Over the last decade, synthetic options have emerged as a versatile financial tool, offering investors an innovative approach to market participation. As an experienced trader, I’ve witnessed firsthand the transformative impact of synthetics in shaping modern investment strategies.

Image: www.pinterest.ph

In this comprehensive guide, we delve into the world of synthetic options, exploring their fundamentals, applications, and implications for modern investing. Drawing upon extensive research and in-depth market analysis, we aim to equip readers with a thorough understanding of this fascinating financial instrument.

Understanding Synthetic Options

Definition and Creation

Synthetic options are innovative financial instruments that offer a way to replicate the behavior of conventional options without owning the underlying asset. They are created by combining two or more existing options with different strike prices and expiration dates.

By crafting synthetic options, traders can tailor their risk and return profiles to suit specific investment objectives and market conditions. This flexibility has made synthetics an increasingly popular choice for sophisticated investors seeking tailored exposure to various underlying assets.

Types of Synthetic Options

There are numerous types of synthetic options, each with distinct characteristics:

- Synthetic Long Calls: Mimic the behavior of a long call option, providing leverage and upside potential.

- Synthetic Long Puts: Emulate a long put option, offering protection against downside risk.

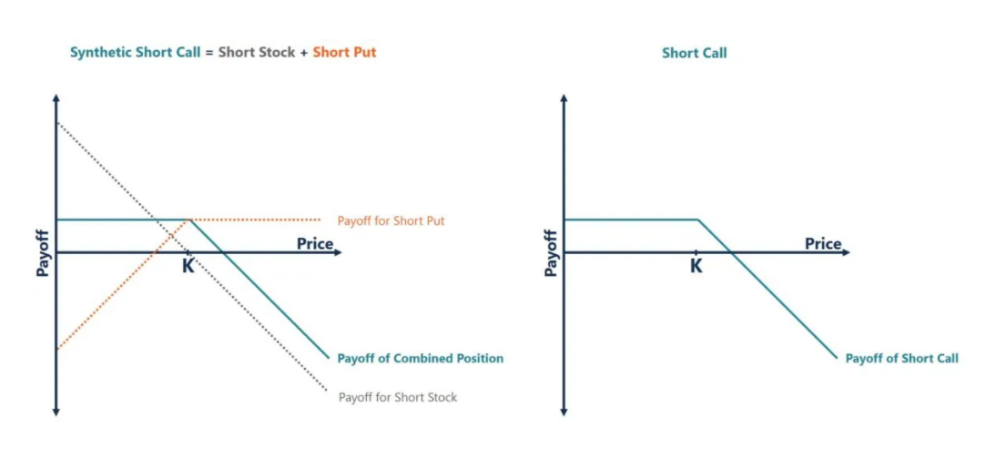

- Synthetic Short Calls: Simulate a short call option, enabling investors to collect premiums and limit downside exposure.

- Synthetic Short Puts: Resemble a short put option, providing income generation while limiting upside potential.

Image: www.youtube.com

Advantages and Drawbacks

Advantages

- Flexibility in constructing custom risk-return profiles

- Lower margin requirements compared to owning the underlying asset

- Potential for enhanced returns through option premiums

- Hedging capabilities to manage risk and volatility

Drawbacks

- Complex execution and management, requiring advanced trading knowledge

- Potential for higher transaction costs compared to conventional options

- Risk of losses if the underlying asset moves outside想定 parameters

Applications in Modern Investing

Synthetic options are increasingly employed in various modern investing strategies:

- Portfolio Optimization: By combining synthetic options, investors can customize portfolios to align with specific risk tolerances, return objectives, and market outlook.

- Risk Management: Synthetics enable tailored hedging strategies, reducing portfolio volatility and preserving capital during market downturns.

- Income Generation: Selling synthetic options can generate income premiums, supplementing investment returns and providing a buffer against market fluctuations.

- Speculative Trading: Sophisticated traders use synthetic options to create complex strategies that capitalize on market inefficiencies and exploit volatility.

Tips and Expert Advice for Successful Trading

Avoiding Common Pitfalls

To navigate the complexities of synthetic options successfully, it’s crucial to avoid common pitfalls:

- Not understanding the underlying risks

- Overleveraging and trading beyond risk tolerance

- Neglecting proper trade management

- Chasing quick profits without a sound strategy

Expert Guidance for Strategic Investing

- Seek guidance from experienced traders or financial advisors who specialize in synthetic options.

- Backtest strategies thoroughly on historical data before implementing them in live trading.

- Continuously monitor market conditions and adjust positions accordingly.

- Understand the trade-offs between risk and return and invest within your means.

FAQs on Trading Synthetic Options

Q: What are the prerequisites for trading synthetic options?

A: A solid understanding of options trading, market dynamics, and risk management principles is essential.

Q: How do I calculate the value of a synthetic option?

A: The Black-Scholes model is commonly used to price synthetic options, considering factors such as underlying asset price, strike prices, expiration dates, and interest rates.

Q: What are the potential risks involved in synthetic option trading?

A: Synthetic options carry risks similar to conventional options, including the potential for losses, limited upside potential, and the need for active management.

Q: Which trading platforms support synthetic options trading?

A: Most major brokerage firms and trading platforms offer synthetic option trading capabilities.

Q: How can I improve my synthetic options trading skills?

A: Continuous education, practice, and seeking mentorship from experienced traders are essential for enhancing synthetic options trading skills.

Trading Synthetic Options

Image: www.angelone.in

Conclusion

Trading synthetic options requires a sophisticated understanding of market dynamics, risk management, and options trading principles. While they offer unique possibilities for customizing risk-return profiles and implementing advanced investment strategies, it’s crucial to approach them with caution, recognizing their inherent risks and complexities.

Are you an avid trader looking to delve deeper into the world of synthetic options? Share your thoughts and experiences below, and let’s engage in a vibrant discussion about this fascinating financial instrument.