Introduction to Gold Options

In the world of financial markets, gold has always been a coveted asset due to its stability and value. Gold options are derivative contracts that provide traders with the right, but not the obligation, to buy or sell a specific amount of gold at a predetermined price on a future date. This versatile instrument allows traders to manage risk, hedge against price fluctuations, and speculate on the gold price’s direction.

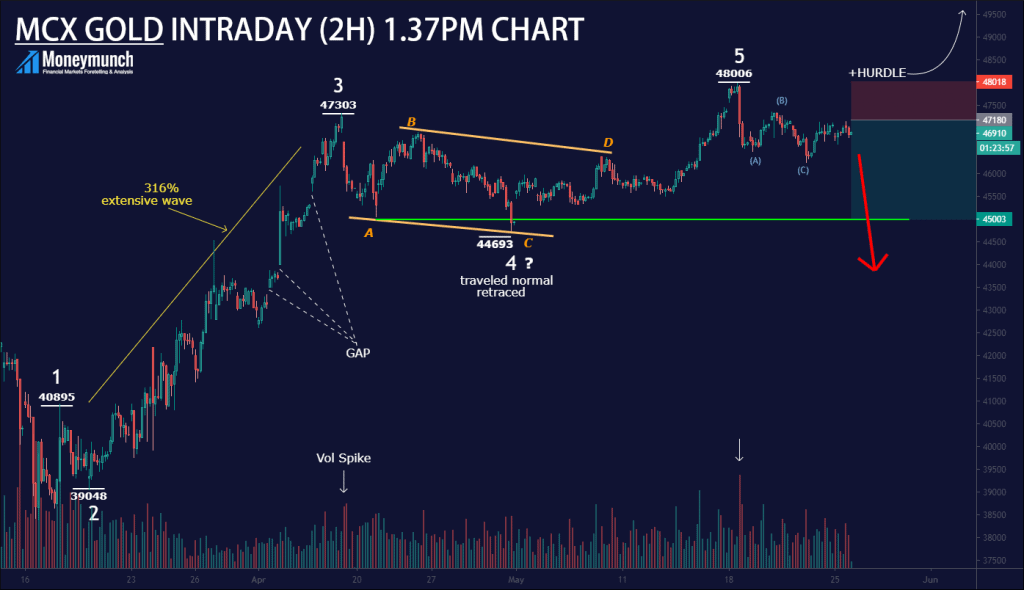

Image: www.tradingview.com

MCX – India’s Gold Options Trading Platform

The Multi Commodity Exchange of India (MCX) is the leading platform for gold options trading in India. MCX offers a wide range of gold options contracts with varying strike prices and expiration dates, providing traders with flexibility in tailoring their trading strategies. The exchange’s robust infrastructure and regulatory framework ensure transparency and security in gold options trading.

Understanding Gold Options Contracts

Gold options contracts consist of two main components:

- Strike Price: This is the predetermined price at which the underlying asset can be bought or sold.

- Expiration Date: The date on which the option contract expires and becomes void.

Gold options can be of two types:

- Call Options: These give the buyer the right to buy gold at the strike price on or before the expiration date.

- Put Options: These give the buyer the right to sell gold at the strike price on or before the expiration date.

Benefits of Gold Options Trading

Gold options offer several advantages to traders:

- Hedging Against Risk: Traders can use gold options to hedge against fluctuations in the gold spot price, protecting their existing gold positions or reducing risk in physical gold investments.

- Speculating on Price Movement: Gold options allow traders to speculate on the direction of gold prices without the need to physically hold the underlying asset. This strategy is often used to capitalize on short-term price movements or volatile market conditions.

- Leverage and Risk Management: Gold options allow traders to gain exposure to the gold market with limited capital outlay. However, it’s important to remember that options trading involves inherent risk and the potential for significant losses.

- Income Generation: Option traders can generate income by selling gold options. This strategy is known as option writing or option selling and requires a deep understanding of the market and risk management techniques.

Image: www.youtube.com

Trading Strategies and Tips

Successful gold options trading requires careful planning and execution. Here are some strategies and tips to consider:

- Define Trading Objectives: Determine whether you aim to hedge risk, speculate, or generate income. This will guide your option selection and trading strategy.

- Analyze Market Trends: Understand the gold market’s fundamentals, technical indicators, and price history to make informed decisions.

- Choose Strike Prices and Expiration Dates: Select strike prices and expiration dates that align with your trading objectives and risk tolerance.

- Manage Risk: Use stop-loss orders and understand the potential losses associated with options trading.

- Execute Trades Cautiously: Enter and exit trades strategically, considering market conditions and potential price movements.

- Seek Professional Advice: Consult with a financial advisor or experienced trader to gain insights and guidance, especially if you are new to options trading.

Frequently Asked Questions

Q: What is the minimum trade quantity for gold options on MCX?

A: The minimum trade quantity is one lot, which represents 100 grams of gold.

Q: How long do gold options contracts last?

A: Gold options contracts typically have expirations ranging from 1 month to 1 year.

Q: What are the fees associated with gold options trading on MCX?

A: MCX charges a transaction fee for both option buyers and sellers. The fee varies depending on the contract size and expiration date.

Q: Can individuals trade gold options on MCX?

A: Yes, individuals can trade gold options on MCX through registered brokers or trading platforms.

Gold Options Trading Mcx

Image: moneymunch.com

Conclusion

Gold options trading on MCX offers traders a versatile instrument to navigate market volatility and potentially profit from gold price movements. By understanding the principles, strategies, and risks involved, traders can maximize their chances of success in this dynamic and rewarding arena.

Are you ready to explore the exciting world of gold options trading on the MCX platform? Consult with qualified experts, study market trends, and make calculated decisions to enhance your success in this multifaceted market.