“In the labyrinthine world of finance, where fortunes are forged and dreams are realized, options trading stands as a beacon of opportunity for savvy investors.”

Image: eaglesinvestors.com

Introduction

Options trading, a financial instrument that empowers individuals to navigate market volatility, has captured the imagination of traders and investors alike. Its intricate mechanisms and boundless possibilities can be both exhilarating and daunting. This comprehensive guide aims to demystify options trading, unraveling its complexities and equipping you with the knowledge and confidence to harness its power.

Delving into the Realm of Options Trading

Options, in essence, grant you the right to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility offers immense strategic advantages, enabling you to tailor your investments to your unique risk tolerance and market outlook.

History traces the origins of options trading back to ancient Greece, where merchants used olive oil contracts to hedge against price fluctuations. Today, options span a vast array of underlying assets, including stocks, bonds, currencies, and commodities, catering to the diverse needs of investors worldwide.

Fundamentals of Options Trading

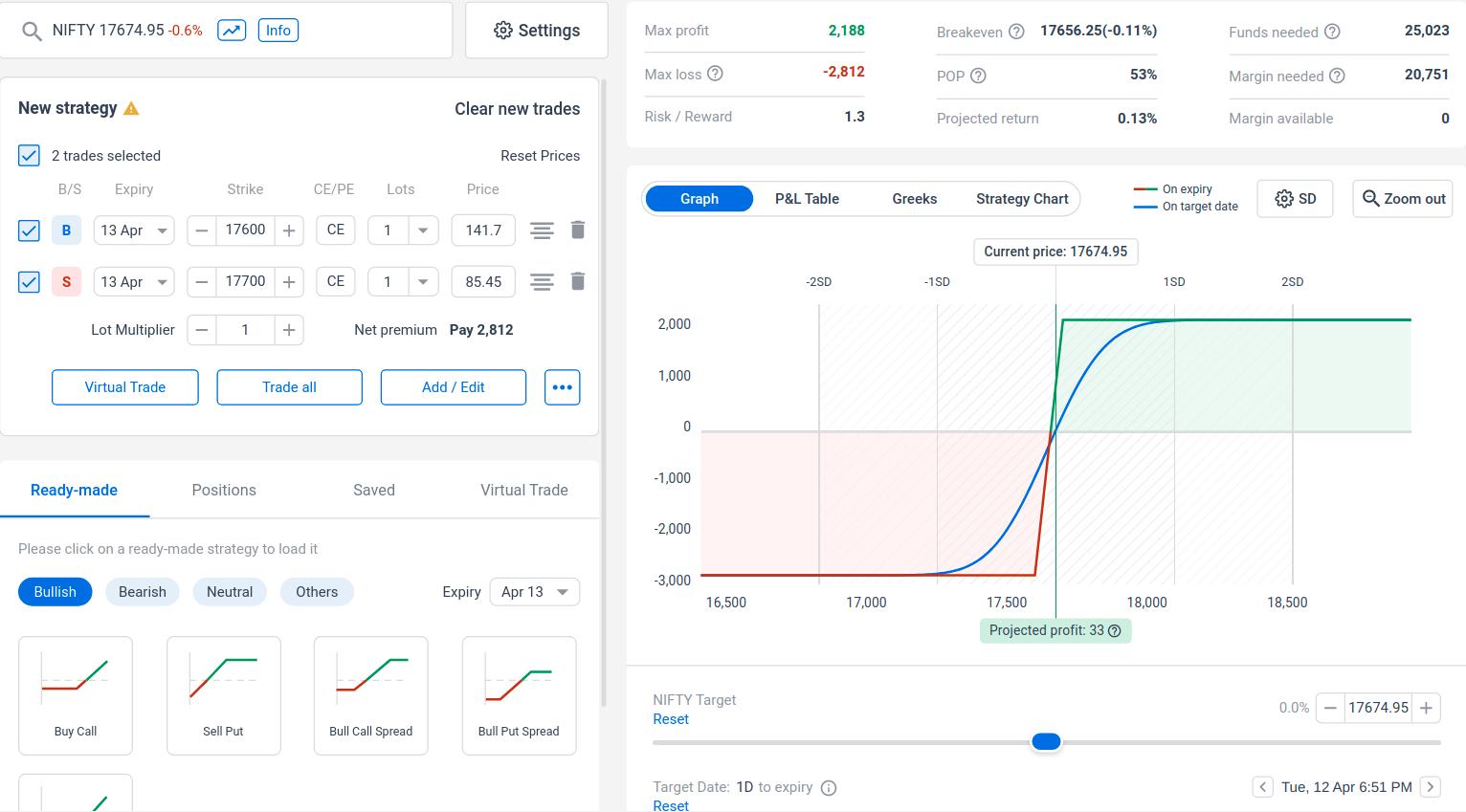

At the heart of options trading lies the concept of “call” and “put” options. Call options convey the right to buy an asset, while put options bestow the right to sell. These options are defined by four key parameters:

- Strike Price: The predetermined price at which you can exercise the option to buy or sell.

- Expiration Date: The date on or before which you must exercise the option.

- Premium: The price you pay to acquire the option, typically quoted as a percentage of the underlying asset’s value.

- Option Type: Call or put option, depending on whether you intend to buy or sell the underlying asset.

Image: www.youtube.com

Understanding Options Strategies

Options offer a diverse array of strategies to cater to varying investment objectives and risk appetites. Some common strategies include:

- Buying Calls: Betting on rising asset prices, giving you the potential to profit from upward market movements.

- Selling Calls: Capitalizing on falling asset prices, earning a premium while limiting potential losses.

- Buying Puts: Hedging against potential losses or speculating on falling asset prices.

- Selling Puts: Receiving a premium while assuming the obligation to buy the asset if its price falls below the strike price.

Unraveling the Benefits and Risks of Options Trading

Benefits:

- Enhanced Leverage: Multiplies your investment potential by providing disproportionate gains relative to the capital outlay.

- Flexibility: Allows you to customize your trading strategy to suit your financial goals and market conditions.

- Risk Management: Provides downside protection, enabling you to limit losses in volatile markets.

Risks:

- Options Expiration: If an option is not exercised before its expiration date, its value becomes worthless.

- Leverage Effect: While leverage can amplify gains, it can also magnify losses, potentially exceeding your initial investment.

- Volatility Risk: The value of options is highly influenced by the underlying asset’s price movements, making them susceptible to market fluctuations.

Harnessing the Power of Options Trading

To navigate the complexities of options trading successfully, consider these expert insights:

- Research and Education: Familiarize yourself with the intricacies of options trading before venturing into the market.

- Risk Management: Define your risk tolerance and establish clear trading rules to minimize potential losses.

- Start Small: Begin with smaller investments until you gain confidence and experience.

- Diversification: Spread your options across different underlying assets to mitigate risk.

- Seek Professional Advice: Consult with a qualified financial advisor to customize options trading strategies tailored to your financial objectives.

Options Trading.Org

Image: stewdiostix.blogspot.com

Embracing a Brighter Financial Future with Options Trading

Armed with the knowledge and insights unveiled in this comprehensive guide, you possess the keys to unlock the boundless potential of options trading. By embracing this instrument strategically, you can optimize your investment portfolio, manage risk, and pave the path to a more prosperous financial future.

So, seize this opportunity to delve into the fascinating world of options trading, where savvy investors navigate market tides with confidence and reap the rewards of informed decision-making.