Introduction

Investing in the stock market can be a great way to grow your wealth, but it can also be risky. One way to reduce your risk is to trade options. Options are contracts that give you the right, but not the obligation, to buy or sell a stock at a certain price on or before a certain date. This can be a great way to gain exposure to stocks without having to buy them outright.

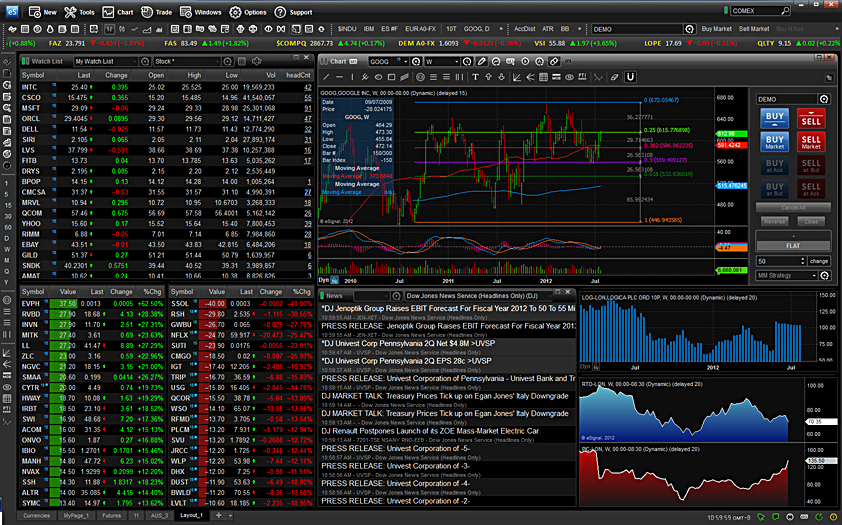

Image: www.samco.in

Not all stocks are good for options trading, however. Some stocks are more volatile than others, which makes them more risky for options traders. Others have low liquidity, which can make it difficult to buy or sell options contracts.

Good Stocks for Options Trading

High Liquidity

The first thing to look for in a stock for options trading is high liquidity. Liquidity refers to the ease with which you can buy or sell a stock. Stocks with high liquidity have a lot of trading volume, which means that there are always buyers and sellers available.

Moderate Volatility

Volatility refers to the amount of price movement in a stock. Stocks with high volatility can experience large swings in price, which can make them risky for options traders. Stocks with moderate volatility are less likely to experience large price swings, which makes them more suitable for options trading.

Image: niyudideh.web.fc2.com

Good Earnings

Another factor to consider when choosing stocks for options trading is earnings. Stocks with strong earnings are more likely to continue to perform well, which can make them a good choice for long-term options strategies.

Latest Trends and Developments in Options Trading

The options market is constantly evolving, so it’s important to stay up-to-date on the latest trends and developments. Here are some that you should be aware of:

- The rise of exchange-traded funds (ETFs). ETFs are baskets of stocks that track a particular index or sector. They offer a convenient way to gain exposure to a group of stocks, and they can be traded just like stocks.

- The increasing popularity of options on ETFs. As ETFs have become more popular, so has the demand for options on ETFs. This is because options on ETFs offer a way to gain exposure to a group of stocks with a single trade.

- The development of new options strategies. There are constantly new options strategies being developed, which can give traders more ways to profit from the market.

Tips and Expert Advice for Options Traders

- Start small. Don’t risk more money than you can afford to lose.

- Do your research. Before you trade options, make sure you understand how they work and the risks involved.

- Use a demo account. Many brokers offer demo accounts that allow you to practice trading options without risking any real money.

- Don’t be afraid to ask for help. If you’re not sure how to trade options, there are many resources available to help you.

FAQs About Options Trading

- What is an option?

- An option is a contract that gives you the right, but not the obligation, to buy or sell a stock at a certain price on or before a certain date.

- What is the difference between a call option and a put option?

- A call option gives you the right to buy a stock at a certain price, while a put option gives you the right to sell a stock at a certain price.

- What is the strike price?

- The strike price is the price at which you can buy or sell the stock.

- What is the expiration date?

- The expiration date is the date on which the option expires.

Which Stocks Are Good For Option Trading

Image: www.pinterest.jp

Conclusion

Options trading can be a great way to grow your wealth, but it’s important to do your research and understand the risks involved. By following the tips and expert advice provided in this article, you can increase your chances of success in the options market.

Are you interested in learning more about options trading? If so, there are many resources available to help you get started.