Introduction

Image: www.mapsofindia.com

Options trading, once reserved for Wall Street’s elite, has become accessible to anyone with the touch of a button. Cash App, a mobile payment solution, has entered the arena with its user-friendly options trading platform, empowering retail investors with a new avenue for potential profit. This comprehensive guide will delve into the world of options trading on Cash App, explaining key concepts, guiding you through the process, and exploring the opportunities it presents.

Understanding Options Trading

Options contracts give buyers the right (but not the obligation) to buy or sell an underlying asset, such as a stock, at a specified price within a certain time frame. Buyers pay a premium for this right. If the option’s conditions are met, the buyer can exercise it and purchase or sell the asset at a potentially favorable price.

Getting Started with Cash App Options

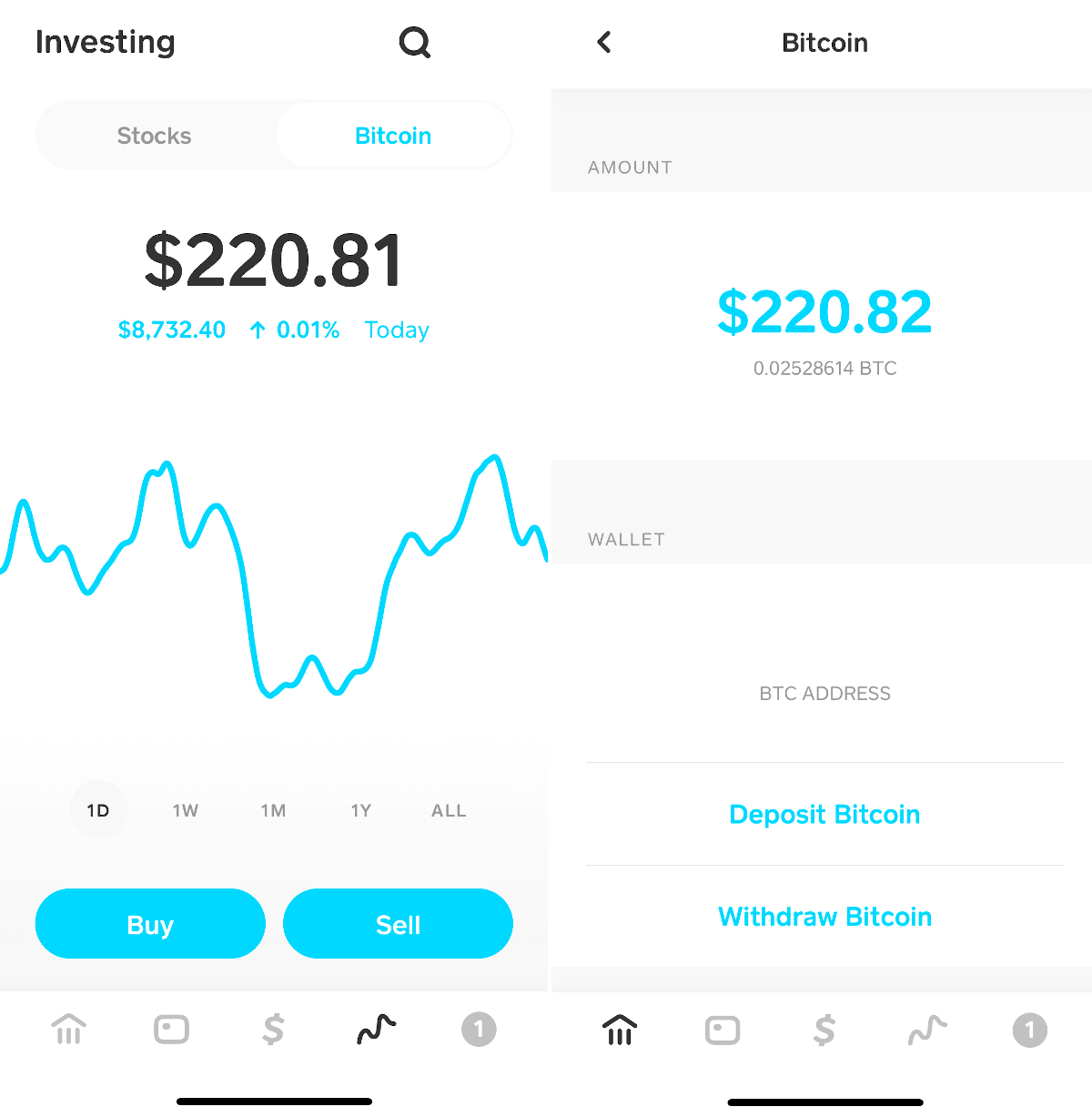

Onboarding with Cash App Options is simple. After verifying your account, navigate to the “Investing” tab and select “Options.” From there, you can connect your bank account to fund your trading activities. The platform boasts intuitive charts and a user-friendly interface, simplifying the trading experience for beginners and experienced traders alike.

Key Concepts and Strategies

Call options provide the buyer the right to buy an asset at a specific strike price on or before the expiration date. Put options give the buyer the right to sell an asset at the strike price. Understanding strike price, expiration date, and premium pricing is essential for successful options trading.

Popular strategies include buying calls for speculative growth or hedging against potential losses. Selling covered calls generates income and limits risk exposure. Selling puts creates potential for profit but carries the obligation to buy the underlying asset if the option is assigned.

Leveraging Cash App Features

Cash App Options offers several unique features that enhance the trading experience. Fractional shares enable investors to buy and sell portions of contracts, making options trading more accessible. The “Risk/Reward” tool quantifies potential profit and loss, aiding in informed decision-making.

Market Trends and Future Outlook

The options market is dynamic and evolving. The rise of mobile trading and zero-commission platforms like Cash App is democratizing access to options trading. Regulatory bodies play a crucial role in ensuring market stability and investor protections.

Conclusion

Options trading on Cash App provides retail investors with the tools and flexibility to invest strategically and potentially generate substantial returns. By grasping key concepts, implementing sound strategies, and leveraging Cash App’s innovative features, individuals can explore new opportunities for financial growth. However, it is essential to approach options trading with an understanding of the inherent risks and seek professional guidance when necessary. Embrace the possibilities and trade wisely on the Cash App Options platform.

Image: madalenemcconnell.blogspot.com

Options Trading Cash App

Image: cryptocurrencyfacts.com