Navigating the turbulent waters of financial markets can be a daunting task, leaving many investors seeking strategies to mitigate risk and maximize returns. Options trading signals have emerged as a valuable tool, enabling traders to identify potential trading opportunities with enhanced accuracy. This article delves into the world of options signals performance, unraveling the intricacies of this indispensable technique.

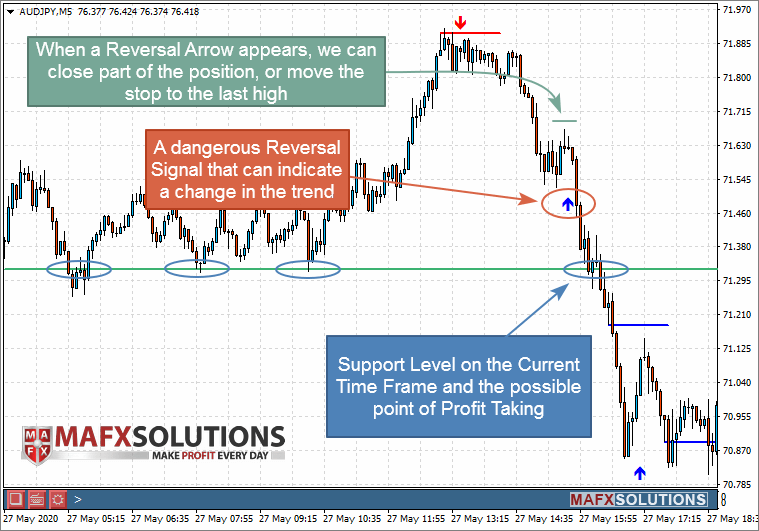

Image: www.stockradar.in

Options Signals: A Guiding Light in Market Darkness

Options, financial instruments derived from underlying assets like stocks or indices, grant traders the right but not the obligation to buy or sell the underlying asset at a specified price within a predetermined period. Options signals are alerts or recommendations generated by quantitative models or human analysts that identify potential options trading opportunities. These signals provide traders with invaluable insights into market trends, price movements, and trading strategies, empowering them to make informed decisions amidst market uncertainty.

Signal Performance: A Tapestry of Factors

The performance of options signals is a multifaceted concept influenced by a symphony of factors. These factors include the underlying asset’s volatility, the signal’s time horizon, and the trading strategy employed. Additionally, the track record and expertise of the signal provider, as well as the historical data used to generate the signals, play pivotal roles in determining performance.

Volatility’s Impact: A Dance of Risk and Reward

Options signals thrive in markets characterized by volatility, where price fluctuations are pronounced. Higher volatility amplifies potential returns but also elevates the risk profile of the underlying asset. Traders must carefully assess their risk tolerance and ensure that options signals align with their investment objectives.

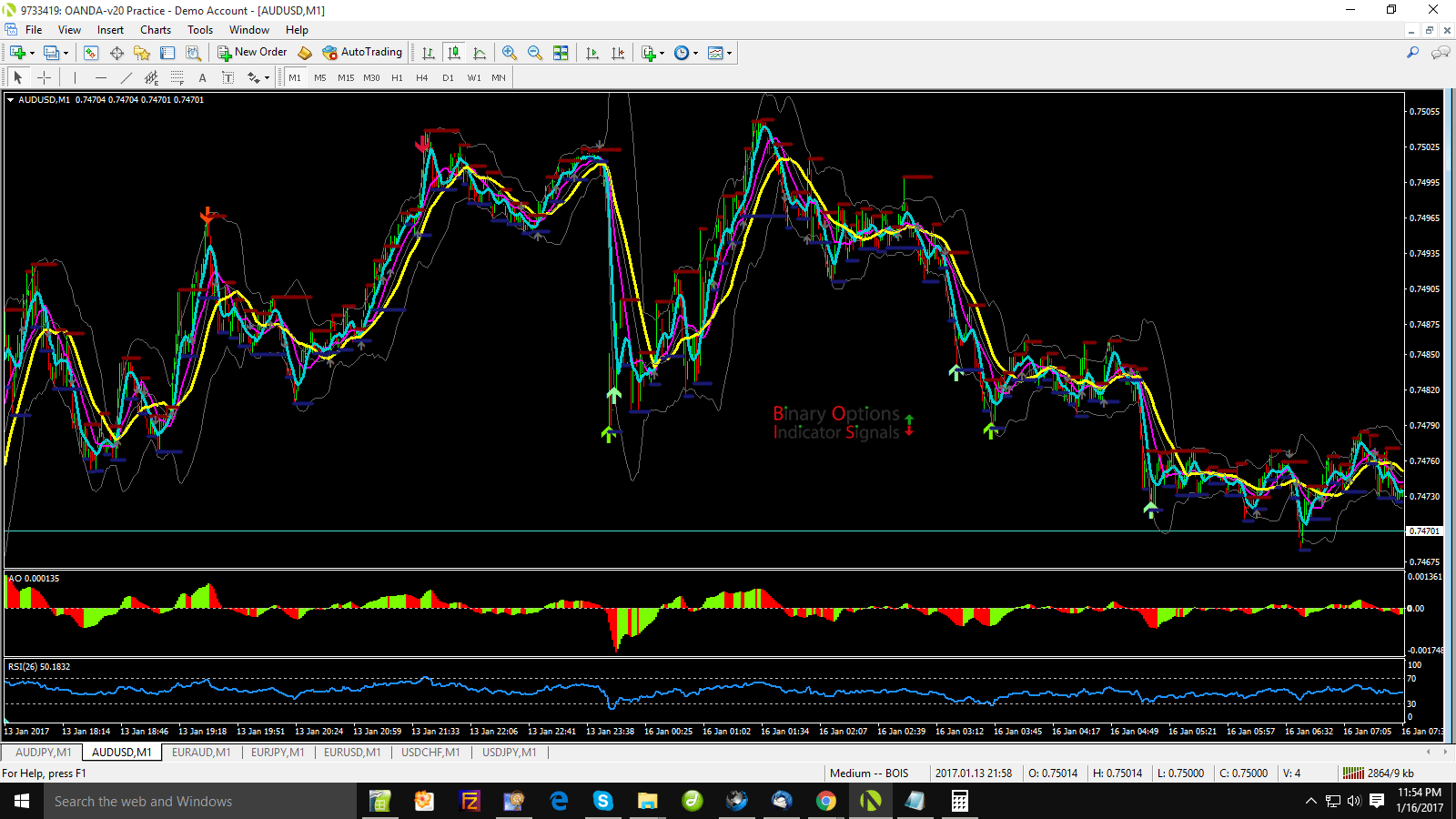

Image: www.mql5.com

Time Horizon: Embracing Patience or Seeking Swiftness

Options signals can vary in their time horizons, ranging from short-term signals that expire within hours to longer-term signals that span multiple days or even weeks. The choice of time horizon depends on the trader’s investment style and desired level of risk. Scalpers, for example, favor short-term signals for quick profit taking, while long-term investors typically prefer signals with extended expiration dates.

Trading Strategy: Orchestrating Success

Options signals can be applied within a diverse array of trading strategies, including covered calls, cash-secured puts, bull spreads, and bear spreads. Each strategy offers unique advantages and risks, and choosing the most suitable strategy requires a thorough understanding of options trading principles and market dynamics.

Unlocking the Power of Signals: A Practical Guide

Harnessing the potential of options signals requires a discerning approach and a disciplined implementation process. To maximize signal performance, traders should conduct thorough due diligence on potential signal providers, scrutinizing their track record, methodology, and fees.

Due Diligence: Separating Gems from Duds

Evaluating the credibility of signal providers is paramount to successful options trading. Look for providers with transparent performance records, robust methodologies, and a history of profitable signals. Review testimonials from satisfied clients and explore online forums where traders share their experiences.

Risk Management: Navigating the Trading Landscape Safely

Risk management is an indispensable aspect of trading options signals effectively. Always use stop-loss orders to limit potential losses and never risk more capital than you’re prepared to lose. Monitor your portfolio closely and adjust your strategy as market conditions demand.

Integration: Weaving Signals into Your Trading Fabric

Options signals should complement your trading strategy, not replace it. Integrate signals with your existing knowledge and experience, filtering out those that don’t align with your risk tolerance and trading objectives. Use signals as a guiding force, but ultimately, the trading decisions should be your own.

Embracing Technological Advancements: AI and Machine Learning

The advent of artificial intelligence (AI) and machine learning (ML) has revolutionized the landscape of options signals performance. AI-powered signal providers leverage sophisticated algorithms and vast data sets to identify trading opportunities with unparalleled precision. These algorithmic signals offer a distinct advantage in highly volatile and fast-paced markets, enabling traders to respond swiftly to market movements.

Trading Options Signals Performance

Image: binaryoptionsindicatorsignals.com

Conclusion: Illuminating the Path to Options Trading Success

Options signals have become an indispensable tool in the arsenal of savvy traders, providing invaluable insights into market trends and trading opportunities. By embracing their power and adhering to sound trading principles, traders can navigate market volatility with enhanced confidence, precision, and profitability. Remember, options trading signals are not a magic bullet but rather a valuable aid that, when used intelligently, can significantly improve your trading outcomes.