In the realm of mobile finance, where convenience meets innovation, the Cash App has emerged as a game-changer. Its seamless interface and user-friendly features have revolutionized the way we manage our finances, and now, with the introduction of the Cash App trading option, investing has become more accessible than ever before.

:max_bytes(150000):strip_icc()/06_Cash_App-fb37676d895347fba391a35b2631f684.jpg)

Image: teakits.blogspot.com

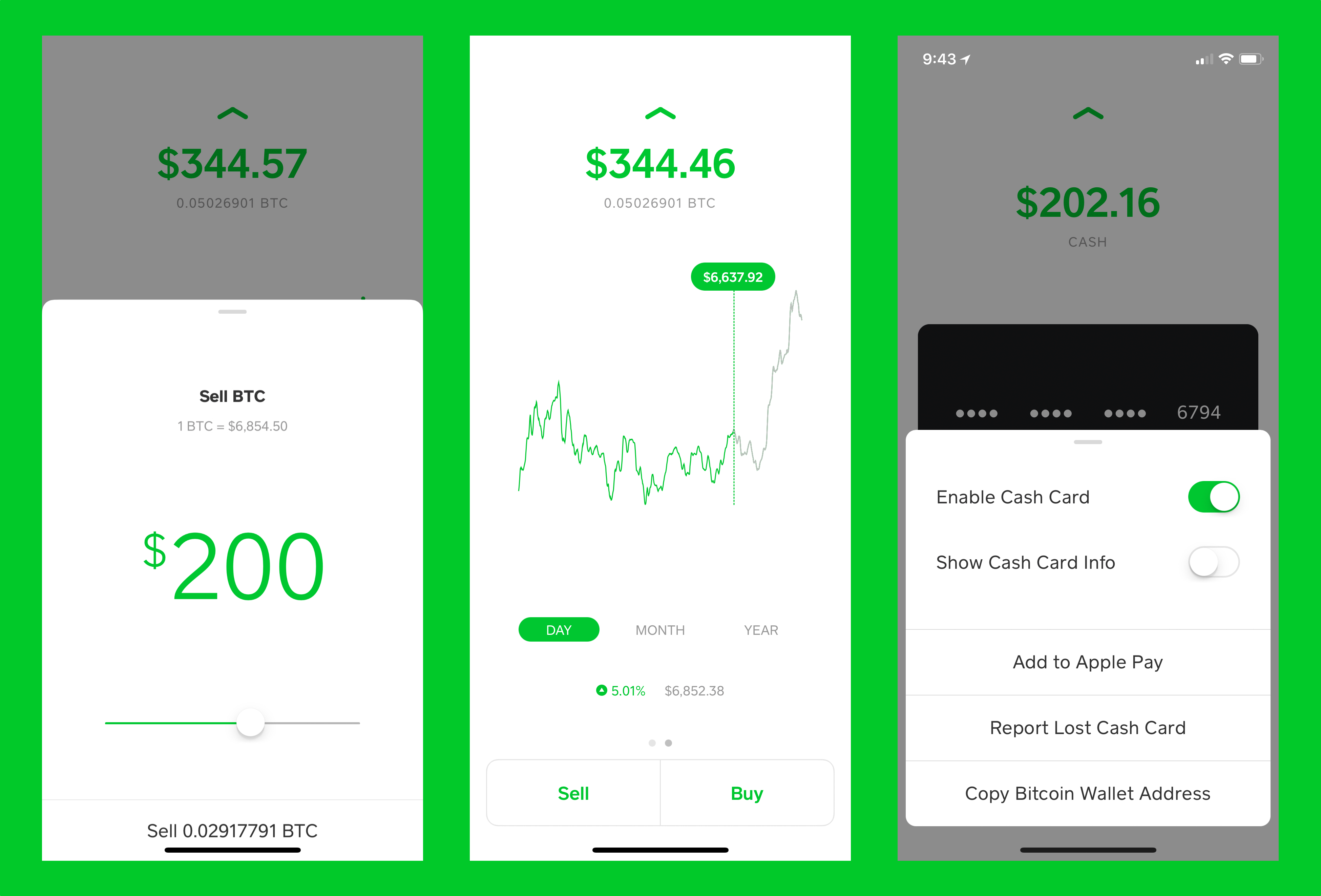

The Cash App trading option empowers you with the ability to buy and sell stocks, ETFs, and cryptocurrency directly from your smartphone. No more complicated trading platforms, no hidden fees, just a simple and straightforward way to participate in the financial markets. This article will delve into the nuances of the Cash App trading option, providing you with all the information you need to make informed investment decisions.

Understanding the Cash App Trading Option

The Cash App trading option is an extension of the Cash App’s existing mobile payment platform. It allows users to invest in a wide range of financial instruments, including:

- Stocks: Individual shares of publicly traded companies.

- ETFs: Baskets of stocks or bonds that track specific indices or sectors.

- Cryptocurrency: Digital currencies like Bitcoin and Ethereum.

The Cash App trading option boasts a user-friendly interface that makes it easy for both beginners and experienced investors to navigate. Its real-time charting and market data ensure that you’re always up to speed on the latest market conditions. And with its low minimum investment requirement, you can get started with as little as $1.

Benefits of Using the Cash App Trading Option

The Cash App trading option offers several advantages over traditional brokerage accounts:

- Simplicity: The Cash App’s intuitive interface makes investing a breeze, even for first-timers.

- Affordability: With no account fees and low trading commissions, you can save money and maximize your returns.

- Convenience: Invest on the go, anytime, anywhere with the Cash App’s mobile application.

- Variety: Choose from a wide range of stocks, ETFs, and cryptocurrency, all in one place.

- Education: The Cash App provides educational resources and tools to help you make informed investment decisions.

Whether you’re looking to diversify your portfolio, invest for the long term, or take advantage of short-term market fluctuations, the Cash App trading option offers something for every investor.

Investing with the Cash App Trading Option

Getting started with the Cash App trading option is as easy as 1-2-3:

- Open a Cash App account: If you don’t already have a Cash App account, download the app and create one. It’s free and takes just a few minutes.

- Enable the Trading Option: Once you have a Cash App account, tap on the “Investing” tab and follow the prompts to enable the trading option.

- Start Investing: Search for the stock, ETF, or cryptocurrency you want to invest in, enter the amount you want to buy, and tap “Buy.”

The Cash App will handle the rest, executing your trades in real-time and storing your investments safely in your account. You can monitor your investments and make adjustments anytime through the Cash App’s mobile application.

Image: techcrunch.com

Expert Insights on the Cash App Trading Option

Renowned financial expert, Peter Lynch, said, “Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.” The Cash App trading option empowers you to do just that.

According to CNBC, “The Cash App is one of the most popular mobile payment platforms, and its trading options are making it even more attractive to users.” The convenience and affordability of the Cash App trading option are making investing accessible to a broader range of individuals than ever before.

Actionable Tips for Using the Cash App Trading Option

To maximize your success with the Cash App trading option, consider the following actionable tips:

- Research before you invest: Take the time to learn about the stock, ETF, or cryptocurrency you want to invest in. Understand the risks involved and set realistic expectations.

- Start small: There’s no need to risk more than you can afford to lose. Start with a small investment and gradually increase your stake as you gain experience.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes and sectors to reduce risk.

- Don’t panic sell: Market fluctuations are a natural part of investing. Avoid making rash decisions based on fear or emotion. Stick to your investment strategy and ride out the ups and downs.

- Consider your goals: Are you saving for retirement, a down payment on a house, or a child’s education? Define your investment goals and tailor your investment strategy accordingly.

Investing in the stock market can be a rewarding experience, but it’s important to approach it with knowledge, patience, and a well-defined strategy. The Cash App trading option provides a convenient and affordable way to get started, empowering you to take control of your financial future.

Cash App Trading Option

Conclusion

The Cash App trading option is a game-changer in the world of mobile finance. Its simplicity, affordability, and variety make it an accessible and empowering tool for investors of all levels. Whether you’re a seasoned investor or just starting out, the Cash App trading option has something to offer you.

Remember, investing is a journey, not a sprint. Take the time to educate yourself, develop a sound investment strategy, and stay committed to your goals. With the Cash App trading option in your hands, you have the potential to unlock financial freedom and achieve your financial dreams.