In the realm of options trading, where strategies abound, a synthetic short is a crafty technique traders employ to establish a position that mimics a short sale without actually borrowing shares of the underlying asset. Understanding this intriguing strategy can empower traders with greater flexibility and potential for profit.

Image: tacticaltradingstrategies.com

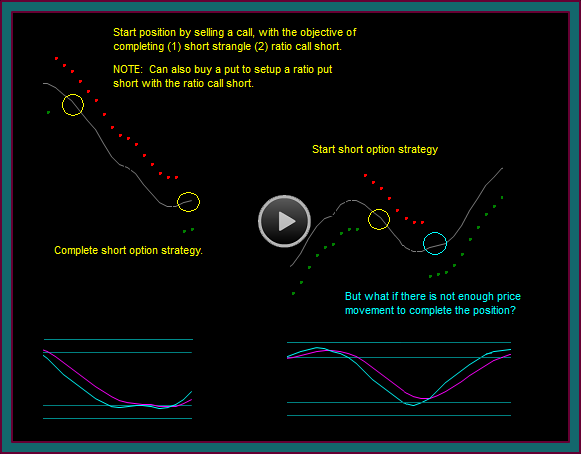

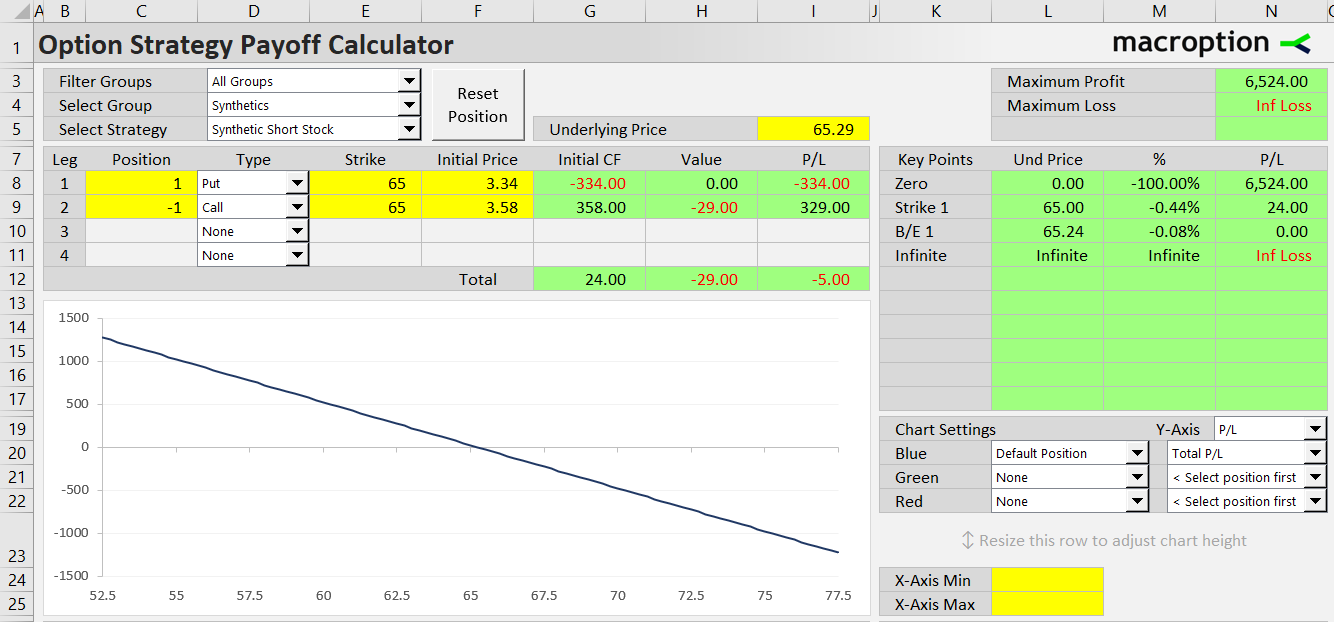

A synthetic short is achieved by combining two separate transactions: selling an at-the-money call option and buying an at-the-money put option on the same underlying asset and expiration date. This clever arrangement effectively creates an equivalent position to shorting the underlying asset. As the value of the underlying asset falls, the value of the sold call option decays, while the value of the purchased put option increases, resulting in a potential profit for the trader.

The synthetic short strategy offers several advantages. Firstly, it eliminates the need to borrow shares, which can be difficult or costly, especially for thinly traded securities. Secondly, it grants traders downside protection. If the underlying asset’s price rises, the purchased put option may offset some of the losses incurred on the sold call option.

However, a synthetic short also carries some risks. As with any options strategy, there is the potential for unpredictable market movements that can result in losses. Furthermore, the cost of purchasing the put option acts as a premium that the trader must pay upfront. This premium represents a potential loss if the synthetic short position is not profitable.

Traders venture into the world of synthetic shorts for various reasons. Some seek to hedge their portfolios against downside risk while maintaining the ability to profit from potential price increases. Others use synthetic shorts to take advantage of specific market conditions, such as anticipating a bearish trend or volatility.

Mastering the ins and outs of a synthetic short requires a comprehensive understanding of options pricing, risk management, and diligent market analysis. By carefully weighing the potential risks and rewards, traders can harness this strategy to navigate the complexities of options trading and pursue their financial goals.

Image: www.macroption.com

What Is A Synthetic Short In Options Trading

Image: optionalpha.com