticipated rise in the underlying asset’s price. Let’s unravel the intricate workings of call options and empower you to navigate this dynamic financial terrain with confidence.

1. Call Options: A Basic Overview

A call option grants the holder the right, but not the obligation, to purchase a specific number of shares of an underlying asset at a predetermined price, referred to as the strike price, within a specified period, known as the option’s expiration date. As the name suggests, a call option is typically employed when the investor anticipates a positive price movement in the underlying asset.

Consider this scenario: You believe that the stock of XYZ Corp. is poised for an upswing, but you don’t have sufficient capital to acquire the shares outright. Instead of sitting on the sidelines, you could opt to purchase a call option. This option would confer upon you the right to buy 100 shares of XYZ Corp. stock at a strike price of, say, $50 within the next two months. If the stock price rises above $50 before the expiration date, you can exercise your option to purchase the shares at the predetermined strike price, pocketing the difference between the strike price and the current market price.

2. Anatomy of a Call Option

To understand the dynamics of call options, it’s essential to grasp the key terms associated with them:

a) Strike Price: This is the predetermined price at which the investor can acquire the underlying asset if they choose to exercise the option.

b) Expiration Date: This marks the specific date by which the option must be exercised or it will expire worthless.

c) Premium: This represents the price the investor pays upfront to the option seller in exchange for the option contract.

d) Underlying Asset: This refers to the underlying asset that the option contract relates to, such as stocks, bonds, or commodities.

3. Benefits and Risks of Call Options

As with any investment instrument, call options come with their own set of advantages and potential drawbacks.

Benefits:

a) Limited Risk: Unlike purchasing the underlying asset directly, call options offer limited downside risk, as the most an investor can lose is the premium they paid for the option.

b) Potential for Leveraged Returns: Call options offer the potential for significant returns if the underlying asset’s price moves in the anticipated direction. This leverage effect allows investors to magnify their gains.

c) Flexibility: Call options provide flexibility, as investors can choose the strike price and expiration date that align with their investment goals.

Risks:

a) Time Decay: The value of call options diminishes over time, particularly as the expiration date approaches. This is known as time decay.

b) Limited Upside Potential: While call options offer the potential for outsized returns, the upside is capped at the difference between the strike price and the underlying asset’s price at the time of exercise.

c) Potential for Loss: If the underlying asset’s price doesn’t rise as anticipated, the option may expire worthless, resulting in the loss of the premium paid.

Image: tradingtuitions.com

4. Execution and Strategies

Deciding whether or not to exercise a call option depends on several factors, including the current market price of the underlying asset and the investor’s profit target. If the underlying asset’s price rises significantly above the strike price, the investor may choose to exercise the option and acquire the asset at the favorable predetermined price. Conversely, if the underlying asset’s price remains below the strike price, the option will expire worthless.

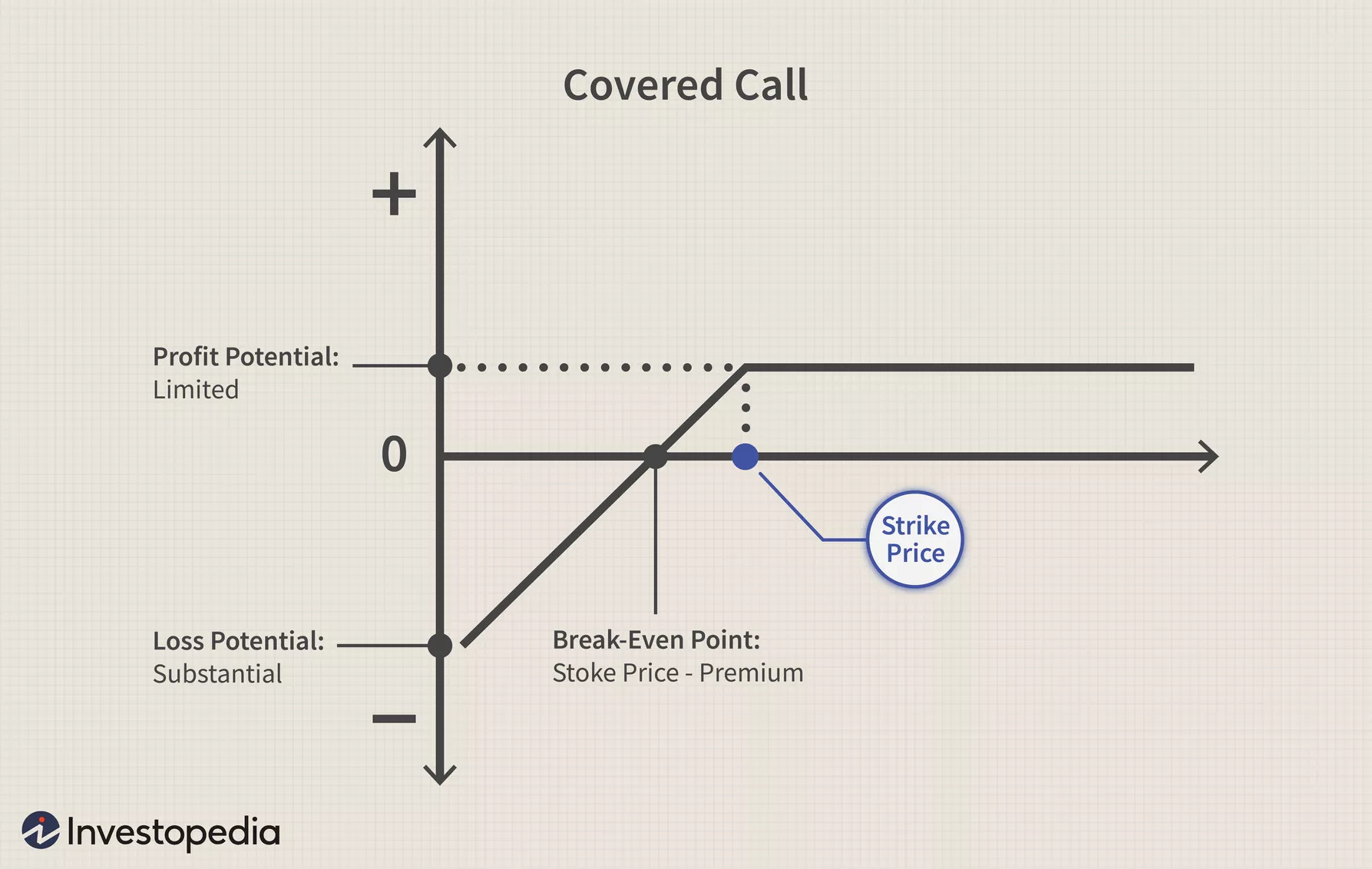

Options trading strategies encompass both simple and complex approaches to navigate market dynamics. For novice traders, buying call options directly is a straightforward method to gain exposure to the potential upside of an asset. Experienced traders, however, employ more nuanced strategies like writing covered calls, where they sell call options against an underlying asset they own, or bull call spreads, which combine the purchase and sale of call options with different strike prices and expiration dates to potentially enhance returns while mitigating risk.

What Is Call In Options Trading

Conclusion

Call options offer a unique blend of risk and reward, providing investors with the flexibility to speculate on the price movements of underlying assets without committing to an outright purchase. By carefully considering the potential benefits and risks, investors can leverage call options to complement their investment strategies. This in-depth guide has equipped you with a comprehensive understanding of call options dynamics, empowering you to make informed investment decisions and potentially harness the opportunities available in this dynamic financial landscape. Remember, the world of options trading awaits your exploration, where knowledge and savvy can unlock the path to financial success.