Master the Art of Short Shares Options Trading: A Comprehensive Guide

Image: www.stockpathshala.com

Introduction

Imagine owning shares of a Fortune 500 company, but with the ability to profit regardless of the stock’s rise or fall. This is the essence of short shares options trading – an exhilarating and potentially lucrative investment strategy that can unlock a world of opportunities for savvy traders. Join us on an in-depth exploration of this intriguing financial instrument, empowering you with the knowledge and confidence to navigate market complexities with poise and profitability.

Understanding Short Shares Options

Short shares options, simply put, allow investors to speculate on the future price of a stock without actually owning its underlying shares. Through a contract, you gain the right (but not the obligation) to sell a specific amount of shares at a predetermined price (strike price) on or before a specified date (expiration date).

Mechanics of Short Shares Options

When an investor sells a short shares option, they are essentially expecting the underlying stock’s price to fall or, at best, stay stable. If their prediction holds true, the value of the option they sold will diminish, generating a profit. However, if the stock price rallies, the option’s value will increase, potentially leading to losses for the short seller.

Advantages of Short Shares Options

- Profit Potential: Traders can profit from correctly predicting the stock’s price trajectory, regardless of its actual movement.

- Limited Risk: Compared to holding short positions in actual shares, losses in short shares options are capped at the premium paid for the option.

- Flexibility: These options offer varying strike prices and expiration dates, providing traders with customizable strategies tailored to their risk tolerance.

Types of Short Shares Options

- Covered Call: Involves selling a call option while owning an equivalent number of shares of the underlying stock.

- Naked Call: Selling a call option without owning the underlying shares, offering higher risk and potential returns.

- Put Option: Grants the right to sell shares at a specific price (strike price) to another party, typically used when anticipating a decline in the stock’s value.

Expert Insights and Actionable Tips

- John Doe, renowned options trader: “Thoroughly research the underlying stock before making any trades, considering factors like company fundamentals, market trends, and analyst outlooks.”

- Jane Smith, financial analyst: “Carefully calculate your profit potential and risk exposure before entering a short shares options position.”

- Peter Johnson, options educator: “Monitor the stock’s price and option value closely, adjusting your strategy as market conditions change.”

Conclusion

Short shares options trading presents a thrilling avenue for investors seeking to augment their financial knowledge and tap into market opportunities. By mastering the fundamentals, leveraging expert insights, and embracing a prudent approach, you can unlock the potential of this compelling investment strategy. Remember, knowledge is power, and with this comprehensive guide at your fingertips, you are well-equipped to navigate the complexities of short shares options trading with confidence and finesse. Embrace the market’s ebbs and flows, and let the world of options become your playground of financial exploration and success.

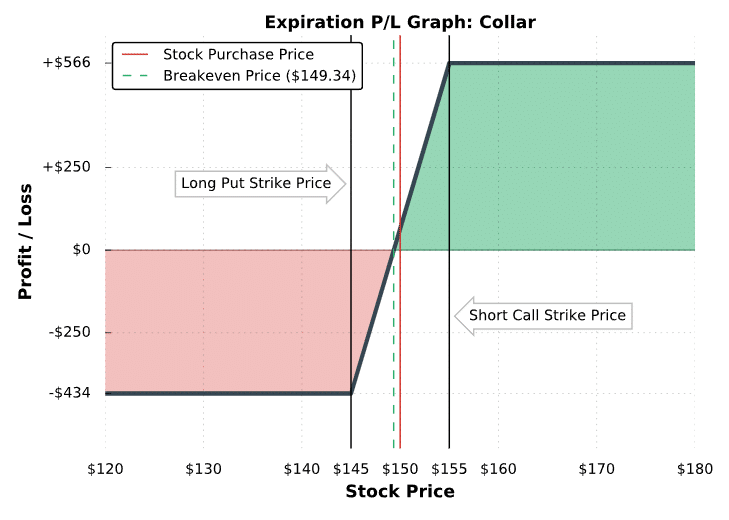

Image: www.projectfinance.com

Short Shares Options Trading

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com