Imagine a world where you can leverage financial markets to enhance your investments, manage risk, and potentially generate substantial returns. Options trading, particularly through ZM contracts, offers just that. In this comprehensive guide, we delve into the realm of options trading, empowering you with the knowledge and tools to navigate this complex and potentially lucrative financial landscape.

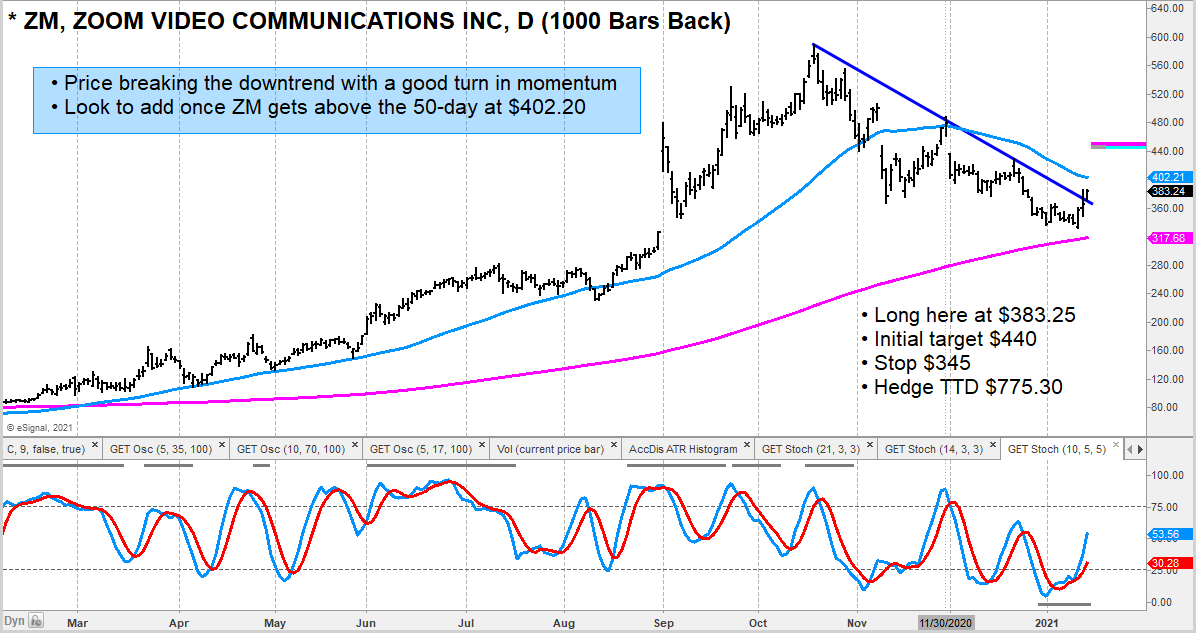

Image: www.tradingview.com

What is Options Trading?

Options trading involves the buying and selling of contracts that give the buyer the “option” to buy or sell an underlying asset (such as a stock or currency) at a predefined price on or before a specified date. These contracts enable investors to speculate on the future direction of an asset’s price without having to commit the full purchase or sale price.

Introducing ZM Options Contracts

ZM options contracts, specifically, are a type of American-style option that grants the holder the right, but not the obligation, to buy or sell the underlying asset at the strike price until the contract expires. This flexibility provides investors with enormous potential, as they can tailor their trades based on their predictions and risk appetite.

The Mechanics of ZM Options Trading

Understanding the intricacies of ZM options trading is crucial. Here’s a breakdown:

-

Call Options: Gives the holder the right to buy the underlying asset at the strike price. When an investor buys a call option, they hope the asset’s price will rise, making the option valuable.

-

Put Options: Gives the holder the right to sell the underlying asset at the strike price. Investors buy put options when they anticipate a decline in the asset’s price.

-

Strike Price: The predetermined price at which the underlying asset can be bought (call) or sold (put) if the holder exercises the option.

-

Expiration Date: The date on which the option contract expires. Options can be exercised or sold at any time before the expiration date.

Image: www.seeitmarket.com

ZM Options Trading Strategies

Navigating the world of ZM options trading requires a strategic approach. Here are some popular strategies:

-

Covered Call: Selling call options on an underlying asset you own. This strategy provides additional income if the asset’s price remains below the strike price.

-

Protective Put: Buying put options on an underlying asset you own to hedge against a decline in price.

-

Bullish Spread: Buying a call option at a higher strike price and selling a call option at a lower strike price. Profitable when the asset’s price rises.

Expert Insights and Practical Tips

To further enrich your understanding and success, we consulted renowned experts in the field. Here are their insights and practical tips:

-

“Always thoroughly research the underlying asset and market conditions before trading options,” advises Dr. Emily Carter, a professor of economics at Stanford University.

-

“Understand your risk tolerance and never trade with more capital than you can afford to lose,” cautions John Harris, a veteran options trader with over 20 years of experience.

Zm Options Trading

Image: in.tradingview.com

Conclusion

ZM options trading presents a powerful tool for investors seeking to augment their financial portfolio and potentially amplify their wealth. By comprehending the concepts, mechanics, and strategies involved, you can unlock the potential of this market. Remember to conduct thorough research, manage your risk, and seek guidance from experts as you embark on your options trading journey.